The latest job market report for 2024–2025 by Top CV, a recruitment technology platform, reveals a multi-faceted labor market with a projected talent shortage in various sectors in 2025.

LABOR MARKET PRESSURES CONTINUE INTO 2024

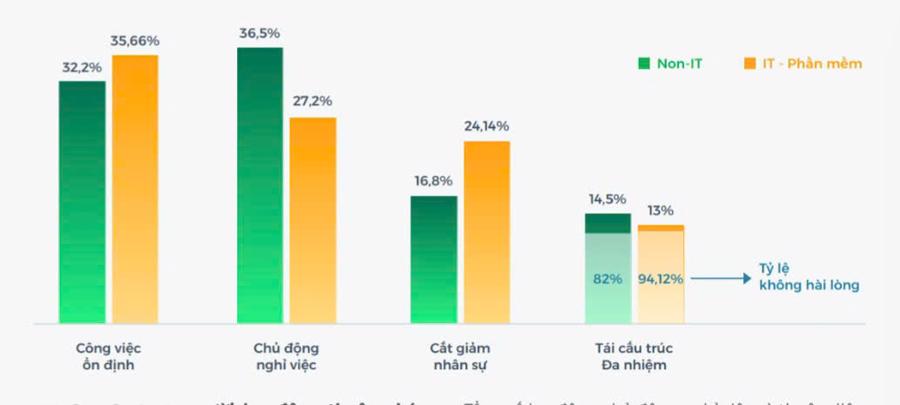

According to Top CV’s report, non-IT sectors are maintaining stable employment levels with no immediate plans for changes. In contrast, 35.66% of IT software companies are experiencing some turnover.

This suggests that a significant portion of the workforce remains unaffected by economic shifts or restructuring. Alternatively, it could indicate a cautious labor force reluctant to change jobs during a period of perceived instability. These individuals are unlikely to enter the job market in the short term.

The combined figures for voluntary resignations and involuntary layoffs in the non-IT sector reach 53.3%, with a similar number of 51.34% in the IT sector. These numbers highlight the challenges faced by the IT industry, despite its rapid growth over the last three years.

Additionally, high layoff rates may reflect companies’ strategic adjustments, financial difficulties, or global economic influences. They could also signify shifts in business strategies, especially for technology companies.

On the other hand, the most stable sectors are Research and Development (R&D), Human Resources, and Education. The stability in the R&D sector is likely driven by the constant need for innovation and product improvement amid increasing competition.

To gain a competitive edge, businesses tend to invest in their R&D teams, ensuring skilled and sustainable workforce development.

Sectors like Human Resources, Training and Development, and Compensation and Benefits exhibit relative stability, indicating a growing emphasis on talent acquisition and retention. This trend empowers companies to build stable and competent teams through comprehensive training, development programs, and transparent, effective compensation policies.

The Education sector maintains its stability due to consistent societal demands. Meanwhile, the Healthcare sector, known for its high-intensity work, often faces challenges with employee burnout.

Top CV’s 2023–2024 Salary Report indicates that median salaries for healthcare employees with 1–4 years of experience range from 6–18 million VND (lower than other sectors, typically offering 8–10 million VND).

The diverse branches of Marketing, Communications, and Advertising require creativity and adaptability to new trends, creating pressure for professionals in these fields.

The Sales and Business Development sector experiences high turnover due to its demanding nature, with frequent job changes driven by the need to meet sales targets and intense pressure.

PRIORITIZING SPECIALIZED POSITIONS TO ALIGN WITH BUSINESS STRATEGIES

As we move into 2025, businesses face the challenge of adapting their strategies. They focus on recruiting specialized positions, both new hires, and replacements.

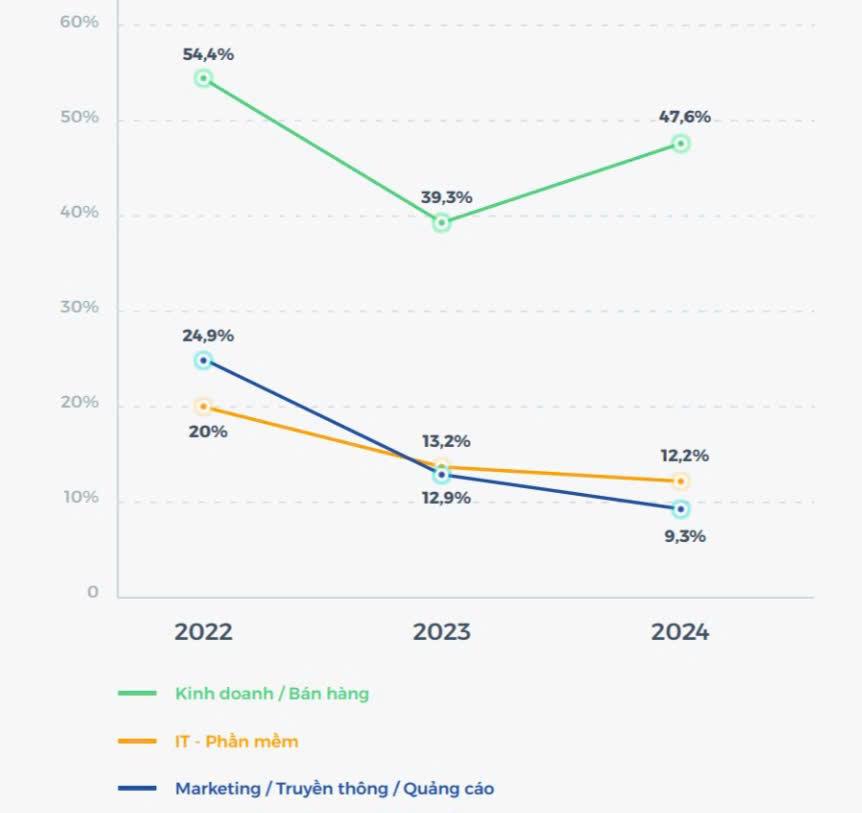

The Sales and Business Development sector has experienced a talent shortage for three consecutive years and is the first area targeted for personnel optimization when needed.

Survey respondents explain that boosting business activities and market growth are crucial for 65.2% of companies. To achieve this, 47.6% plan to prioritize hiring in Sales and Business Development, especially targeting individuals with 2–3 years of experience, followed by those with 1–2 years of experience.

This strategy makes sense, given that this group directly generates revenue, expands the market reach, and attracts new customers. As businesses scale, they require a larger sales force to maintain their presence and drive growth.

The IT software sector comes next, primarily seeking candidates with at least 2–3 years of experience and specialists with 3–5 years of experience (12.2%). This is followed by Marketing, Communications, and Advertising (9.3%), Customer Service (5.1%), and Human Resources (4%).

Compared to the 2023–2024 report, the demand for Sales and Business Development talent has significantly increased by approximately 8.3%.

Meanwhile, the IT software sector continues to face a talent shortage, although there has been a slight decrease in demand (around 1%). This suggests that the feverish demand for IT professionals is cooling down, and companies are now prioritizing candidates with 2–3 years of experience over specialists.

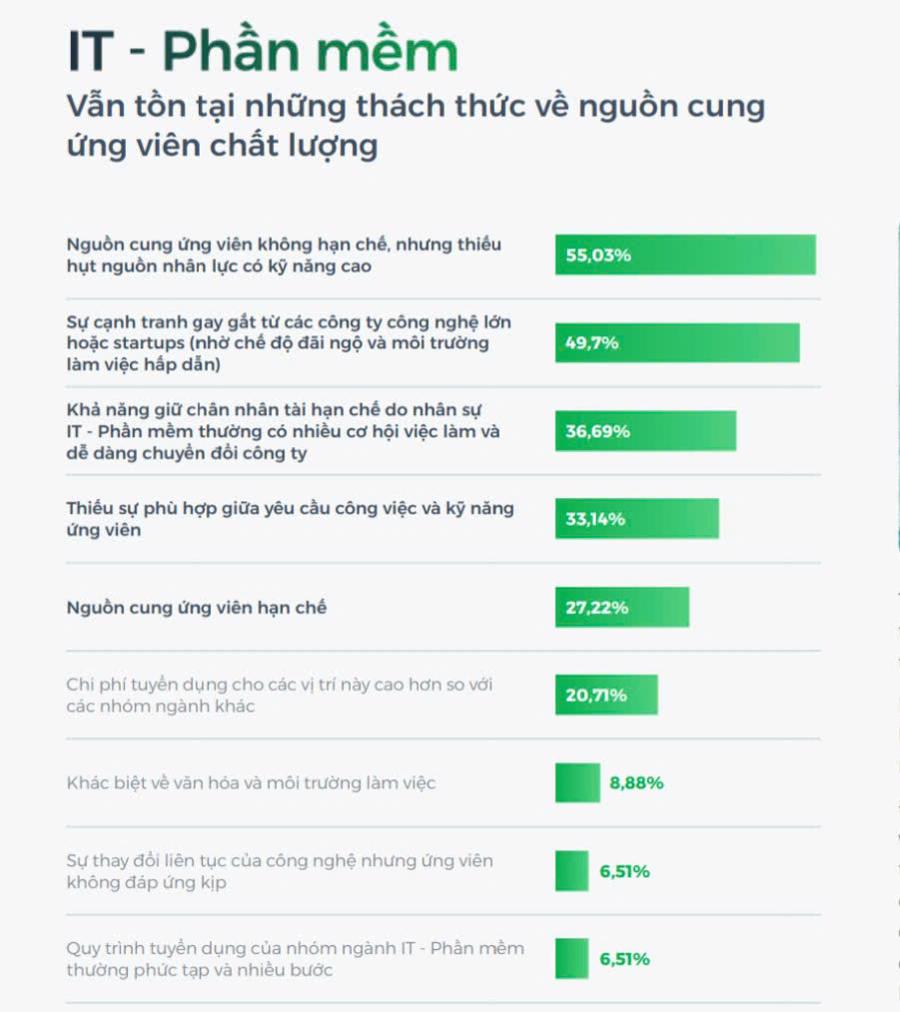

The survey reveals that in 2024, the IT software industry will continue to struggle with talent acquisition, mainly due to a shortage of highly skilled professionals (55.03%).

Additionally, companies often offer attractive compensation packages to lure IT professionals, leading to challenges in retaining this talent (49.7%). The recruitment process for these positions typically involves multiple interview rounds and technical assessments, especially code testing and algorithm challenges.

Technology companies emphasize evaluating technical skills through practical tests and in-depth interviews. As a result, the recruitment process for IT professionals can be lengthy, and delayed responses may cause companies to miss out on excellent candidates.

While the Sales and Business Development group is the top priority for recruitment, it is also the first sector considered for personnel optimization (21.6%). This is mainly due to changing market demands that impact products and services, leading to reduced headcount requirements (52.34%).

Other sectors that may undergo optimization include Marketing, Communications, and Advertising (9%) and Customer Service (7.5%), as these positions can be restructured for multi-tasking. The IT software sector (5.7%) typically adjusts its workforce according to shifting technology demands.

This report is based on a quantitative survey of nearly 3,000 businesses and employees across various industries and sectors nationwide, conducted from August 13 to September 13, 2024. It also references reliable data from official government sources and reputable international industry sources.

The Tech Talent Hunt: Uncovering the Elusive IT Experts

As digital transformation and the adoption of AI technology gather pace, the demand for skilled IT professionals continues to surge, compelling businesses to invest in attracting and nurturing talent, says Francois Lancon, Chairman of ManpowerGroup Asia Pacific & Middle East.

“Leak” in the F&B Industry: The High Staff Turnover Woe Affecting 85% of Businesses, Causing a Headache for Over 50% of Cafe Owners.

The F&B industry is notorious for its high staff turnover, with a staggering 80% of its workforce comprising teenagers seeking part-time work to boost their income and gain experience. This transient nature of the workforce is highlighted by recent statistics, which reveal that nearly 80% of F&B staff in Vietnam leave their jobs within a year, while only 0.9% stay for over five years.