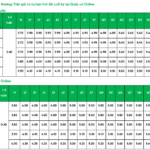

LPBank has officially reduced savings interest rates for short-term maturities since December 5. Specifically, the savings interest rate for the 1-2 month term decreased by 0.2% per year, to 3.6% and 3.7% per year, respectively. Savings interest rates for terms of 3-5 months simultaneously decreased by 0.1% per year to 3.9% per year. LPBank also decreased the interest rate for the 6-11-month term by 0.1% per year to 5.1% per year.

The remaining terms remain unchanged by the bank. Specifically, the interest rate for the 12-16 month term is 5.5% per year. The highest savings interest rate currently offered by LPBank is 5.8% per year for online deposits with a term of 18-60 months.

LPBank’s latest online savings interest rates.

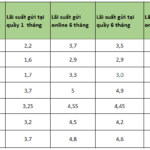

Similarly, IVB Bank has joined the list of banks reducing interest rates, just a few days after significantly increasing them. Specifically, IVB Bank lowered the interest rate from 6.5% per year to 6.2% per year for the 24-36 month term. Meanwhile, the interest rate for 18-month deposits decreased by 0.25% per year to 6.05% per year, equal to the 13-month term.

The bank maintained the interest rates for other maturities. The 1-month term currently offers an interest rate of 4% per year, 4.1% per year for 2 months, and 4.35% per year for 3 months. Savings interest rates for terms of 6-9 months are currently at 5.35% per year, and 12 months is at 5.95% per year.

However, this bank currently offers an interest rate as high as 6.45% per year for flexible deposits with a long-term maturity of 5-15 years. In addition, under this type of deposit, interest rates for terms of 12-48 months are also applied within the range of 5.95-6.25% per year.

Earlier, on December 3, IVB Bank increased the interest rate for 24-36-month term deposits to 6.5% per year, the highest compared to other banks, and also increased the interest rate for 13-18-month term deposits to 6.3% per year.

IVB Bank’s latest savings interest rates.

ABBank also adjusted its savings interest rates downward starting November 30. Accordingly, the highest savings interest rate for the 24-month term decreased from 6.3% per year to 5.7% per year. The interest rate for 15-18-month term deposits also decreased from 6.2% per year to 5.7% per year.

The bank also adjusted short-term interest rates. Specifically, the interest rate for the 3-month term increased by 0.1% per year to 4.2% per year. For the 5-month term, the interest rate decreased by 0.1% per year to 4.2% per year.

Interest rates for other terms remained unchanged. Specifically, the interest rate for the 1-month term is currently at 3.2% per year. Interest rates for terms of 6-11 months are up to 5.6% per year. The interest rate for the 12-month term remains at 5.8% per year. For the 36-60-month term, ABBank maintains an interest rate of 5.7% per year.

ABBank’s latest savings interest rates.

Experts predict that savings interest rates will show a slight upward trend rather than overheating and may stabilize or gradually decrease in the early part of the next year, especially after the Tet holiday.

Dr. Nguyen Hoang Nam, Head of the Finance and Banking Department at Dai Nam University, predicted that the turnover of the Vietnamese dong would remain low compared to the currencies of other economies in the same state. Therefore, in the last few weeks of 2024, Dr. Nam expected that there would not be a rush to increase interest rates.

Regarding the recent trend of banks simultaneously increasing savings interest rates, the expert attributed it to the lack of liquidity among commercial banks, unlike previous hikes caused by inflation or exchange rate fluctuations.

Currently, Circular No. 06/2023/TT-NHNN allows debt rescheduling for loans due for a number of borrowers. This means that instead of money returning to the system for commercial banks to continue lending, it is still somewhere in the economy.

The Big Three Shake Up Savings: Techcombank, VPBank, and MSB Kick Off December With a Bang by Hiking Deposit Rates

In the first week of December, several banks adjusted their savings interest rates, with the highest increase reaching 0.7% per annum. This move underscores a shift in the financial landscape, as institutions recognize the importance of competitive rates to attract and retain customers.

Gold Prices Rise Slightly After US Jobs Report and Political Turmoil in South Korea, France

The spot gold price in New York edged higher on Tuesday (December 3) after stronger-than-expected employment data reinforced expectations of a more cautious Fed in its monetary policy easing process. In the Asian market, gold prices also ticked up following political turmoil in South Korea and France.