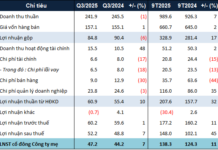

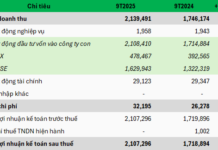

The consolidated financial statements of 27 listed banks show that total NPLs in the first nine months of 2024 exceeded VND 259,000 billion, a nearly 28% increase from the beginning of the year. This raises important questions: Can banks maintain adequate loan loss provisions to safeguard against credit risk? And is their current loan portfolio truly safe in a volatile economic environment?

As we approach the deadline, it’s crucial to examine the NPL coverage ratio, which assesses a bank’s defense against credit risk. With Circular 02 ending in late 2024, non-performing loans will exert considerable pressure on the financial system, and NPLs are predicted to increase by 1-2%. This poses a threat to banks’ profitability and capital adequacy, making it challenging to manage NPL and LLR ratios.

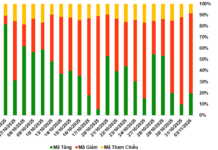

Currently, the industry-wide NPL ratio is nearly 5%, and if we consider only listed banks, it stands at approximately 2.26%. Meanwhile, the average LLR across the industry has dropped to its lowest level in the past five years, falling from over 140% in 2022 to just over 82% in 2024. This indicates that most banks are underprepared in terms of provisions for potential NPLs.

State-owned banks like Vietcombank, VietinBank, and BIDV have maintained LLRs above 100%, enhancing their resilience to credit risk. In contrast, retail and wholesale banks, along with others like MBBank, ACB, and LPBank, face challenges in increasing loan loss provisions, impacting short-term profitability, liquidity pressures, and their ability to cope with potential risks when Circular 02 expires. This situation also constrains credit growth, especially as competitive deposit interest rates force banks to optimize their assets and enhance risk management.

Vietnamese banks employ diverse lending portfolio strategies to mitigate risk and optimize profits. Each bank targets specific customer segments, resulting in varying risk structures that influence NPL recognition and loan loss provisions. Therefore, when analyzing provision levels, it’s essential to consider the unique characteristics of each bank’s loan portfolio composition and its dynamics.

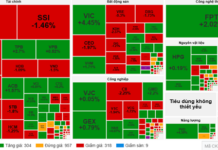

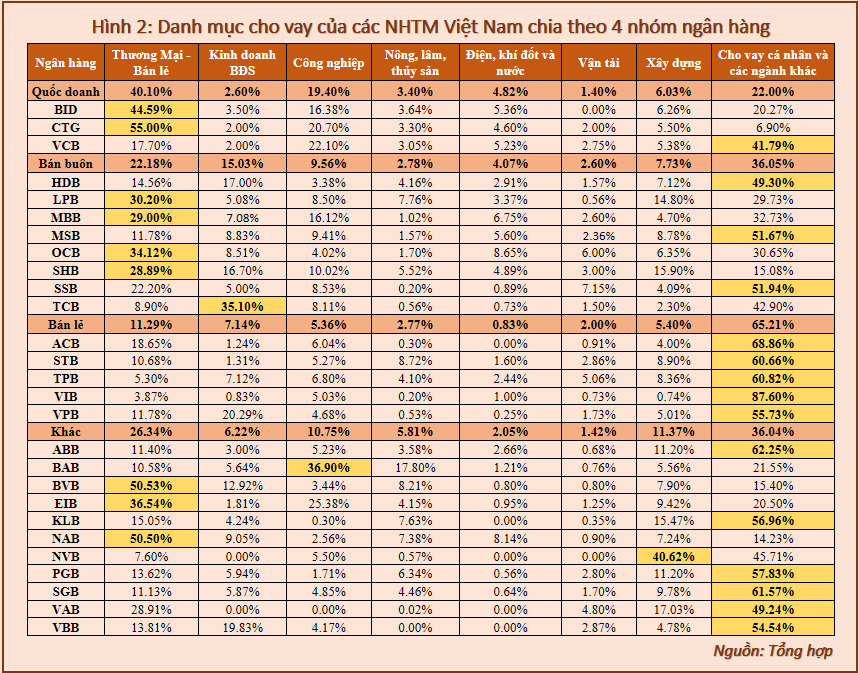

As seen in the table below, the lending portfolios of four bank groups (state-owned, wholesale, retail, and others) exhibit distinct strategies and customer focuses. State-owned banks heavily target the trade-retail sector (40.1%) while maintaining diversity across industries, especially with a lower focus on real estate. Wholesale banks show less disparity but maintain high concentrations in trade-retail, real estate, and industrial sectors, with TechcomBank prioritizing real estate lending. Retail banks primarily serve individual customers and other sectors, reflecting a focus on consumer or small-scale loans. The “other banks” group also displays diversity, tailored to each bank’s unique strategy. Overall, each group has distinct advantages to serve their target customers and effectively manage risks.

|

State-owned banks have the advantage of low-cost capital mobilization, enabling them to maintain low lending rates and mitigate credit risk. However, they have significantly lower net interest margins (NIMs) compared to the industry average, ranging from 2.5-3%, and this metric has been on a continuous downward trend for the past two years to support growth. In contrast, retail and wholesale banks like VPBank, MBBank, and Techcombank achieve better NIMs than the industry average due to their ability to select higher-yielding loans, but they also assume higher potential risks.

As Circular 02 approaches its end date, the decision by the State Bank of Vietnam (SBV) not to extend it further is a positive sign that the banking system has effectively managed NPLs. This decision reflects both the regulator’s confidence and the banks’ preparedness, with sufficient resources, including NPL provisions and improved asset quality, to face the challenges ahead. While restructured loans will need to be reclassified after Circular 02 expires, the expected increase (1-2%) is within the system’s capacity to manage.

Major banks like Vietcombank, BIDV, and VietinBank have maintained LLRs above 100%, creating a safety net against credit risk. From another perspective, while Circular 02 provided temporary relief from NPL pressure, it also impacted the quality of bank profits. The extended debt restructuring period led to profit recognition that didn’t fully reflect the actual risk level during this phase. This dynamic prompted investor caution, causing the price-to-book (P/B) ratio for Vietnamese banks to drop significantly. Reports indicate that the industry’s average P/B ratio has fallen to 1.5 times, a notable decrease from the 1.7-1.8 times average over the past five years.

Not extending Circular 02 presents an opportunity for banks to rebalance asset quality and pursue more sustainable growth. This decision encourages banks to return to transparent business strategies, focusing on managing actual credit quality rather than relying on policies to conceal risks. Additionally, as profits improve based on genuine asset quality, bank stock valuations have the potential to rebound to higher levels, aligning with their performance and efficiency.

Banks need to strengthen their risk management capabilities, particularly in classifying and provisioning for NPLs. For small and medium-sized banks, this requires proactive adjustments to their loan portfolios and improvements in service quality. Moreover, enhancing profitability through revenue diversification and adopting modern technologies will be crucial to regaining market trust and improving valuations in the future. While not extending Circular 02 creates short-term pressure, it is a necessary step toward placing the banking system on a more sustainable and transparent growth trajectory.

As Circular 02 nears its end, Vietnamese banks face a significant challenge in managing NPLs and maintaining capital adequacy. While larger banks are better positioned due to higher NPL coverage ratios, smaller and medium-sized banks need clear strategies to navigate the upcoming changes. Effective collaboration between the SBV and banks in managing NPLs, improving lending strategies, and enhancing risk management will determine the stability and sustainable development of Vietnam’s financial system in the years ahead.

“A Tumultuous Year: Trung Nam Group Reports Losses of 2,878.2 Billion VND in 2023”

Established in 2004, Trungnam Group has evolved over 18 years into a diverse ecosystem with a presence in five key sectors: Energy, Infrastructure, Construction, Real Estate, and Information and Electronics Industry.

The New Land Price Framework: Unlocking the Secrets of Real Estate Credit

The introduction of Ho Chi Minh City’s new land price list will bring land prices closer to market values, ensuring transparency and fairness in land price determination. However, the implementation of this new land price list will impact the asset valuation process for credit extension and NPL resolution for credit institutions.