The battle between Long Chau and local pharmacies in Ha Nam province.

Traditional pharmacies and small chains are facing immense pressure

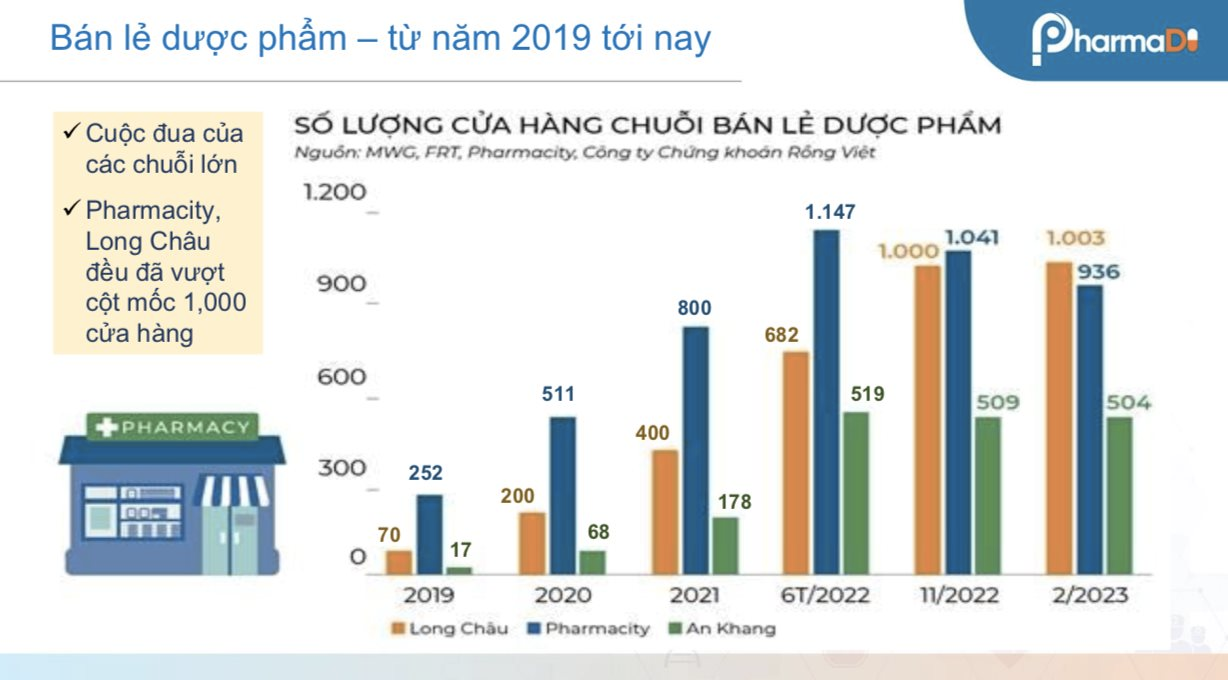

Despite Long Chau’s leadership stating that they neither intend to nor are capable of defeating small, independent pharmacies, the reality is that ‘happiness is a narrow blanket’, and wherever Long Chau makes a grand entrance, many traditional pharmacies disappear. This has been proven in major cities like Ho Chi Minh City and Hanoi, where the trio of Long Chau, Pharmacity, and An Khang dominate.

Among them, with its experience in the FPT Shop model and technological backing from the FPT Corporation, Long Chau’s growth has been the most formidable. They now have nearly 2,000 pharmacies and vaccination centers and are the only chain to turn a profit on each store.

In the past few years, both Pharmacity and An Khang have been struggling to achieve profitability on each sales point like Long Chau, so their scale has hardly expanded. Pharmacity maintains a scale of 900–1,000 stores, while An Khang operates 300–350 stores. So, it’s no exaggeration to say that Long Chau is ‘leading the race’. As for their target number of stores, Long Chau has not disclosed this information.

The market for pharmacy and cosmetic chains before 2018, before Long Chau’s emergence.

Before Long Chau appeared, there were about 50,000 pharmacies in Vietnam. Currently, there are about 17,000 pharmacies, a decrease of about 25%. Additionally, if we count the number of stores of all the major chains like Long Chau, Pharmacity, and An Khang, along with smaller chains, there are about 5,000.

According to statistics up to September 2024, Long Chau has about 1,849 sales points, with an average revenue of 1.2 billion VND per store per month, totaling 18,000 billion VND in revenue, which accounts for 22% of the market share.

Currently, in the Vietnamese pharmaceutical and cosmetic market, there are also some large foreign brands such as AEON Wellness, Watsons, and Matsumoto Kiyoshi…

Watsons has 7 stores in Ho Chi Minh City and 1 in Can Tho. Matsumoto Kiyoshi, Japan’s top 3 drugstore chain, entered Vietnam in 2020 and now has 7 stores in Ho Chi Minh City and 3 in Hanoi; they also have over 17,000 stores in Japan and Taiwan.

“,

Master – Pharmacist Le Phuong Dung shared at the event “Pharmacy Business – Change or Disappear”.

Master – Pharmacist Le Phuong Dung is currently the Founder – CEO of MPG Academy, Pharmaco Agency, and MPG Drugstore. The event “Pharmacy Business – Change or Disappear” was co-organized by MPG, Pharmaco, and PharmaDi, specializing in marketing and sales for small and large chains to help them not “disappear” under pressure from larger chains.

However, according to Ms. Le Phuong Dung, there are still some small pharmacy chains that are valiantly fighting alongside Long Chau without suffering setbacks, thanks to their long-standing reputation, quick adaptation, and profound understanding of the local market. Examples include the Phuong Chinh chain in Hai Ba Trung district, Hanoi, Long Hien in Thanh Hoa, and A Dong in Ha Nam.

The 4P strategy for traditional pharmacies to keep up with modern chains

Also, according to Ms. Le Phuong Dung, the biggest challenges for small, independent pharmacies in Vietnam include marketing, finance, and human resources. At the same time, pharmacy owners lack strategic thinking and technological capabilities, such as combining offline and online approaches.

Master – Pharmacist Le Phuong Dung (in red) with other speakers at the event “Pharmacy Business – Change or Disappear”

Currently, Long Chau’s strategy includes up to 15P, but I only want to bring to the small, independent pharmacy owners the 4 basic Ps: product, price, place, and people.

“,

First, regarding product strategy:

in modern pharmacies, although non-drug products only account for 20% of revenue, they contribute up to 80% of profits. To ensure financial stability, in the future, we should consider selling more functional foods or cosmetics/consumer goods.

In the strategic pharmaceutical industry, we used to go to the market or online platforms to check prices, looking for the cheapest options with the most incentives. Now, we need to prioritize product quality first and choose to import drugs with clear origins or unique technologies.

Nowadays, it’s not uncommon for pharmaceutical factories to communicate their history, such as having 70 years of formation and development, or having no competitors in the same industry thanks to new technology. We can use our partners’ stories to market our products.

Pharmacy owners should choose pharmaceutical companies with diverse product lines so that we can easily cross-sell,

” suggested Ms. Le Phuong Dung.

For a pharmacy, it’s challenging to attract new customers, so to increase revenue, we must try to increase the value of each order from loyal customers. Many pharmacies have started selling ‘solution packages’ instead of individual products. For example, for diabetic patients, they offer a package for controlling the disease, including a monitoring device, medication, and functional foods. Every pharmacist must be a health consultant, not just a drug seller!

Each pharmacy should have 20 to 30 strategic partners to enhance its competitiveness by ‘standing on the shoulders of giants’. In addition to selling products, large partners often have policies to support pharmacies in marketing and training human resources.

Inside Phuong Chinh pharmacy in Hai Ba Trung district, Hanoi.

Second, regarding pricing strategy:

pharmacy owners must be more flexible with pricing. Previously, we only focused on the product and kept a fixed price throughout its life cycle. Now, we need to offer promotions and discounts for cross-selling when the drugs are close to their expiration date, instead of discarding them as before.

Additionally, we can categorize products to create a sales funnel: which products should be sold online, which industries should be sold offline, which are the main products, and which can be sold at competitive prices. We can still make good profits even when deciding to compete on price if we know how to negotiate well with strategic suppliers. The principle is: the shorter the product life cycle, the deeper the discount, and within six months, we can consider giving them away.

Third, regarding place:

now, the location is not just a place to sell pharmaceuticals but also to display other industries such as consumer goods and cosmetics, and it serves as a communication tool through signage, posters, or standees.

There are two typical examples of effectively utilizing locations to compete with the big players. Phuong Chinh is one of the oldest and largest pharmacy chains in Hanoi, and they have chosen to focus on Hai Ba Trung district, where they have 8 stores, making them the largest chain in the district.

Despite the presence of Pharmacity and Long Chau, Phuong Chinh has retained its customers by redesigning its stores in a modern style: in addition to pharmaceuticals, they offer a wide range of other products, creating a cozy shopping environment, being transparent about prices, and offering promotions.

Long Hien is the busiest pharmacy chain in Thanh Hoa province.

In the center of Thanh Hoa, according to Ms. Le Phuong Dung, Long Hien is the busiest pharmacy chain in the province, although they only have 9 stores. This long-standing local pharmaceutical chain has quickly embraced the trend of modern pharmacies, especially by adding cosmetics and consumer goods to their product range very early on, to upsell to the hundreds of customers who visit their stores daily. Long Chau currently has 29 stores in Thanh Hoa.

Currently, Long Hien’s revenue from cosmetics and consumer goods is almost equal to that of prescription drugs from hospitals, which used to be their only source of income,

” revealed Ms. Le Phuong Dung.

Unify multi-channel marketing:

the marketing/PR message must be consistent and timely across both online and offline platforms.

Currently, many pharmacies owned by young people regularly livestream to sell products on TikTok or Facebook, earning tens of millions of VND per month, even though they don’t have a large following.

We can use AI to design and create detailed content for marketing and sales. After about six months of learning, employees and Ms. Le Phuong Dung have been able to use AI to create content, including articles and clips, quickly and then distribute them across multiple channels, such as websites, Facebook, and Tiktok…

In addition, we can market the pharmacy through the personal brand of the pharmacist. In Hanoi, many customers don’t remember the name of the pharmacy but remember the name of the pharmacist.

In Ha Nam province, the A Dong pharmacy chain is still valiantly fighting against Long Chau. There are areas where one A Dong pharmacy is sandwiched between three Long Chau pharmacies, yet they survive. The owner of this local pharmaceutical chain, Mr. Nguyen Huy Hoan, with his distinctive bald head, always sits in the center of the store to consult and sell medicines, and customers love to chat with the ‘bald pharmacist’.

A store of the A Dong chain in Ha Nam

In another aspect, the A Dong chain has been actively marketing and PR since 2019, appearing in major newspapers and media outlets in Vietnam. Currently, as they aim to position themselves as the first pharmaceutical chain to cover all district towns in Ha Nam, A Dong has continuously opened new stores in recent years. Each store requires an investment of over 200 million VND, and out of their total of 15 stores, a few are making losses, but the chain persists because they ‘dare to play, dare to take risks’.

Long Chau has 9 stores in Ha Nam, while Pharmacity and An Khang have not yet entered this province.

Finally, regarding human resource strategy:

“Pharmacies that want to break through in the digital world must have people who ‘dare to pioneer, dare to die’. We cannot use 0.4 people for the 4.0 digital transformation. Pharmacists today, in addition to their professional knowledge, need to know how to create content through Canvas, CapCut, or AI, or livestream to sell products during quiet hours.

To achieve this, we must change the salary structure to reward multi-tasking and the actual contributions of human resources. Currently, MPG employees’ income comes from 4 sources: basic salary + marketing/PR, sales commissions…

“, suggested the CEO of MPG Drugstore.

The process is also important:

from pharmacies in hospitals to private companies, everyone is using AI to process orders, inventory, and demand forecasting… Walgreens, one of the largest pharmaceutical chains in the US, has processed 300 prescriptions per hour with AI. With this volume of work, manual processing would take about a day.

With over 1,600 stores and a portfolio of 30,000 products, Long Chau is using AI to predict customer needs, manage inventory, optimize supply chain management… Their inventory has decreased from 13% to 5%. Moreover, Long Chau also uses AI to enhance the customer experience by providing reminders for medication or vaccination schedules.

In the future, will the large chains also win in the provincial market?

Discussing this issue in the BSA-organized seminar

Trends in Shopping for Tet 2025

, an expert in sales working for a global company in the food and healthcare sector shared: in 2025, the major pharmaceutical chains in the market will continue to prioritize efficiency on each store.

The Rise and Fall of Temu in Vietnam: From Consumer Craze to Fizzle in Just Two Months

The brief tenure of Temu in the Vietnamese market once again highlights the importance of monitoring and regulating cross-border e-commerce platforms. This ensures consumer protection and fosters fair competition with domestic businesses.

Strolling Through Hanoi’s Old Quarter: An Evening with the Prime Minister and Jensen Huang, Indulging in Local Delicacies

On December 5, Prime Minister Pham Minh Chinh and NVIDIA Corporation’s founder and CEO, Jensen Huang, embarked on a cultural journey through Hanoi’s iconic landmarks. The evening began with a visit to the picturesque Ngoc Son Temple, nestled on Hoan Kiem Lake, offering a serene escape in the heart of the bustling city. They then strolled along the lake’s shores, taking in the tranquil waters and the vibrant atmosphere of Hanoi’s Old Quarter, a melting pot of rich history and vibrant local culture.

The Rise of Vietnamese E-Commerce: A New Player Enters the Fray as Temu Takes a Pause

The news of Temu’s temporary closure and Viettel Post’s upcoming launch of a cross-border exchange platform signals an intensifying “race” in the e-commerce industry as 2024 draws to a close.

A Race Against Time: Long Thanh Airport – A 2025 Vision

On December 3rd, Prime Minister Pham Minh Chinh visited Dong Nai to inspect and expedite the progress of two key infrastructure projects: the Long Thanh International Airport and the Bien Hoa-Vung Tau Expressway. With his keen interest and personal involvement, the Prime Minister emphasized the importance of these projects in boosting the region’s economic development and connectivity.