Services

TTC AgriS has announced its plan to divest from six non-core businesses to focus on expanding its product portfolio and strengthening its presence in the FBMC (Food-Beverage-Milk-Confectionary) market.

|

On December 4, 2024, TTC AgriS revealed its strategic decision to restructure its investment portfolio by exiting non-core businesses. Specifically, the company will divest from six companies, including Ho Chi Minh City Tourism Corporation (HOSE: VNG), Gia Lai Electricity Joint Stock Company (HOSE: GEG), Dang Huynh Industrial Park Investment and Management Joint Stock Company, Tan Hoi Industrial Cluster Infrastructure Investment Joint Stock Company, Tan Dinh Import-Export Joint Stock Company, and Toan Hai Van Joint Stock Company. The proceeds from these divestments will be reinvested into TTC AgriS’s core business activities.

According to the announcement, TTC AgriS will sell its entire 1.7 million shares in Ho Chi Minh City Tourism Corporation (VNG) in December 2024, followed by Tan Hoi Industrial Cluster Infrastructure Investment Joint Stock Company and the remaining companies in the portfolio.

During the TTC AgriS Stakeholders Site Visit 2024 held in Tay Ninh on October 18, 2024, which was attended by over 70 partners from domestic and foreign financial institutions, TTC AgriS reaffirmed its commitment to finding suitable partners and accelerating its portfolio restructuring process. The company intends to focus solely on its core businesses related to agriculture and the FBMC industry.

Ms. Dang Huynh Uc My, Chairman of TTC AgriS, shared the company’s plans to find suitable partners and accelerate portfolio restructuring at the TTC AgriS Stakeholders Site Visit 2024.

|

At the Annual General Meeting of Shareholders for the 2023-2024 fiscal year, held on October 24, 2024, Ms. Dang Huynh Uc My, Chairman of the Board, shared the strategic business direction of TTC AgriS: “We have successfully integrated a Circular Trade Value Chain and a Smart Agricultural Economic Model, aiming for a revenue target of VND 60,000 billion by 2030 and Net Zero by 2035. Moving forward, TTC AgriS will focus on expanding our raw material sources and investing in additional food, beverage, and confectionery production facilities to closely align with our goal of 100% participation in the global FBMC value chain. We will also actively divest and restructure our investments unrelated to the agricultural value chain to concentrate our resources on our core businesses, delivering superior value to our shareholders and stakeholders.”

The investment portfolio restructuring is a significant step in TTC AgriS’s strategy to focus its resources on core business activities and deepen its presence in the FBMC market. The company is currently seeking partners and working on divesting from the remaining companies in the aforementioned portfolio of six.

Adhering to its new business model, TTC AgriS has been actively pursuing M&A activities in the food and beverage industry. Specifically, in September 2024, TTC AgriS announced a completed investment of 1.5 million AUD in East Forged, an Australian company specializing in cold brew nitro tea. In October 2024, TTC AgriS expressed its intention to invest in Betrimex, a leading Vietnamese company in the manufacturing, distribution, and trade of coconut products, with a planned investment of up to 40% of Betrimex’s charter capital. This investment is expected to be executed between October 2024 and the end of the 2024-2025 fiscal year.

Mr. Justin McGowan, Queensland Trade and Investment Commissioner (bottom row, left), Ms. Dang Huynh Uc My, Chairman of TTC AgriS (bottom row, right), Ms. Doan Vu Uyen Duyen, CEO of GMAA (top row, left), and Ms. Kym Cooper, Founder of East Forged (top row, right), during the signing ceremony held at the Queensland Trade and Investment Office, Australia.

|

Unlocking the Power of Language for TTC AgriS’ Investment Restructuring and Core Operations

TTC AgriS (HOSE: SBT) has announced plans to restructure its investment portfolio by divesting from two listed companies and four unlisted entities. This strategic move aims to sharpen the company’s focus on its core businesses.

The Unifying Rubber Conflict: When Stakeholders Disagree on Divesting Super-Profitable Investments.

The major shareholders of Cao su Thong Nhat JSC (HOSE: TNC) are at odds over their investment in Baria Serece. With a combined stake of over 40%, the two groups have a significant influence on the company’s future. The question now is: will they find a united front, or will their divergent views lead to a stand-off?

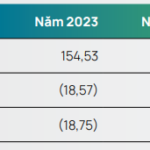

First Quarter of FY 2024-2025: TTC AgriS Reports Positive Financial Results, with a Threefold Increase in Revenue.

The Ho Chi Minh City-listed TTC AgriS (HOSE: SBT) kicked off FY 2024-2025 on a positive note, with robust operational performance and a threefold increase in revenue from its FBMC segment, underpinned by improved gross profit margins.