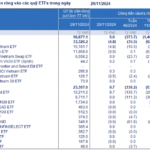

On December 6, 2024, FTSE is expected to announce the constituent stocks of the FTSE Vietnam All-share and FTSE Vietnam Index. On December 13, 2024, MarketVector will announce the Marketvector Vietnam Local Index.

December 20, 2024, is expected to be the completion date for the restructuring of the portfolios of ETFs referencing these indices. The official cut-off date for the two indices is November 29, 2024.

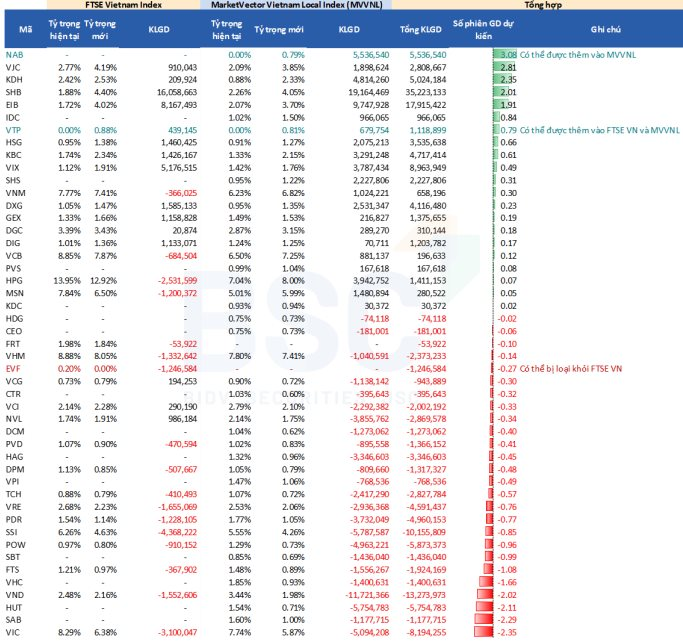

In a recent report, BSC Securities predicted the constituent stocks and the number of stocks to be bought/sold for the ETFs referencing these indices.

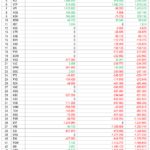

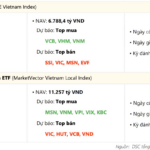

For the FTSE Vietnam Index (FTSE ETF), BSC predicts that Viettel Post (VTP) stock will be added as it has met the requirements in terms of liquidity, free-float ratio, and foreign ownership ratio. Additionally, the market capitalization of this stock is currently in the top 88% of the accumulated capitalization of eligible stocks.

On the other hand, EVF stock is likely to be removed as it does not meet the market capitalization weight that can be purchased for the index basket.

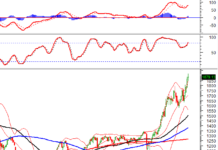

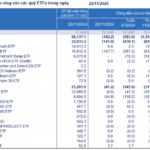

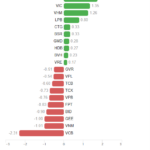

With these changes, BSC estimates that the FTSE ETF will significantly buy SHB (16 million shares), EIB (8.2 million shares), and VIX (5.2 million shares) and sell VND (1.6 million shares), VIC (3.1 million shares), SSI (4.4 million shares), and HPG (2.5 million shares) to restructure the portfolio.

For the MarketVector Vietnam Local (VNM ETF), BSC predicts that the index will add two new stocks: Viettel Post (VTP) and NamA Bank (NAB). According to BSC’s analysis team, these stocks meet the requirements in terms of liquidity, free-float ratio, and foreign ownership ratio, and their market capitalization is within the 85% range of the accumulated capitalization of eligible stocks, making them likely candidates for inclusion.

With these changes, BSC estimates that the VNM ETF will significantly buy SHB (19.2 million shares), EIB (9.7 million shares), NAB (8.5 million shares), KDH (4.8 million shares), and HPG (3.9 million shares) and sell VND (13.3 million shares), VIC (8.2 million shares), SSI (10.2 million shares), and POW (5.9 million shares) to restructure its portfolio.

Conversely, BVH stock may be removed as its market capitalization is currently outside the 98% range of the accumulated capitalization of eligible stocks.

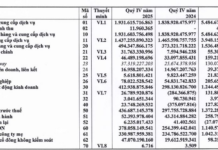

Predicted number of stocks to be bought/sold by foreign ETFs in Q4/2024

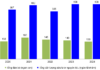

Quarterly Review: Which Sector Will the 18,000 Billion NAV ETF Funds Buy Aggressively?

According to the latest report from BSC Research, the portfolios of two prominent ETFs are set to undergo notable changes during the upcoming Q4 2024 reconstitution. Viettel Post’s VTP is anticipated to feature in both ETF portfolios, while Nam A Bank’s NAB is likely to be added to the VNM ETF.