A survey of several real estate trading pages reveals that apartment prices in Hanoi started to drop in November and December. For instance, an apartment in Long Bien district that was advertised at an average price of VND 55-65 million/sqm in October is now listed at VND 50-60 million/sqm.

Similarly, a residential area in Hai Ba Trung district, which had a typical price of below VND 80 million/sqm in October, is now advertised at VND 72-80 million/sqm.

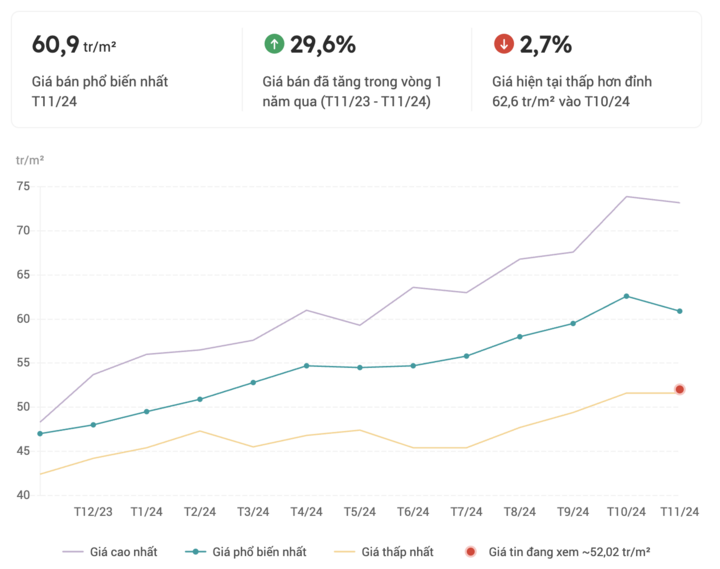

The apartment prices in another residential area in Nam Tu Liem district also witnessed a slight decrease, from VND 62.6 million/sqm in October to around VND 60.9 million/sqm.

A 70 sqm resettlement apartment in Cau Giay district, which had been occupied for over a decade, was pushed up to nearly VND 60 million/sqm a few months ago following the market’s “fever” but has now dropped to over VND 50 million/sqm after multiple failed sales attempts.

A residential area in Nam Tu Liem district shows a downward price trend. (Screenshot)

Not only have the prices dropped, but the number of apartment transactions has also significantly declined. Ms. Le Thi Tan, a Hanoi-based apartment broker, shared that she used to receive hundreds of inquiries and finalize the sale of 2-3 apartments monthly. However, in the past two months, she has only received 20-30 calls and hasn’t closed any deals.

According to Ms. Tan, most potential buyers nowadays only view properties and wait for prices to drop further, while sellers continue to raise their asking prices despite the lack of purchases.

The owner of a real estate exchange in Hanoi observed that apartment transactions in the city have decreased over the past two months because the prices had risen too high and became unaffordable for most buyers. Currently, his company’s inventory consists mainly of two-bedroom apartments priced at around VND 5 billion.

Hanoi apartment prices are stabilizing. (Illustrative image)

”

Two-bedroom apartments priced at VND 2.8-3 billion will sell quickly. On the other hand, those priced at VND 5 billion and above take a long time to find buyers. However, the high prices are due to the sellers’ expectations. They all want to sell their apartments at the highest possible price, so they keep increasing the asking price. This situation frustrates brokers because we cannot find buyers.

“, he said.

Mr. Giang Anh Tuan, Director of Tuan Anh Real Estate Exchange, stated that after a period of strong increases, apartment prices have now exceeded the income of many workers. Consequently, transactions have significantly dropped as buyers have stopped their search.

Mr. Tuan attributed the price reduction in some apartments to previous price inflation. In some old apartment projects, owners heard information from brokers about prices in nearby projects and used those as a reference for their properties, resulting in high asking prices. However, transactions were challenging because those apartments showed signs of deterioration and lacked the amenities of newer developments nearby.

There are also cases where prices are driven up by a group of brokers and property “middlemen” to create an “artificial fever.” ”

After a period of no sales, many owners have been forced to lower their asking prices, leading to a downward trend in some areas

“, Mr. Tuan explained.

Mr. Pham Duc Toan, General Director of EZ Property, shared a similar opinion, stating that apartment prices had only heated up locally in Hanoi due to the imbalance between supply and demand. Now that Hanoi’s apartment prices have peaked, many buyers have paused their home-buying plans, resulting in low liquidity in the market.

Mr. Toan predicted that apartment prices would unlikely rise further in the future. However, it would also be challenging for prices to drop immediately unless sellers needed money and decided to sell quickly.

Regarding Hanoi’s apartment prices in the upcoming time, Ms. Nguyen Hoai An, Director of CBRE Hanoi, offered her perspective. She believed that the city’s apartment market is gradually alleviating the “thirst” for housing supply. While prices won’t decrease, they won’t surge as they did in the previous period.

Currently, there is a diverse range of apartment products for both owner-occupiers and investors, and the price level is higher than in previous years. Therefore, expecting a drop in property prices is unrealistic. Real estate prices can only decrease when there is an oversupply, slow demand growth affecting market liquidity, and impact on selling prices; or when there are significant shifts in the macro economy, financial markets, and economic growth.

In Vietnam, while the economy is growing steadily, and interest rates, inflation, and exchange rates are controlled at reasonable thresholds, the housing supply remains insufficient and imbalanced across segments. Therefore, it is challenging to expect a decrease in real estate prices in the short term.

”

By 2025, the supply of new apartments may reach over 30,000 units. Prices will not drop but will likely increase at a slower pace, possibly by 5-8% compared to 2024

“, predicted Ms. Hoai An.

At the 2024 year-end conference on December 14, the Ministry of Construction acknowledged that, despite positive developments in the real estate market, there has been a situation where housing prices have risen sharply beyond the financial reach of the majority of the population, especially in Hanoi, Ho Chi Minh City, and other major cities.

”

Apartment prices in Hanoi continue to rise in both new and old projects. The price level of new projects has increased by about 6% quarterly and 25% annually, with some areas increasing by about 35-40% depending on the location compared to the second quarter of 2024

“, stated the report from the Ministry of Construction.Despite the price hikes, the total number of apartment and detached house transactions in 2024 was about 137,386 units, up 102.2% compared to the same period in 2023. The total number of land plot transactions was about 446,899 lots, up 138.1%.

For 2025, the Ministry of Construction sets a target of 27 sqm of living space per person and the completion of over 100,000 social housing units.

The Buzzing Land Auction Preparations in Ninh Binh, Nam Dinh, and Hung Yen: Over 1,100 Land Lots Up for Grabs, with Starting Bids as Low as VND 2.5 Million per sq. meter.

As 2024 draws to a close, provinces surrounding Hanoi are gearing up to auction off a staggering number of land plots. Over a thousand lots will be up for grabs, offering a plethora of opportunities for prospective investors and homeowners alike. This upcoming event is set to be a landmark occasion, with the potential to shape the real estate landscape of the region.

Unlocking the Potential: Rediscovering Dong Trieu’s Real Estate Renaissance

Nestled in the province of Quang Ninh, Dong Trieu is blossoming like a “seed of potential”, emerging as a shining star in the economic development landscape of Northern Vietnam. Having only recently gained city status on November 1, 2024, Dong Trieu has already proven its allure, attracting astute investors who are eager to explore the opportunities that this burgeoning city has to offer.

The Soaring Cost of Real Estate in Ho Chi Minh City: Apartments Reach 493 Million VND per Square Meter, Villas Sell for 70 Trillion VND each.

The Ho Chi Minh City real estate market is showing signs of recovery, with notable price movements. Luxury condominiums are leading the way with prices reaching a staggering VND 493 million per square meter, while villas are also making a statement, demanding up to VND 700 billion per unit.