According to Mr. Luc, by the end of September 2024, real estate credit outstanding balances reached VND 3,150 trillion, accounting for nearly 21% of the economy’s total outstanding credit. Lending to the real estate sector increased by 9.15% (higher than the 9% increase in overall credit), with lending to real estate businesses increasing by 16% while lending to the housing sector increased by only 4.6%.

Meanwhile, lending rates have dropped significantly compared to 2023, favoring the real estate market. However, despite the low-interest rates, people are still reluctant to borrow large amounts of money to purchase real estate. The main reason is that property prices remain high, exceeding the financial capacity of the majority of the population.

Dr. Luc suggested that to encourage more people to invest in real estate, businesses need to strive to reduce or stabilize prices in some projects and segments through appropriate promotional forms, accepting smaller but sustainable profit margins.

Most experts in the industry agree that property prices are still the biggest barrier for home buyers. Although lending rates have dropped, the current property prices make the monthly payments a significant burden, especially for those with middle incomes.

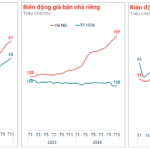

Ms. Nguyen Hoai An, Senior Director of CBRE Hanoi, previously stated that income growth has failed to keep up with the rise in property prices, affecting home affordability. Currently, new apartment prices average VND 64 million per square meter (excluding VAT and maintenance fees) in Q3 2024, up nearly 26% year-on-year. The increase in primary project prices has also pushed secondary prices up by almost 26% year-on-year to VND 46 million per square meter.

Photo: TB

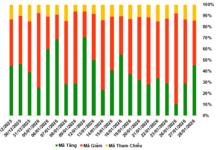

Mr. Nguyen Van Dinh, President of the Vietnam Real Estate Brokerage Association (VARS), stated that the Hanoi real estate market, from apartment segments to auction sessions, has shown signs of abnormally high prices, affecting the psychology of market participants. As the prices are pushed to an “unreasonable” level, the number of transactions decreases as more buyers refuse to accept such increases.

According to the VARS President, there are two main solutions: curbing the group of factors pushing up real estate prices and increasing the supply of social housing to balance supply and demand. Among them, regulating the market through real estate tax policies can help reduce speculation and curb rising land prices. This policy also encourages owners of abandoned projects to rent or sell, increasing the supply in the market.

A recent report by the National Assembly’s supervisory delegation showed that after the Covid-19 pandemic, Vietnam’s real estate market faced severe difficulties. During 2022-2023, the real estate supply decreased sharply, while property prices continued to soar, far exceeding the income of the majority of the population.

Mr. Vu Hong Thanh, Chairman of the National Assembly’s Economic Committee, stated that real estate prices in major cities like Hanoi and Ho Chi Minh City are inappropriate regarding people’s income. Many urban areas are abandoned, and projects are delayed, wasting land resources and investment capital.

Delegate Nguyen Thi Thuy from Bac Kan province pointed out that the phenomena of price manipulation, speculation, and market disruption have caused chaos. Unrealistic price increases in big cities have made it challenging for many households to own homes, while speculators take advantage of the situation to accumulate assets and wait for higher prices.

According to Ms. Thuy, during the land and housing fever, the psychology of buying land and houses for profit has been rising in a part of the population, causing the already high prices to soar even higher.

Additionally, there is an imbalance in the apartment segments. The market currently lacks affordable housing options for middle-income earners, while there is an oversupply of luxury apartments.

The National Assembly’s supervisory delegation also recommended that the Government, the Prime Minister, and related agencies continue to review and adjust policies to develop a safe and healthy real estate market. There is a need to diversify the supply to meet housing demands and focus on social welfare. The delegation also emphasized the necessity of measures to bring property prices back to their actual value and prevent price manipulation and speculation.

The Capital’s Land Allocation: Auctioning Off 30,500 sqm for Social Housing Development

The recent allocation of land in Tam Hung, Thanh Oai district, by the Hanoi People’s Committee, marks an exciting development. Out of the total area of nearly 30,500 square meters, almost 10,000 square meters of residential land will be auctioned, with an additional 5,000 square meters designated for social housing construction. This news signals potential opportunities for investors and developers, as well as a positive step towards addressing housing needs in the area.

The Regal Legend: Vietnam’s Premier Residential Destination

In just under 3 years, the super urban area, Regal Legend, has transformed the coastal city of Dong Hoi. With its exceptional architectural masterpieces and vibrant resident community, this development has fostered a bustling business environment and a host of unique, frequent events that have elevated the city’s appeal.

“A Taxing Matter: Curbing Property Speculation with Time-Based Levies”

The Ministry of Finance is proposing to study and implement a tax on capital gains from real estate transfers. This progressive initiative aims to revolutionize the nation’s tax landscape by introducing a nuanced approach to taxation, one that is sensitive to the varying financial circumstances of citizens. By taking into account the duration of property ownership, this proposed tax adjustment has the potential to foster a more equitable society, where the tax burden is distributed in a manner that accounts for the diverse economic realities of the populace.