Credit Growth Reaches 12.5% as of December 7

|

Deputy Governor of the State Bank of Vietnam Dao Minh Tu

|

Credit growth as of December 7 reached 12.5%, according to Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu. This is a positive development compared to the same period in 2023, when credit growth was at 9%.

As of November 29, credit growth stood at 11.9%. The total outstanding loans of the economy reached approximately VND 15,300 trillion, while capital mobilization reached around VND 14,800 trillion. The growth rate of outstanding loans is higher than that of capital mobilization, indicating that in addition to the capital mobilization efforts of commercial banks, the SBV has also taken proactive measures to support commercial banks through policy management tools.

Mr. Tu attributed the faster credit growth this year compared to the previous year to the favorable conditions and achievements in various sectors of the Vietnamese economy, including high export growth and the recovery of business production and investment activities. The proactive and harmonious management from the central to local levels, especially by the Government and the Prime Minister, in both sectoral and macro-economic policies, fiscal and monetary policies, has also contributed to this positive development.

The decisive factor, however, has been the management measures taken by the SBV. From the beginning of the year, the SBV set a credit growth target of 15% and has been resolute in its management, despite the impact of the third storm. “If it weren’t for the third storm, credit growth this year could have been even higher,” Mr. Tu expressed.

It is worth noting that the SBV has been proactive in its management, and commercial banks have been proactive in determining credit limits based on the capital needs of the economy and their own capabilities. Banks that have reached their credit limits set at the beginning of the year are also proactive in increasing their limits without waiting for the SBV’s announcement, as was the case in previous years.

This year’s capital resources and mobilization have been harmoniously ensured, with a significant reduction in lending interest rates. Compared to the beginning of the year, the average lending interest rate has decreased by 0.96%, helping businesses reduce input costs and actively invest.

The SBV has also actively removed obstacles in procedures and regulations and has implemented a debt rescheduling mechanism after the third storm. These policies have proven effective, as businesses have actively embraced them, contributing to the resolution of production and consumption issues. While risks in the real estate and securities sectors are still being tightly controlled, conditions in these sectors have improved.

When asked if the 15% growth target would be achieved, Mr. Tu replied, “I would like to answer that 15% is a guiding figure in our management. With the current credit growth rate and the typically active disbursement at the end of the year, I am confident that we can achieve the 15% credit growth target.”

By Khang Di

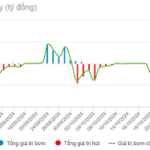

The Central Bank’s Net Withdrawal Exceeds VND 27 Trillion

The State Bank of Vietnam (SBV) has resumed net withdrawal on the open market operation (OMO) channel, marking a shift from the previous month’s net injection to support systemic liquidity due to seasonal factors.

This Week’s Market: Will Liquidity Continue to Decline, but Can VN-Index Sustain Its Uptrend?

Despite the uncertain recovery pace, with liquidity continuing to decline, the Vn-Index is expected to extend its upward trajectory, buoyed by supportive domestic news.