|

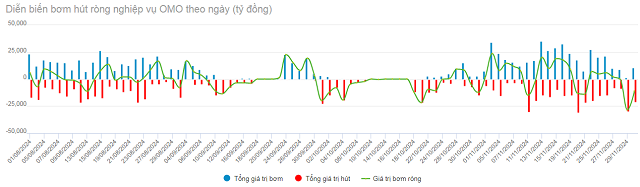

OMO Net Pumping by Day from Aug-Nov 2024. Unit: VND billion

Source: VietstockFinance

|

From Nov 25 to Dec 2, the operator reversed the net pumping on the open market channel, with a total volume of VND 27,230 billion, mainly due to the term purchase channel recording large maturing volumes.

Specifically, the total new issuance volume in the 7-day term purchase channel at an interest rate of 4%/year reached VND 64 trillion out of a total of VND 88 trillion in maturities. In addition, the bill auction channel was still activated with a new issuance volume of VND 11,480 billion at an interest rate of 3.9-4%/year out of a total of VND 8,250 billion in maturities.

At the end of the week of Dec 2, the outstanding volume in the term purchase channel was VND 44 trillion, and the bill channel reached VND 21.28 trillion.

Data from the SBV showed that as of Nov 22, 2024, system credit grew by 11.12% compared to the end of 2023, while the credit growth (CG) target set for the whole of 2024 was about 15%. Therefore, the SBV announced that from Nov 28, 2024, it will proactively adjust to increase the CG target for 2024 for credit institutions according to specific principles, ensuring openness and transparency. The supplementation of this limit is the SBV’s initiative and credit institutions do not need to propose it.

|

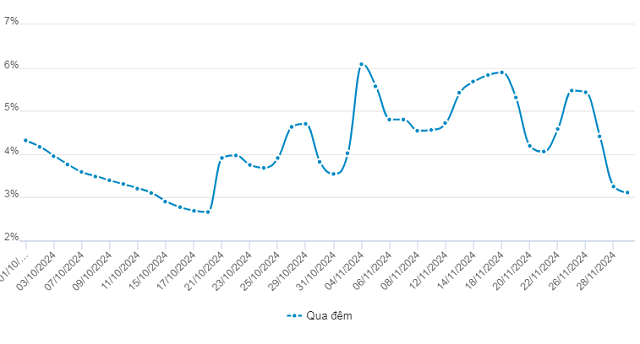

Interbank interest rates for overnight term from Aug-Nov 2024. Unit: %

Source: VietstockFinance

|

The overnight interbank interest rate remained above 5% in the first two days of the week (Nov 25-26) but quickly cooled down to 3.11% in the trading session on Friday (Nov 29), down 147 basis points from the previous week. This is also the lowest interbank interest rate for the overnight term in more than a month (since Oct 21, 2024) – reflecting stable liquidity again after 1 month the operator used the term purchase channel with large volume to provide liquidity to commercial banks at an interest rate of 4%/year when the system’s liquidity was under pressure due to seasonal factors (last quarter of the year).

|

DXY Movement in the Last 3 Years

Source: marketwatch

|

USD/VND exchange rate pressure also cooled down last week as the DXY index fell sharply in the international market to 105.78 points, breaking the 3-week consecutive rising streak.

The exchange rate listed at Vietcombank accordingly decreased by VND 40/USD in the buying direction and VND 46/USD in the selling direction compared to the previous week, to the level of VND 25,130-25,463/USD (buying – selling) at the end of Nov 29, within the allowed trading band ceiling (VND 23,038-25,464/USD). Meanwhile, the free-market exchange rate fluctuated within a narrow range of VND 25,650-25,750/USD.

Khang Di

The Highest Savings Rates: A Turnaround for a Bank Under Special Supervision

“Currently, most banks under special control, including Dong A Bank, OceanBank, CB, and GPBank, are offering some of the highest interest rates in the market.”