Mr. Phan Anh Tuan, born in 1975, was introduced by NVS as a Master of Finance and Banking with 26 years of experience in the financial and securities industry. He began his tenure as Chairman of the Board of Directors and has been accompanying NVS since 2014.

Currently, in addition to his role on the Board, Mr. Tuan also heads the NVS Executive Committee as CEO. However, on the 21st of November, prior to this, Mr. Tuan also submitted his resignation from this position.

|

Mr. Phan Anh Tuan and other members of the Board of Directors at Navibank Securities

Source: Navibank Securities Website, December 4, 2024

|

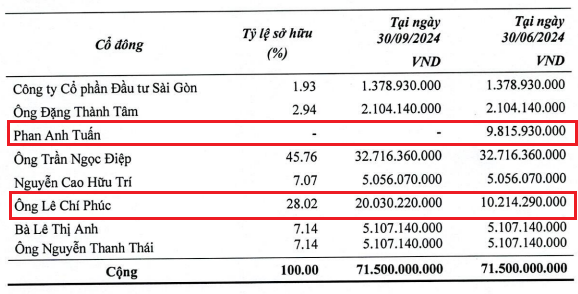

According to NVS’ semi-annual report for the first half of 2024, Mr. Tuan holds over 10% of the capital in SGI Investment Fund Management Joint Stock Company – the unit managing the Ballad Vietnam Equity Growth Fund (The Ballad Fund, abbreviated as TBLF). In addition to Mr. Tuan, another NVS Board member, Mr. Le Chi Phuc, also holds over 10% of the capital in SGI Fund Management.

According to SGI Fund Management’s Q3/2024 financial statements, as of September 30, 2024, Mr. Tuan had divested his entire holding of more than 9.8 million shares (13.73%), while Mr. Phuc increased his ownership to the same amount, holding over 20 million shares (28.02%) and becoming the second largest shareholder. In addition, Mr. Phuc also serves as CEO of SGI Fund Management.

|

Changes in SGI Fund Management’s shareholder structure in Q3/2024

Source: Q3/2024 Financial Statements of SGI Fund Management

|

Navibank Securities was established in 2008 and currently has a charter capital of VND 252 billion. The company is headquartered on the 6th floor, Handi Resco Building, 521 Kim Ma, Ngoc Khanh Ward, Ba Dinh District, Hanoi. It operates in various fields, including securities brokerage, securities investment consulting, securities underwriting, securities depository, and proprietary trading.

In the first nine months of 2024, NVS recorded over VND 52 billion in operating revenue, a 30% decrease compared to the same period last year, mainly due to reduced profits from financial assets measured at FVTPL. Ultimately, the company posted a net profit of over VND 17 billion, only half of the previous year’s figure.

Huy Khai