Delegates attending the Vietnam – US Cooperation Forum 2024 on the morning of December 6th. Photo: The Manh

|

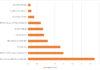

Under a potential “Trump 2.0” administration, there are predictions of changes to the US economic policy, pertaining to imports, tariffs, and protectionist measures. With a bilateral trade deficit of up to $90.6 billion in the first ten months of 2024, Vietnam faces the risk of a series of trade remedy investigations from the US.

Assessing the situation, Ms. Truong Thuy Linh, Deputy Director of the Trade Remedies Authority, pointed out that the US is the country that has applied the most trade remedy measures globally. In 2024 alone, the US accounted for 11 out of 27 trade remedy investigations involving Vietnam, and they have also increased “double” investigations, including both anti-dumping and countervailing duties in the same case…

Not only has the US intensified trade remedy investigations, but they also frequently conduct “cluster” investigations, meaning that for the same product, they will investigate multiple countries simultaneously, rather than focusing on a single country.

Vietnam’s deep involvement in global supply chains and its attraction of Chinese investment make it particularly vulnerable to US investigations targeting other countries.

According to Ms. Linh, US trade remedy measures are becoming increasingly stringent and rigid, and their frequent changes create challenges for exporting businesses. For instance, since the beginning of 2023, the US has made two changes to their trade remedy measures, including the unprecedented concept of “transnational subsidies,” a regulation unheard of in the WTO. Since this law came into effect on April 24, 2024, the US Department of Commerce (DOC) has received petitions to investigate solar energy manufacturers from four countries: Thailand, Malaysia, Cambodia, and Vietnam, alleging that they benefit from Chinese transnational subsidies.

The US has also added provisions for selecting surrogate countries to calculate anti-dumping duties for non-market economies (including Vietnam). The countries often chosen by the US as surrogates for Vietnam, such as Indonesia and India, have certain restrictions related to intellectual property rights, human rights, labor, and the environment, as they are developing countries with similar development levels. These countries are also among the most targeted by countervailing duty investigations worldwide.

Therefore, if the US selects a surrogate country with a higher level of economic development than Vietnam, it will result in higher surrogate values, leading to increased dumping margins, which will put Vietnamese exporting businesses at a disadvantage.

Ms. Linh also expressed her regret that the US has not yet recognized Vietnam’s market economy status. However, she believes that Vietnam will soon be recognized as the country’s economic system operates on market economy principles, and there is support from the business community in the EU, South Korea, and US businesses operating in Vietnam…

Faced with this significant challenge, Mr. Diep Thanh Kiet, Vice Chairman of the Vietnam Leather, Footwear and Handbag Association (LEFASO), highlighted Vietnam’s strength in adapting and responding robustly to difficult situations. When the US withdrew from the Trans-Pacific Partnership (TPP) in 2016, the Vietnamese government persistently pursued a flexible diplomatic approach, signing a series of Free Trade Agreements (FTAs).

Similarly, the COVID pandemic disrupted supply chains but also presented an opportunity for Vietnamese businesses to build domestic supply chains, and in the footwear industry, many major brands placed orders, with some businesses achieving 70-80% self-sufficiency in raw materials.

According to Mr. Diep, it’s not just the US; even countries with FTAs with Vietnam are tending to protect their domestic production by raising technical barriers. Therefore, the challenge for Vietnamese businesses is not only about trade policies but also about overcoming technical barriers related to green, clean, and circular production…

In the wood industry, Mr. Nguyen Hoai Bao, Vice Chairman of the Ho Chi Minh City Handicraft and Wood Industry Association (HAWA), stated that the Vietnamese wood industry has greatly benefited from FTAs, with almost 100% of its major markets enjoying zero-tariff treatment. The US remains Vietnam’s largest market, accounting for 55% of the industry’s total export turnover, while Vietnam is the second-largest furniture supplier to the US, after China.

Regarding upcoming challenges, there is a risk of tariffs being imposed if Trump is elected, but our biggest competitor, China, faces even higher tariffs, so the association is not overly concerned about this issue. Instead, they are more worried about inflation in the US.

Nevertheless, according to Mr. Bao, the biggest opportunity for Vietnamese businesses lies in e-commerce, where they can take advantage of their strengths in raw material sourcing, design, and sales planning, although logistics network connectivity remains a challenge…