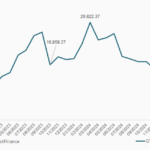

The VN-Index soared after a deep dip, as a massive influx of cash entered the market, with securities stocks as the main focus. The VN-Index surged by over 27 points (equivalent to 2.19%) to 1,267 points at the close of the December 5 trading session. Notably, the matching liquidity on the HOSE also increased by more than 60% compared to the previous session, reaching 19,200 billion VND – the highest level in the past two months. This indicates the excitement of investors after the market’s previous stagnant phase.

Commenting on the market developments, Mr. Nguyen Minh Hoang, Director of VFS Securities Analysis, attributed the market’s explosive performance to increased bottom-fishing forces at the 1,240-point support level, which boosted buying momentum and triggered widespread capital dispersion.

“One of the reasons for the market’s sudden surge was the emergence of (unofficial) information regarding the potential visit of FTSE Russell representatives to Vietnam, where they would meet with several custodians, brokers, and the SSC. Securities stocks such as HCM, SSI, and VCI, which were expected to benefit from this development, surged to the ceiling, creating a pull effect that attracted capital to other stocks and sectors, especially large sectors like Banking and Real Estate,” analyzed the VFS Director.

Additionally, after numerous sessions of aggressive net selling, foreign investors’ shift to net buying significantly contributed to enhancing investor sentiment and market liquidity.

According to the expert’s comprehensive assessment, this was a good capital inflow session, with strong dispersion after the index adjusted to the 1,240 level. With the current gain, the VN-Index confirmed and continued the upward trend from the 1,200-point bottom formed on November 20. By breaking through the 1,260-point resistance, the market could witness a strong resurgence of capital inflows, confirming a “double bottom” and advancing towards higher resistance zones around 1,290 – 1,300.

Looking at the long-term outlook, the VFS expert believes that capital inflows could be reactivated once the uncertainties surrounding the new US policies are clarified early next year. Additionally, Vietnam’s economic prospects are forecast to be positive in the coming year, with GDP growth expected to remain at 6.5%, which will be linked to the business growth of enterprises.

Furthermore, capital inflows are expected to improve with the acceleration of public investment. The narrative around the potential upgrade of the trading system and the market’s tier advancement by 2025 could be a significant factor in attracting foreign capital, estimated to be in the billions of USD. Mr. Hoang stated that when these supportive factors have a more apparent impact on the market, domestic capital will also witness more vibrant trading as market sentiment improves.

Additionally, the US Dollar Index (DXY) has shown signs of forming a short-term peak in the 107 region, despite remaining at elevated levels. Historical data suggests that the DXY and VN-Index tend to move in opposite directions. Whenever the DXY peaks and declines, the VN-Index tends to bottom out and rise. The continuous rise in the DXY over the past period has also contributed to weak market liquidity as domestic investors became more cautious, and foreign investors maintained net selling.

However, in the period leading up to the end of 2024 and the beginning of 2025, liquidity may not improve significantly as the DXY maintains its upward trend, and the Fed’s “no rush to cut interest rates” stance continues to exert pressure on the SBV’s exchange rate control and system liquidity management. Therefore, there remains a possibility that the SBV will slightly increase the operating interest rate by 0.25% in early 2025, and in this case, the market may need to adjust further to discount this risk.

Overall, the VFS expert maintains that the market’s nature remains sideway accumulative with a large amplitude, characterized by weak capital inflows and high differentiation. Therefore, investors should continue to maintain a reasonable cash-stock ratio of 50-50, refrain from borrowing to invest, and prioritize sectors and stocks with strong growth prospects and reasonable valuations, such as Industrial Real Estate, Exports, Public Investment, Steel, and Banking.

Given the weak and rapidly rotating market liquidity, investors should avoid chasing prices and instead focus on buying during market and stock corrections to strong support zones.

The Vietnamese Stock Market Soars: A Surprising Rise to the Top in Asia

The Vietnamese stock market witnessed an unexpected surge in trading activity, with the VN-Index leading gains across Asia. This rally was characterized by a significant jump in trading volume and a return to net buying by foreign investors, setting the stage for a potential shift in market dynamics and investor sentiment.

The Good News: Foreigners Change Course, Pouring Nearly VND 700 Billion into Vietnam Stocks – What’s the Focus?

In the afternoon trading session, HPG stock witnessed the largest foreign buying on HOSE, with a value of VND 127 billion. Following closely, MSN, FPT, and SSI stocks each experienced net buying of over VND 70 billion.