Illustrative image.

Speaking at a recent seminar, senior economist Assoc. Prof. Dr. Dinh Trong Thinh shared that apartments have overtaken land as the leading investment channel.

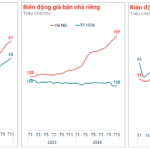

“A few years ago, land in many areas, including those far from the center and in small alleys, experienced a feverish surge in prices as many investors jumped in. Now, the investment trend has shifted,” Mr. Thinh assessed.

Investing in land in Hanoi now requires significant financial resources, and for actual housing, one must consider construction and renovation costs. In terms of meeting real housing needs, the trend is leaning towards the convenience and affordability of apartments. Land, at this point, is only for those with a genuine need for land-based housing or for long-term investment, and even then, the profit margins may not be as attractive as before.

“In 2024, all attention has turned to apartments due to the ever-increasing demand. From an economic perspective, investing in apartments offers the potential for monthly rental income, especially in conveniently located areas. The demand for rentals is substantial, if not enormous, and rental prices have been rising rapidly. Investing in apartments at the right time also holds the promise of higher profit margins, especially with the forecast that apartment prices are unlikely to decrease,” Assoc. Prof. Dr. Dinh Trong Thinh added.

From a business perspective, Mr. Ngo Huu Truong, Deputy General Director of Hung Thinh Group, shared: “As a business, I find land investment to be an attractive channel. However, we believe that now is not the right time to invest. The market prices are currently high, and investing in this segment requires substantial capital. Without a clear investment strategy, it could pose risks for investors.”

Meanwhile, for young people, Mr. Truong believes that investing in rental apartments is a more sensible choice, generating a stable income stream from leasing the property. Especially with the scarcity of inner-city land, moving to more distant areas is an inevitable trend.

Sharing his insights on the land segment, Mr. Nguyen Quoc Anh, Deputy Director of Batdongsan.com.vn, said that after the Land Law 2024 took effect, the land market underwent significant changes in supply and transaction activities. The land segment has been showing positive developments, reducing land fever and price manipulation, creating a new cycle of stable, transparent, and sustainable land development.

According to him, from the first quarter of 2026 to the fourth quarter of 2026, the market will enter a stable orbit. Prices and liquidity will surge across diverse forms. This can be considered the best scenario for the market after a long period of stagnation.

Sharing this view, Mr. Le Dinh Chung, a member of the Real Estate Brokerage Association of Vietnam’s Market Working Group, said that the “wave” of land is currently only local in some areas on the outskirts of Hanoi and has not spread to many places.

By the second quarter of 2025, the land market may witness more balanced development in many places. However, investing in land at this time requires a medium-term vision, with a capital recovery period of at least one to three years, instead of expecting quick profits from speculation.

“An Gia Launches The Gió Riverside in Q1 2025: A Prestigious Riverside Development”

The An Gia Real Estate Group (Stock Code: AGG) is set to unveil its latest project, The Gió Riverside, in Q1 2025. This highly anticipated development comprises approximately 3,000 residential units, with construction initiated by the developer in June 2024.

Golden Standards for Sustainable Investments

With its attractive financial policies, Conic Boulevard offers investors a straightforward path to profit optimization without requiring a substantial initial investment. The project boasts high liquidity, thanks to its prime location within an established residential area with a complete infrastructure. This means units are ready for handover, ensuring long-term and sustainable benefits for investors.

The Southern Surge: As Ho Chi Minh City’s Real Estate Market Bounces Back

As we move into the final quarter of 2024, Ho Chi Minh City’s real estate market has experienced a notable recovery in terms of interest, supply, and selling prices. This positive trajectory has caught the attention of investors and property businesses from the north, who are now eyeing opportunities in the southern market.