Compared to the 2024 targets, this plan increases by 72% and 251%, respectively. This is also the year that SGR plans to achieve record-high profits.

In addition, Saigonres aims for a total investment of VND 1,895 billion, a 15% increase compared to the 2024 plan.

Furthermore, the SGR Board of Directors has approved December 23, 2024, as the record date to finalize the list of shareholders to seek their approval via postal voting on resolutions related to changing the company’s business lines and amending its charter. The voting process is expected to take place in January 2025.

Saigonres has also decided to terminate the operations of its subsidiary, Saigon Real Estate JSC – Real Estate Trading Floor, effective December 31, 2024.

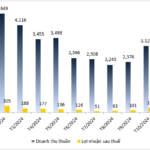

In terms of business performance, in Q3 2024, Saigonres recorded consolidated net revenue of nearly VND 58 billion, 3.2 times higher than the same period last year. The company attributed this significant increase to higher project revenue. Net profit exceeded VND 42 billion, a 2.3-fold increase.

However, due to a loss of nearly VND 14 billion in the first quarter, the company’s cumulative profit for the first nine months of 2024 was over VND 18 billion, a 62% decrease compared to the same period last year, despite a 2.5-fold increase in net revenue to nearly VND 118 billion.

According to the resolution passed by the SGR Board of Directors, the company aims to achieve a post-tax profit of VND 104 billion for the full year 2024, a slight increase of 1% from 2023. However, with only 18% of the target achieved after nine months, the company still has a long way to go.

Previously, the SGR Board of Directors approved the plan to offer 20 million shares in a private placement to professional securities investors at a price of VND 40,000 per share. The offering is expected to take place in Q4 2024 – Q1 2025.

If the issuance is successful, the company will raise VND 800 billion, of which VND 300 billion will be used to repay loans, and VND 500 billion will be invested in the Viet Xanh Eco-Urban Area project.

Viet Xanh Eco-Urban Area Project Illustration

|

Thanh Tu

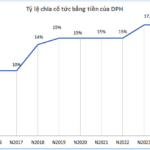

The Ultimate Cash Dividend: DPH Locks in a 17% Cash Dividend Payout.

With this cash dividend payout, Haiphong Pharmaceutical Joint Stock Company (UPCoM: DPH) is on track to fulfill its 2024 dividend plan, delivering returns to its valued shareholders.