“Hanoi’s Apartment Market: Navigating Sustainable Living and Investment Choices”

Illustrative image.

At the seminar “Hanoi’s Apartment Market: Where lies the Sustainable Living and Investment Choices?”, Mr. Ngo Huu Truong, Vice President of Hung Thinh Group, shared his insights on the perception of real estate as a valuable asset, especially in Asian countries, where the mindset of “land and housing as savings” is prevalent.

From a developer’s perspective, Mr. Truong believes that going forward, it will be challenging to see a decrease in property prices, particularly in the apartment segment.

He attributes this to inflation and exchange rates, which have indirectly influenced property prices. Despite Vietnam’s successful inflation control, the rising gold and exchange rates have shifted capital flows. This has led to a trend of asset hoarding, with some investing in real estate, viewing it as a valuable asset.

Additionally, one of the prominent trends today is the emergence of “all-in-one” apartment projects, offering residents a fully integrated space with amenities ranging from schools and hospitals to commercial centers, amusement parks, and green spaces. These factors will determine a condo project’s actual utility value, making it difficult for prices to decrease.

Such projects not only meet living needs but also offer long-term investment value. “A well-planned project with a synchronized utility system and professional operation will attract both actual homebuyers and secondary investors,” said Mr. Truong.

At the seminar, economic expert, Assoc. Prof. Dr. Dinh Trong Thinh, shared his insights on the market’s future, predicting a stabilization with a slowdown in price increases, unlike the feverish pace witnessed in the past.

Accordingly, buyers’ capital will likely shift from high-priced areas to more competitive regions with growth potential.

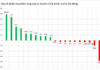

Looking back at 2024, Mr. Thinh observed a remarkable surge in Hanoi’s apartment prices. The average price, which was 40 million VND/m2 in 2022, soared to over 70 million VND/m2 by the end of the third quarter of 2024. The market no longer offers projects priced below 60 million VND/m2, with some mid-range projects even surpassing 100 million VND/m2. This price hike is evident in both the primary and secondary markets, including older projects.

From a positive perspective, Mr. Thinh attributes this to an unexpected boost in market psychology. The release of pent-up demand for housing and investment, coupled with various factors restoring customer and investor confidence, has resulted in a demand explosion. Meanwhile, the scarcity of supply has further fueled price increases.

Commenting on housing needs, Ms. Nguyen Minh Chi, Deputy General Director of Phu Tai Land, stated, “The current supply cannot meet the demand, especially in the inner-city districts, where there are fewer and fewer projects being developed. Moreover, thousands of students flock to the capital to study and join the workforce each year, all seeking accommodation. Consequently, the demand for housing in Hanoi can only increase.”

In terms of policies, Hanoi is expanding and developing to cater to the diverse needs of its residents. However, projects in the inner-city districts are becoming increasingly scarce.

According to Ms. Chi, surveys reveal that there is only one project in Hoang Mai district and one or two projects in Thanh Xuan and Ha Dong districts. With insufficient supply to meet actual demand, prices will continue to rise, especially as Hanoi’s land fund becomes scarcer.

Why Aren’t Buyers Willing to Invest in Real Estate?

“Housing prices are a significant barrier for prospective homeowners, despite the increasing demand for housing and favorable loan interest rates.” said Dr. Can Van Luc, Member of the Monetary and Financial Policy Advisory Council.

The Penultimate Word in Property: Vinhomes, Nam Long, Khang Dien, An Gia, and Ha Do Investors Reap Rewards in Vietnam’s Luxury Real Estate Boom

The real estate market in Hanoi and Ho Chi Minh City witnessed a remarkable surge in sales during the third quarter of 2024, with a 48% increase compared to the previous quarter – the highest growth in the last four quarters. This upward trend is set to continue, with recent regulatory changes in the real estate sector expected to accelerate project development and boost sales throughout 2025.

“A Lane House Worth its Weight in Gold: $500k Now, ‘Won’t Sell for Less than $1M by Year-End’”

In less than a year, the price of a small alley house, inaccessible by car, can soar from 5.5 billion VND to 10 billion VND after just two changes of ownership and renovations.