Global Petroleum Commercial Joint Stock Bank (GPBank), a zero-dong bank that has not yet been transferred, has just applied a new electronic savings interest rate for individual customers. Accordingly, the bank has increased the interest rate for deposits with terms of 1-36 months by 0.3% per year.

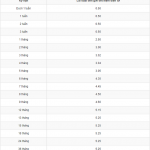

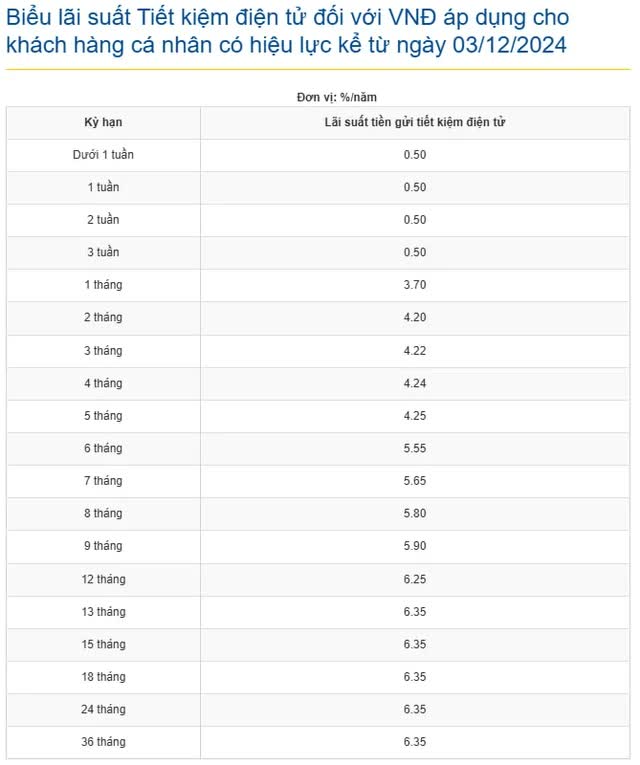

Specifically, the interest rate for 1- and 2-month terms has been increased to 3.7% and 4.2% per year, respectively. Interest rates for terms of 3-5 months now range from 4.22% to 4.25% per year.

GPBank’s savings interest rate table.

The 6-month term interest rate at GPBank has been increased to 5.55% per year, the 7-month term is currently listed at 5.65% per year, the 8-month term is 5.8% per year, and the 9-month term is applied with an interest rate of 5.9% per year.

Notably, the online savings interest rate for a 12-month term at GPBank has increased to 6.25% per year. Meanwhile, terms of 13-36 months are offered an interest rate of up to 6.35% per year.

With this adjustment, GPBank is currently the bank with the highest-listed savings interest rate in the system for regular deposits (excluding large deposits that enjoy special interest rates).

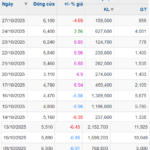

DongA Bank, a specially controlled bank, offers deposit interest rates that are among the highest in the system. For terms of 1-2 months, it offers up to 3.9% per year; for 3-5 months, it lists 4.1% per year. The interest rate for 6-8 months is 5.55% per year; 12 months is 5.8% per year, and 13 months is 6% per year.

In addition, this bank also applies an additional margin of 0.15% to 0.25% based on the deposit amount or term. For 13-month term deposits with interest paid at maturity, from VND 200 million to less than VND 500 million will be added 0.05% per year; from VND 500 million to less than VND 1 billion, 0.10% per year; and from VND 1 billion onwards, 0.15% per year.

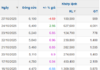

CB Bank has adjusted its savings interest rates for the second time after officially being transferred to Vietcombank. Accordingly, the interest rate for a 6-month term has been reduced to 5.45% per year, a further decrease of 0.5% per year; the 12-month term is now 5.55%, a reduction of 0.5%; and the 13-month term is 5.7% per year, a decrease of 0.1% per year.

However, CB Bank’s rates are still much higher than those of Vietcombank. Currently, Vietcombank’s 6-month interest rate is 2.9% per year, and its 16-month rate is 4.6% per year.

Meanwhile, Oceanbank, another zero-dong bank that has been transferred, has not made any adjustments to its interest rates. Accordingly, the 1-2 month term is at 4% per year; 3-6 months is 4.3% per year; 12 months is 5.7% per year; and the 18-36 month term is up to 6.1% per year.

MB Bank, which took over Oceanbank, has a lower interest rate schedule. Specifically, the 1-month term is 3.7% per year; 12 months is 5.05% per year; and 36 months is 5.9% per year.

It is known that after the official transfer of these two zero-dong banks, two other banks, GPBank and DongA Bank, are expected to be transferred to other banks in the future.

The Power of Compounding: Maximizing Returns with VPBank’s Latest Fixed Deposit Rates for August

“This August, VPBank is offering an impressive interest rate for deposits locked in for 24 months or more. With this promotion, your money will work harder for you, earning a return that beats inflation and helps secure your financial future.”