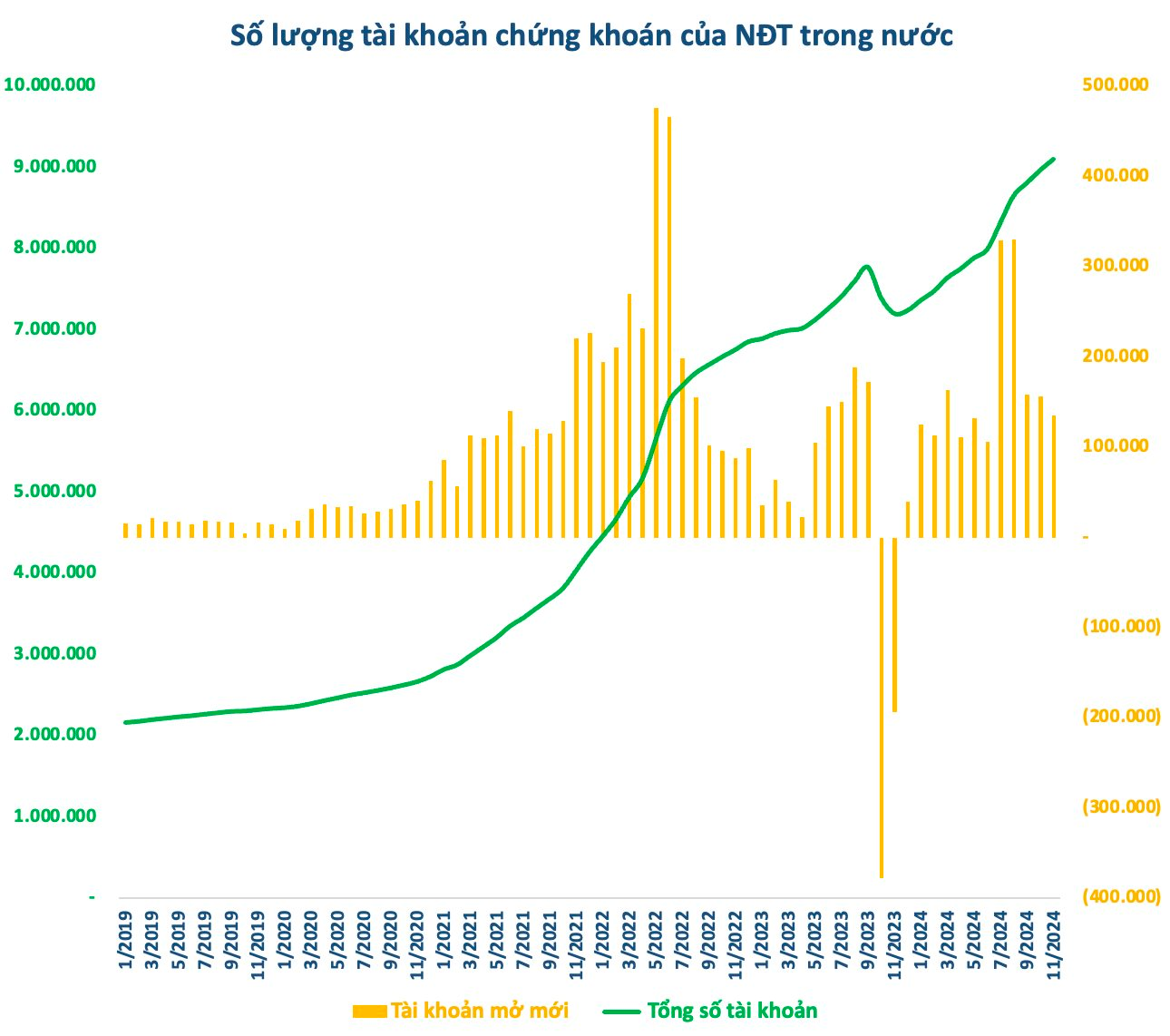

According to data from the Vietnam Securities Depository Center (VSD), the number of domestic investor accounts increased by over 135,000 accounts in November 2024, a significant drop of more than 20,000 accounts compared to the previous month. This was the lowest number of new accounts added in the past five months. The increase in accounts mainly came from individuals, while organizations only added 107 accounts.

As of the end of November, the cumulative number of domestic investor accounts has increased by 1.86 million this year. With nearly 9.1 million individual investor accounts, equivalent to about 9% of the population, the country has achieved its 2025 target ahead of schedule and is now aiming for 11 million accounts by 2030.

Figure 1: Number of new domestic investor accounts (Source: VSD)

The decrease in new account openings occurred amidst strong market fluctuations in November. The VN-Index consecutively dropped from the beginning of the month and even dipped below 1,200 at one point before recovering. The rebound towards the end of the month pushed the index back above 1,250 points, resulting in a 1.11% monthly loss.

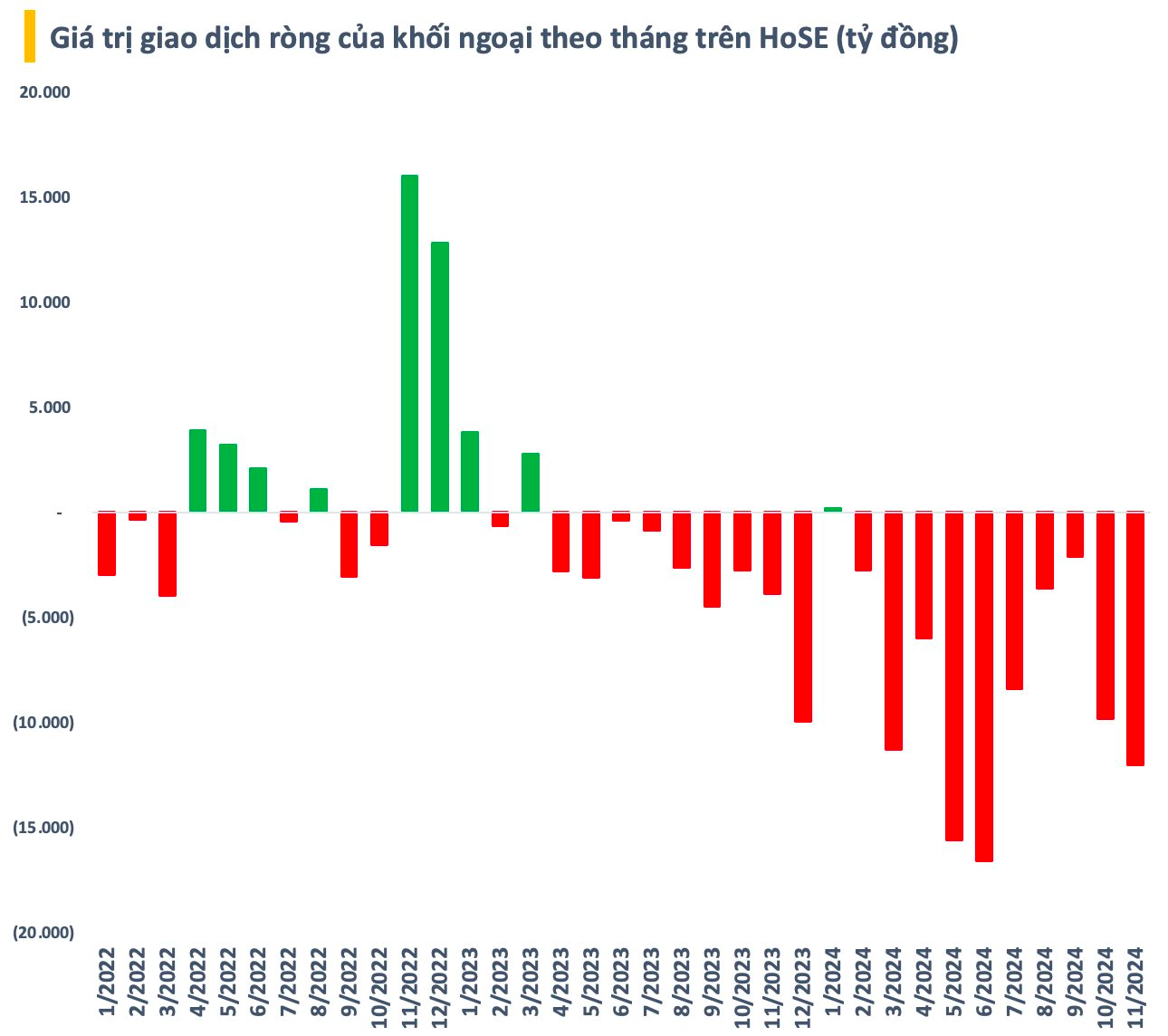

Notably, net selling pressure from foreign investors continued to increase. The net selling value on HoSE exceeded VND 12,000 billion in November. Thus, after a period of reduced selling, foreign investors resumed heavy selling. Cumulatively, in the first eleven months of the year, foreign investors net sold a total of VND 88,000 billion on HoSE, a record number in the history of Vietnam’s stock market.

Figure 2: Net buying/selling value of foreign investors on HoSE (Source: VSD)

Despite the net selling, the number of foreign investor accounts in Vietnam continued to increase month by month. Specifically, the number of foreign accounts increased by 162 in November, lower than the 230 accounts added in the previous month. Individuals accounted for 148 of the new accounts, while organizations added 14. The total number of foreign investor accounts now stands at 47,598.

In a recently updated report released in mid-November, Dragon Capital attributed the strong US dollar in October to expectations of policy changes in Mr. Trump’s new term, which could lead to higher-than-expected inflation and put pressure on currencies in emerging markets, causing the VND to depreciate by 2.9%. Dragon Capital assessed that the strong US dollar could prolong the outflow of foreign investment from emerging markets back to the US.

Despite the continuous net outflow of foreign capital, many large foreign funds remain optimistic about the prospects of Vietnam’s stock market, especially the Pyn Elite Fund. Mr. Petri Deryng, the fund’s head, forecasts that the profits of listed companies on Vietnam’s stock market could grow by about 20% this year and maintain a similar pace in 2025. Vietnam’s stock market remains reasonably valued, with a projected P/E ratio of around 10 times for 2025.

Dragon Capital’s Foreign Ownership in PVS Shares Rises Above 7%

Dragon Capital has bolstered its investment in PVS by acquiring an additional 1.42 million shares, elevating its ownership stake from 6.8054% to 7.1025%.

The FDI Magnetism Rankings for the First 11 Months of 2024: Bac Ninh Sustains its Top Spot, with a Dark Horse Province Surpassing Ho Chi Minh City to Claim Second Place.

The Foreign Investment Agency (Ministry of Planning and Investment) noted that in the first eleven months of 2024, registered FDI capital continued to rise slightly (1%) compared to the same period last year, albeit at a slower pace, down by 0.9 percentage points from the ten-month period. Notably, November witnessed a substantial surge in investment volume compared to previous months, attracting nearly USD 4.12 billion, accounting for 13.1% of the country’s total investment in the eleven-month period.

The VCB Pushes VN-Index Below 1,250 Points, Insurance Stocks Surge: A Market Surprise

The recovery efforts this afternoon failed to bear fruit, as the dominant force of the ‘super-pillar’ VCB overwhelmed the lackluster performance of other blue-chips. The VN-Index closed with a loss of 1.38 points, with VCB’s 1.27% decline accounting for over 1.6 points. However, bottom-fishing funds were active, driving significant gains in numerous stocks, particularly in the insurance sector.