The Institute of Energy’s (Ministry of Industry and Trade) report on International Experience and Nuclear Power Development in Vietnam clearly states that the development of small modular reactor (SMR) technology, with a smaller scale than traditional large nuclear power plants, has garnered interest from many countries.

SMRs offer several advantages, including reduced installation time and cost savings, enhanced safety and security features due to their passive safety design philosophy, minimizing radiation leaks in most scenarios, and flexibility in installation and site location.

The world’s first floating nuclear power plant by the Russian Federation.

|

Notably, the distributed nature of SMRs reduces the need for transmission grid enhancements compared to large-scale nuclear power; they support flexible operation of the power system with a high penetration of renewable energy; and floating SMRs can quickly supplement capacity shortages in load centers.

The development of floating SMRs is also advantageous due to the mobility of the plant, allowing it to be moved from one place to another if needed. In this regard, floating nuclear power units are suitable for operation in coastal areas or places far from the central power system.

In addition, SMR reactors have the potential to replace retired coal-fired power plants, as emphasized by the Institute of Energy.

However, SMRs face challenges in commercialization. While initial projects have shown positive results, commercialization may lead to significantly higher investment costs due to the lack of dedicated manufacturing supply chains.

Currently, various technologies with different purposes are being developed and operated, ranging from micro-reactors with capacities below 10MW to large reactors with capacities up to 300MW.

However, according to the International Atomic Energy Agency (IAEA), only two countries operate SMRs: China and Russia. While Russia is in the process of installing a 70MW capacity reactor, China has recently started commercial operation of its first unit at the Shidaowan site with a capacity of 200MW.

The Institute of Energy also notes that, despite being SMRs, there is a need to harmonize international regulatory mechanisms with safety assessment and approval standards by the regulatory agencies of each country. Moreover, public acceptance is crucial, and SMRs are considered similar to large-scale nuclear power plants in this regard.

So far, no design has been invested in mass production, and most are initial pilot versions, with the supply chain yet to be established. Additionally, developing multiple dispersed SMRs can pose challenges in public acceptance and incur higher security assurance costs compared to larger units.

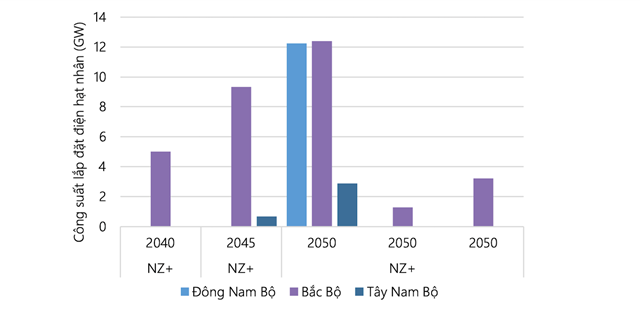

No regional nuclear power investments before 2040 in all scenarios.

|

The report “Vietnam Energy Outlook – Pathway to Net Zero Emissions” by the Department of Electricity and Renewable Energy (Ministry of Industry and Trade) in collaboration with the Danish Energy Agency, released in June 2024, suggests that investing in nuclear power should focus on SMR technology, opting for emerging technologies with the advantage of shorter construction times and distributed installation.

However, the regional location is also a factor to consider when assessing the potential role of nuclear power in Vietnam.

The report concludes that investing in SMR nuclear power plants in the North or Southeast regions is the optimal solution for providing electricity to major load centers, as it eliminates the need for additional inter-regional transmission grid investments.

With this choice, nuclear power can become cost-competitive in some regions when low-cost renewable energy technologies, such as ground-mounted solar power, have been fully exploited in areas with high electricity demand.

The report by the Department of Electricity and Renewable Energy also cautions that since nuclear power is a new concept in Vietnam, there is a level of uncertainty regarding the cost and time required to develop the necessary infrastructure and knowledge to implement this highly specialized technology.

|

On November 30, the National Assembly passed the Resolution of the 8th Session, agreeing to continue the policy of investing in the Ninh Thuan nuclear power project. The Government was assigned to allocate resources to restart the Ninh Thuan nuclear power project as per the conclusions of the competent authority. Thus, after eight years of suspension, the Ninh Thuan nuclear power project is restarted. Previously, the sites selected for the construction of Ninh Thuan 1 and 2 nuclear power plants had undergone a lengthy and meticulous evaluation process, meeting stringent international criteria and deemed suitable for the development of nuclear power plants in Vietnam. |

Tam An