left intent:

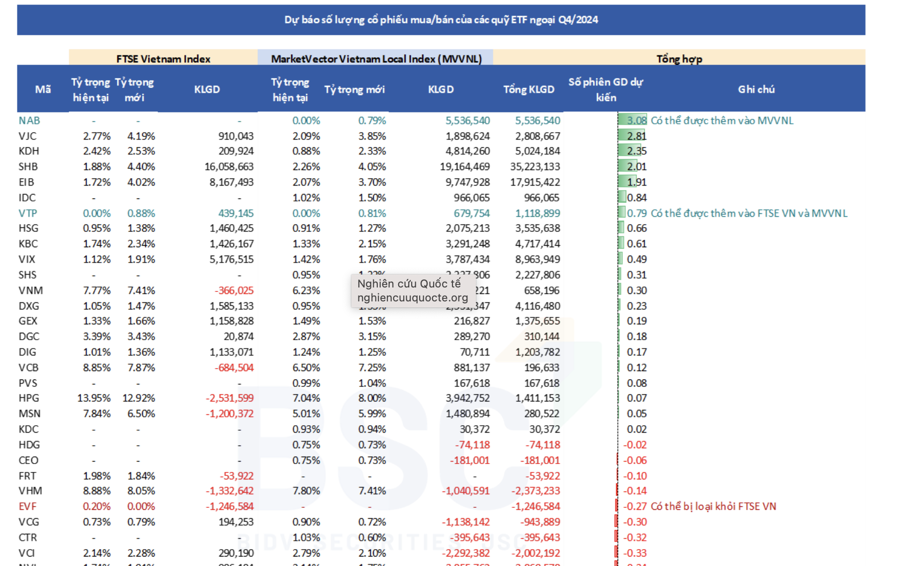

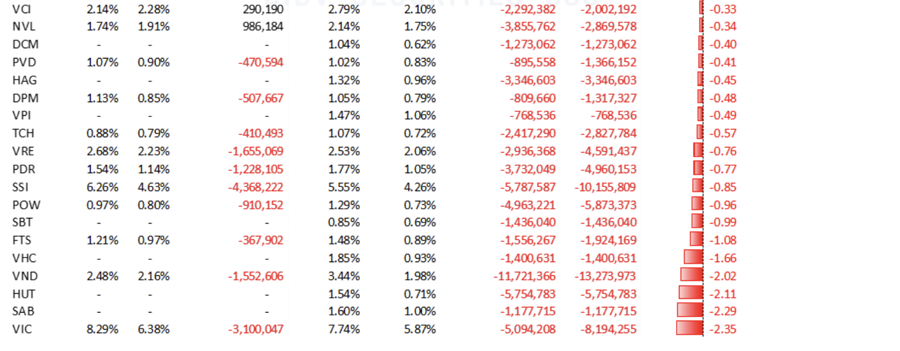

On December 6, 2024, FTSE is expected to announce the constituent stocks of the FTSE Vietnam All-share and FTSE Vietnam Index. On December 13, 2024, MarketVector will announce the Marketvector Vietnam Local Index.

December 20, 2024, is expected to be the day for the completion of the restructuring of the portfolios of ETFs referencing these indices. The official cut-off date for the two indices is November 29, 2024.

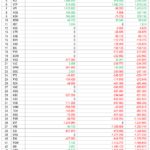

BSC forecasts the constituent stocks and the number of stocks to be bought/sold for ETFs referencing these indices. Specifically, for the FTSE Vietnam Index (referencing ETF FTSE), VTP is expected to be added as it has met the requirements in terms of liquidity, free float ratio, and foreign ownership ratio. In addition, the capitalization of this stock is currently also in the top 88% of the cumulative capitalization of eligible stocks.

EVF may be removed as it does not meet the market capitalization weight threshold for the index basket.

For the MarketVector Vietnam Local Index (referencing VanEck Vectors Vietnam ETF): NAB, VTP are expected to be added as they have met the requirements in terms of liquidity, free float ratio, and foreign ownership ratio. Additionally, the capitalization of these stocks is currently within the 85% threshold of the cumulative capitalization of eligible stocks.

BVH: may be removed as the capitalization of this stock is currently outside the 98% threshold of the cumulative capitalization of eligible stocks.

A synthesis of the two funds shows that NAB is expected to be the most purchased with 5.5 million shares, while other stocks such as VJC, KDH, SHB, EIB, and VTP will also be bought with significant quantities.

On the other hand, VIC is expected to be the most sold stock with 8.19 million shares, followed by SAB, HUT, VND, SSI, and HAG.

Previously, SSI Research forecasted the FTSE Vietnam Index as follows: VTP and VPI could be added to the index basket. Specifically, the price of VTP stock has increased significantly by 77% compared to the price on August 30, 2024, helping the stock meet two criteria for capitalization, including being in the top 88% of cumulative free-float capitalization among eligible stocks, and the investable capitalization of VTP in the index basket is greater than 1%. In addition, for VPI, compared to the previous period, this stock has now met the liquidity criterion.

On the contrary, EVF and NVL may be removed from the index basket. Specifically, for EVF, the stock does not meet the requirements for free-float ratio and free-float capitalization. For NVL, the stock has been under warning since September 23, 2024.

Research forecasts the MarketVector Vietnam Local Index as follows: SIP and VTP may be added as they are in the top 85% of cumulative free-float capitalization among eligible stocks. No stocks are expected to be removed.

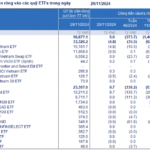

The total assets of the FTSE Vietnam Swap UCITS ETF as of November 29 amounted to VND 6,558 billion (USD 258.7 million). Specifically, the total asset value of the fund decreased by 27% compared to the beginning of the year, NAV decreased by 4.9% compared to the beginning of the year, and net outflows reached VND 1,716 billion (USD 67.7 million).

The total asset value of the VanEck Vectors Vietnam ETF as of November 29 amounted to VND 11 trillion (USD 434 million). Specifically, the total asset value of the fund decreased by -17.7% compared to the beginning of the year, NAV decreased by -9.2% compared to the beginning of the year, and net outflows reached -VND 1,158 billion (USD 45.7 million)

What Stocks Will the VNM ETF and FTSE ETF Seek in the 4th Quarter Restructuring of 2024?

The VTP stock is anticipated to be included in two stock index baskets: the FTSE Vietnam Index and the MarketVector Vietnam Local. This inclusion is expected to boost the stock’s visibility and liquidity, attracting more investors and potentially leading to increased trading volume and enhanced market presence. With this development, the VTP stock is poised to gain traction and prominence in the Vietnamese market and beyond.

The Great ETF Exodus: $2.2 Trillion Outflows in 7 Weeks

For the seventh consecutive week, outflows from ETF funds continued, totaling over VND 2,200 billion. The outflows were predominantly from the VFM VNDiamond ETF fund.