“Lack of Non-Bank Lending Institutions in Vietnam: A Challenge for SMEs Access to Finance”

Currently, there is a lack of non-bank lending institutions in Vietnam, as shared by Ms. Pham Thi Thanh Huyen at an event organized by the Ministry of Planning and Investment in collaboration with the United States Agency for International Development (USAID). The event, titled “Enhancing Financial Inclusion through Credit Scoring,” shed light on the dominance of banks in the lending market and the absence of other financial institutions such as non-deposit-taking lending organizations.

These missing institutions play a crucial role in providing loans to small and medium-sized enterprises (SMEs). While banks are willing to lend to companies with good credit quality, it becomes more challenging for businesses with lower credit ratings to secure loans.

According to Ms. Huyen, there is a need for non-bank lending institutions specializing in commercial lending to fill this gap. Despite having over 40 banks, around 16 consumer finance companies, and about 10 financial leasing companies, Vietnam lacks commercial lending institutions commonly found in developed countries and China, where they outnumber banks.

The absence of these institutions makes it difficult for SMEs to access loans, hindering their growth and contribution to the economy. Ms. Huyen emphasized the importance of such organizations in China, where there are thousands of non-deposit-taking lending companies, and in developed countries, where their numbers can surpass that of banks tenfold.

Regarding loan capital, Ms. Huyen mentioned the presence of a few fintech companies in the market, such as Funding Societies, but their impact has been modest. This could be attributed to the imposition of foreign models and a lack of thorough market research, including legal frameworks, loan demands, and the nature of businesses in Vietnam.

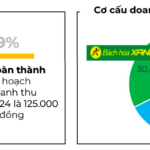

However, some fintech companies, like Validus and Velotrade, are making notable contributions. Validus, for instance, provides loans to businesses within the supply chain of Bach Hoa Xanh, a well-known supermarket chain in Vietnam. By utilizing invoices and accounts receivable as collateral, Validus facilitates access to capital for suppliers and businesses within the Bach Hoa Xanh ecosystem.

On the other hand, Velotrade, a Hong Kong-based fintech company, specializes in import-export financing and offers invoice financing for single or batch invoices. These innovative approaches to lending showcase the potential of fintech in enhancing financial inclusion.

Additionally, some Vietnamese banks, including HDBank, VPBank, TPBank, SeABank, and SHB, have successfully implemented supply chain financing, benefiting SMEs.

Ms. Huyen emphasized the importance of understanding the lending landscape and encouraged businesses to explore banks’ products to find suitable options aligned with their nature of operations. This proactive approach can facilitate conversations and increase the chances of securing loans.

Ms. Pham Thi Thanh Huyen sharing her insights at the workshop. Photo: Tu Kinh

|

At the workshop, Ms. Huyen highlighted the need for a lending ecosystem in Vietnam, acknowledging that the policies and credit packages introduced by the State Bank of Vietnam (SBV) for SMEs have had limited reach and effectiveness. She suggested adjustments, such as encouraging banks to accept accounts receivable and goods as collateral, especially for businesses lacking real estate assets to pledge.

Moreover, Ms. Huyen emphasized the importance of third-party risk assessment services. With hundreds of thousands of loans to manage, banks cannot effectively assess all risks internally. Third-party risk assessment providers, like FiinGroup, can fill this gap by offering credit scoring services. Banks can then utilize these credit scores to make informed lending decisions and set appropriate interest rates.

A representative from Sacombank elaborated on this, explaining that credit scores are used for initial loan evaluations, and periodic reassessments are conducted every three, six, or twelve months, depending on the loan. Credit scores also enable financial institutions to offer exclusive benefits to customers.

Ms. Huyen underscored the necessity of banks utilizing third-party services due to the limitations of internal data. For instance, banks may lack specialized teams to produce industry reports, but some third-party providers can fill this gap. She cited the example of the tourism industry, which was severely impacted by the COVID-19 pandemic a few years ago but is now on a path to recovery. Industry reports can provide valuable insights into its development trajectory, making accounts receivable from businesses in this sector more viable for loan assessments.

To facilitate the lending process, Ms. Huyen encouraged businesses to be transparent with their financial information and more proactive in sharing relevant data. She emphasized that the quality of credit scoring relies on the cooperation of enterprises, as transaction information with partners may not be easily accessible otherwise.

Additionally, businesses should understand that relying solely on information from the Vietnam Credit Information Center (CIC) may not be sufficient for banks to make accurate lending decisions. Supplementing this with data from third-party sources can provide a more comprehensive view of a business’s financial standing.

Lastly, business owners should be aware of the various types of assets they can use as collateral, such as movable assets like warehouses and accounts receivable. By proactively suggesting these options during loan negotiations, they can increase their chances of securing funding and avoid missing out on valuable opportunities.

Tu Kinh

Unlocking Credit Opportunities for the Underserved

With total deposits of around 15 quadrillion VND as of now, the interest rates are quite low, yet banks are “desperately seeking borrowers”. Experts suggest that banks need to open up more to Fintech in the approval process and move away from the traditional “collateral requirement” mindset if they want to avoid capital stagnation. However, how much banks are willing to embrace Fintech is a challenging question due to the prevalent “all-or-nothing” mentality.

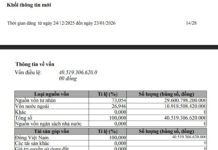

Optimizing Transparency in the Corporate Bond Market

According to the Vietnam Bond Market Association (VBMA), the size of Vietnam’s corporate bond market in 2022 was approximately 14.81% of GDP, which is still modest compared to other countries in the region.

The Rise of Mobile Money in Vietnam: A Rapidly Growing User Base

As of the end of May 2024, the number of Mobile Money users in Vietnam surpassed 8.8 million, reflecting a 3.3% increase compared to the previous month. This growth is accompanied by a significant expansion in the number of Mobile Money acceptance points, with nearly 280,000 locations now recognizing Mobile Money as a valid form of payment.