Services

|

Nam A Bank Representative – Mr. Vo Hoang Hai, Deputy CEO, received the title of Top 50 Most Effective Companies in Vietnam in 2024

|

The Top 50 Most Effective Companies in Vietnam in 2024 were announced on the afternoon of December 11, with Nam A Bank ranking 7th. The awards ceremony was held during the 2024 Enterprise Governance Conference. This prestigious ranking has been organized annually for 13 years by Nhip Cau Dau Tu Magazine, with consultations from leading economics and business experts from Harvard Business School, and references from reputable global rankings to find and honor the most efficient companies in the Vietnamese stock market.

The Top 50 Most Effective Companies in Vietnam in 2024 were selected based on the measurement of the companies’ business results over three consecutive years, using three growth indicators: revenue, return on equity (ROE), and earnings per share.

The measurement aims to objectively assess the management capabilities of enterprises. Nam A Bank has excellently met these specific criteria based on its outstanding financial results, effective risk management, and continuous improvement in asset quality over the years.

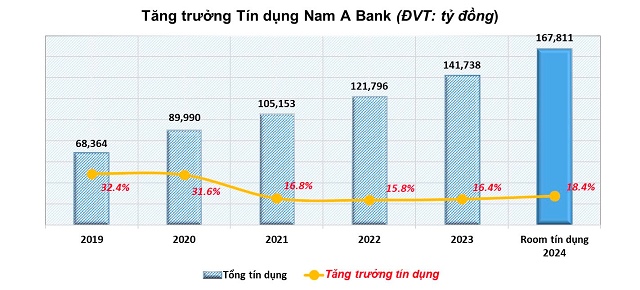

Nam A Bank is among the commercial banks approved by the State Bank of Vietnam (SBV) for a high credit growth limit in 2024.

At the beginning of 2024, the SBV set a credit growth target of approximately 15% for banks through Directive No. 01/CT-NHNN dated January 15. As of August 28, banks that had lent over 80% of their assigned credit limit from the beginning of the year were granted additional limits by the SBV, based on the following principle: Additional credit balance compared to the previously announced SBV limit = Credit balance as of December 31, 2023 x 2023 Ranking Score x 0.5%. Nam A Bank was among the banks that met the conditions for the SBV to consider increasing the credit limit in this round. As a result, Nam A Bank recorded a credit growth rate of 15.8% for the first nine months of 2024, 1.75 times higher than the system average, placing it among the top four banks with the highest credit growth rates in the system.

On November 28, 2024, the SBV announced that it would adjust the credit limits for banks. This was the second time this year that the credit limits were increased. According to SBV Document No. 9790, the credit growth targets for credit institutions were adjusted upwards. Nam A Bank’s approved credit growth rate for 2024 was 18.4%.

|

Nam A Bank can effectively utilize 100% of its credit limit this year thanks to the recovery of the economy and its traditional customer base. In the long term, Nam A Bank’s credit will follow the value chain model of various industries, with a focus on expanding this model to strategic sectors, including agriculture, forestry, fisheries, education, healthcare, and resorts. For sectors related to construction and real estate, the loan balance currently accounts for less than 20% of the total.

Recently, Nam A Bank partnered with Vingroup, GSM – Green and Smart Movement Joint Stock Company, to launch a competitive interest rate loan program for investing in Vinfast electric cars for business purposes, with a loan-to-value ratio of up to 90%, contributing to the growth of “Green Credit” in line with Nam A Bank’s orientation as a “Green and Digital Bank.”

In recent years, Nam A Bank has not only focused on growth through impressive business performance but has also consistently emphasized asset quality. Thanks to its remarkable financial results over the past few years, Nam A Bank has accelerated its provision for credit loss to manage asset quality while still achieving high credit growth targets.

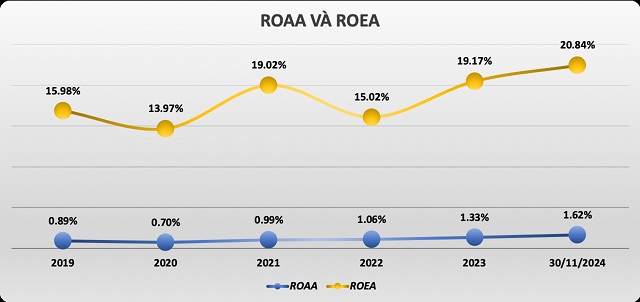

Nam A Bank’s operational efficiency ratios have grown significantly. Notably, Nam A Bank has entered the top three banks with the highest ROE, reaching over 20.84%, and its ROA stood at 1.62%.

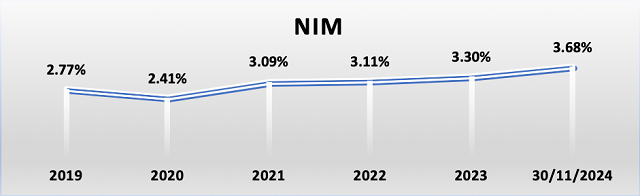

As of November 30, 2024, the bank’s NIM reached 3.68%, up from 3.6% at the end of the second quarter of 2024. Nam A Bank expects its NIM to remain in the range of 3.5-3.8% from now until the end of 2024, as interest rates continue to be kept low to support individuals and businesses amid economic challenges.

|

Despite the challenges faced by the overall economy, Nam A Bank’s capital adequacy ratio is well-controlled, with a CAR of 11%, significantly above the 8% requirement set by the SBV. Other safety indicators also ensure compliance with the SBV’s permissible limits.

As the only bank in the system to list its shares on the HoSE in 2024, Nam A Bank’s transparent and stable operations are further evidenced by significant milestones this year, such as the completion of the project to convert financial reports to International Financial Reporting Standards (IFRS), contributing to the transparency and improvement of the bank’s financial reporting to international standards for investors, especially foreign investors; Moody’s upgrade of Nam A Bank’s credit rating in two categories: asset quality from B3 to B2 and profitability, along with indicators of earning capacity, from B2 to B1, etc.

The Race for Record-Breaking Bank Stock Performance is Not Over Yet

Despite the market’s lackluster performance in December 2024, the banking sector defied the odds by rallying to break records for several stocks, a feat not achieved in November 2024.

The Ultimate Guide to SCIC’s Upcoming Divestment Auction of Duoc Khoa Pharmacy Chain

On December 6, the State Capital Investment Corporation (SCIC) announced its decision to approve the sale of its shares in DK Pharma, a leading pharmaceutical company in Vietnam.