Recently, on December 6, Thanh Cong Textile Garment Investment Trading Joint Stock Company (code: TCM) announced that it had received a decision from the Post-Clearance Inspection Department – General Department of Customs on tax finalization for exported and imported goods based on the results of the post-clearance inspection phase from July 2019 to June 2024.

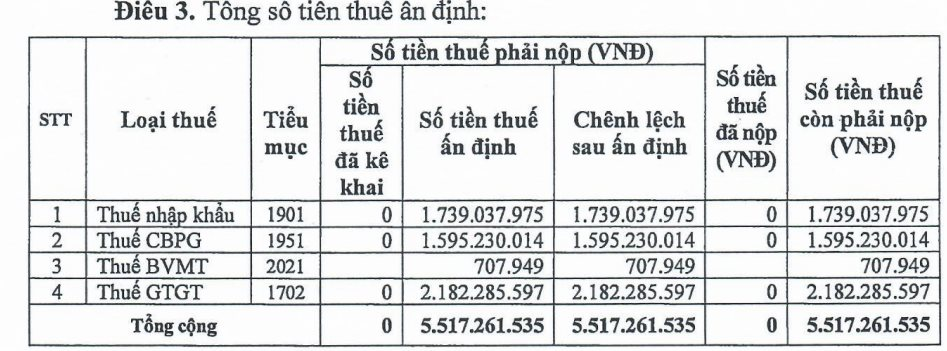

Accordingly, the total amount of finalized taxes, including import tax, anti-dumping tax, environmental protection tax, and VAT that TCM has yet to pay is over VND 5.5 billion. The company said it had completed its tax obligations as regulated.

The reason for this was that TCM incorrectly declared tax exemption subjects, leading to a shortfall in import tax payments; mismanagement, and inaccuracy in accounting for imported raw materials and supplies, resulting in discrepancies in some items at the end of 2023, which the company could not accurately explain and specify the reasons for the discrepancies…

A day earlier, according to a decision dated December 5 of the Hanoi Tax Department, Hanoi Textile Garment Joint Stock Corporation (Hanosimex, code: HSM) was administratively fined for tax violations, with a total of nearly VND 383 million in back taxes and late payment penalties. Hanosimex had made incomplete declarations, failed to fully declare the indicators on tax returns, declared VAT on goods and services purchased without meeting the conditions for deduction, and accounted for some unreasonable and illegitimate expenses, violating the regulations.

The New 5% VAT on Fertilizers: MBS Unveils Businesses Set to Benefit

MBS Securities believes that applying a value-added tax to fertilizers (at a rate of 5%) will enable businesses to claim input VAT deductions, thereby supporting the profitability of domestic fertilizer producers.

Farmers and Agricultural Businesses Yearn to Pay VAT

The upcoming agenda for the National Assembly includes the discussion and potential passage of the Value-Added Tax Law (amended) on November 26th. A highly debated topic among the public is the government’s proposal to shift fertilizers, agricultural machinery, and fishing vessels from tax-exempt to a 5% tax-liable status.