MARKET REVIEW FOR THE WEEK OF 09-13/12/2024

During the week of December 9-13, 2024, the VN-Index paused its upward trend after three consecutive weeks of gains, with trading volume remaining below the 20-week average. This reflects a still cautious investor sentiment.

Currently, the index is sitting above the Middle Bollinger Band. If it manages to hold above this level in the upcoming sessions, the outlook may not be too pessimistic.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Formation of Three Black Candles pattern

On December 13, 2024, the VN-Index declined and formed a Three Black Candles pattern, accompanied by continuously weakening trading volume that fell below the 20-day average in recent sessions. This indicates a less-than-optimistic investor sentiment.

Additionally, a Death Cross between the 50-day SMA and the 100-day and 200-day SMAs has formed, while the Stochastic Oscillator has given a sell signal in the overbought region. If the indicator falls out of this region in the coming sessions, the risk of a downward adjustment increases.

HNX-Index – Testing the 50% Fibonacci Retracement level

On December 13, 2024, the HNX-Index declined after testing the mid-term downward trendline, which also coincides with the 50% Fibonacci Retracement level (corresponding to the 229-233 point region). This indicates a less-than-optimistic investor sentiment.

Furthermore, trading volume continues to weaken and remains below the 20-day average, while the MACD is narrowing its gap with the Signal line. A negative scenario is likely to emerge if the indicator gives a sell signal and capital inflows do not improve in the near future.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index indicator for the VN-Index has crossed below the 20-day EMA. If this state persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Foreign Capital Flow Variation: Foreign investors continued to net sell on December 13, 2024. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

Technical Analysis Department, Vietstock Consulting

Technical Analysis for the Session on December 12: Risk Signals Persist

The VN-Index and HNX-Index rose in tandem, with trading volume also showing significant improvement during the morning session, indicating a renewed sense of optimism among investors.

The Market Beat: Afternoon Dip Turns All Three Boards Red

The unexpected afternoon slump saw all three market indices close in the red on December 12th. The VN-Index led the decline, falling 1.51 points to 1,267.35, followed by the HNX-Index, which dropped 0.19 points to 227.99. The UPCoM index also slipped, shedding 0.06 points to close at 92.68. Foreign investors offloaded Vietnamese shares for the fourth consecutive session.

“Steering Through the Storm: Navigating Investment Strategies for 2025 and Beyond”

In less than a month, the stock market will close out an unpredictable 2024. As we transition into the new year, investors are seeking answers to the question: What’s in store for 2025? To provide insights and guidance, VPBankS Talk 04, themed “Navigating Through the Storm,” will be held on December 16.

The Stock Market Soars Unexpectedly by 27 Points: What’s Behind the Surge?

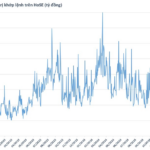

The standout feature of this report is the HOSE matching liquidity, which surged over 60% from the previous session to 19.2 trillion dong – the highest level in the past 2 months.