The Vietnamese banking industry faced a challenging economic landscape in 2024, with weak consumer demand, a slow recovery in the real estate market, intense interest rate pressure, and fierce competition for capital mobilization. However, through flexible adjustments to business strategies, improved risk management practices, and a focus on core credit segments, many banks maintained growth and stability.

The banking industry is inherently growth-oriented, not only due to responsibilities towards shareholders but also because banks play a crucial role in channeling capital to the economy and businesses, regardless of the economic climate. However, banks employ different growth strategies depending on the phase of the economic cycle, each with a targeted customer base that aligns with their core competencies.

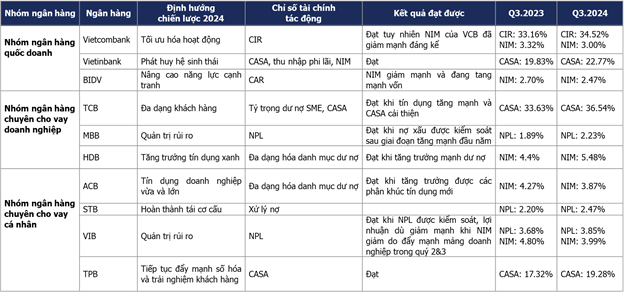

A review of the strategies employed by commercial banks in 2024 reveals interesting insights. For state-owned banks, the year stood out for the distinct strategies adopted by the three listed banks. A notable trend was each bank’s focus on leveraging its core strengths and competitive advantages. For instance, Vietcombank prioritized internal optimization, risk management, and cautious credit disbursement amid macroeconomic instability. Towards the end of the year, Vietcombank ramped up credit disbursements to capitalize on the rebound in credit demand. Despite a decline in NIM from 3.3% to 3.0%, this remained within manageable limits, reflecting the bank’s “slow and steady” approach.

In contrast, VietinBank adopted a more defined strategy by leveraging the ecosystem of large corporations and enterprises, thereby increasing the CASA ratio—a crucial metric for reducing funding costs. VietinBank’s CASA rose from 19-20% to nearly 23% in 2024, an unprecedented achievement. This strategy enhanced interest income, diversified revenue streams, and improved operational efficiency. Meanwhile, BIDV aimed to “enhance competitiveness,” but this vague direction made it challenging to implement focused plans.

BIDV focused on capital raising, but its credit growth and NIM improvement fell short of expectations.

|

Figure 1: Re-evaluating Banks’ Growth Strategies

Source: Consolidated

|

Among private banks, Techcombank, MB Bank, and HDBank continued to focus on corporate credit, leveraging the growth of the FDI and private sectors. MB Bank, for example, effectively managed risk and controlled bad debt from restructured loans, despite a sharp increase in the first quarter that was subsequently curbed. By catering to the credit needs of large economic groups, these banks benefited from improved financial performance and the enhanced financial capabilities of their corporate clients.

For banks targeting personal credit, such as VPBank and TPBank, 2024 presented significant challenges. Consumer demand remained subdued, and non-performing loans from low-income customers increased. VPBank, once renowned for its pre-2022 strategy of providing consumer credit to low-income individuals through its subsidiary FE Credit, had to tighten risk management. In the final quarter, VPBank introduced more flexible loan packages, but growth and bad debt pressures persisted, impacting overall efficiency. Banks like ACB shifted their focus from SMEs to large enterprises due to the challenges faced by SMEs. After years of restructuring, Sacombank accomplished its set goals. While TPBank’s growth was modest, it enhanced customer experience and maintained a favorable CASA position.

Overall, banks of all sizes aimed beyond mere credit growth. During shareholder meetings, instead of pursuing aggressive growth targets, many banks prioritized controlling core indicators like CASA, recognizing its importance for long-term sustainability. The focus on CASA, risk management, and operational optimization became the “key” to the industry’s resilience during challenging times.

Strategy Achievement and Market Response

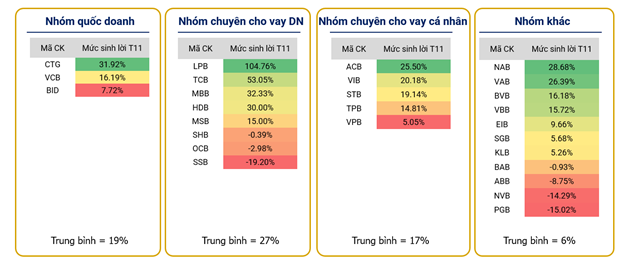

Despite the unfavorable macroeconomic environment, the banking industry maintained relatively stable growth. Estimates suggest that the average return on bank stocks in 2024 was around 16%, outperforming the market average of 10-11%. This indicates that investors continue to value the sector’s resilience and potential.

Banks specializing in corporate lending (Techcombank, MB Bank, HDBank, and Loc Phat Bank) recorded high returns, reflecting their ability to capture the right credit flow trends and their robust risk management capabilities. The state-owned bank group, including Vietcombank, VietinBank, and BIDV, delivered stable performance but with some differentiation. VietinBank stood out with its improved CASA, effective NIM management, while Vietcombank maintained stability despite a dip in NIM. BIDV faced more significant challenges, with difficult credit growth, rising bad debts, and declining NIM, which was reflected in its stock price, growing only by about 7%, below the market average.

|

Figure 2: Banks’ Return on Equity

Source: Consolidated

|

On the other hand, small banks outside the top 15 received less attention from large investment funds due to higher risks and information volatility. While some of these banks demonstrated growth potential, their transparency and stability fell short of attracting long-term capital.

Regarding foreign capital, while there was a general perception of foreign investors selling off stocks, they did not extensively sell bank stocks. Their sales typically targeted banks focusing on personal credit due to concerns about bad debts and the slow recovery in consumer spending. Conversely, state-owned banks and corporate lenders continued to attract interest with their sustainable growth strategies, demonstrating resilience to short-term economic fluctuations.

In summary, 2024 witnessed a clear differentiation in strategies and financial performance within the Vietnamese banking industry. Success hinged on choosing the right credit segments, improving CASA, effective risk management, and ensuring business model sustainability. Banks that accurately identified trends, maintained strong financial foundations, and implemented clear strategies overcame challenges, delivering stable returns to investors. Looking ahead, despite ongoing economic fluctuations, the banking industry remains the economy’s backbone, offering sustainable growth opportunities and attractive profitability potential compared to the overall market.

Lê Hoài Ân, CFA

Suspend Payment Transactions and Withdrawals for Customers with Expired or Invalid ID Documents from January 1st, 2025

To meet the high demand for payment services during the busy period of late 2024 and the Lunar New Year of 2025, the State Bank of Vietnam (SBV) issued Document No. 10182/NHNN-TT on December 12, 2024. This document instructed relevant units within the SBV, credit institutions, Napas, and payment service providers to implement several measures to ensure smooth and secure payment transactions during this crucial time.

Positive Signals from the Vietnamese Banking Sector in Q3 2024

In a tumultuous economic climate, the Vietnamese banking sector in Q3 2024 demonstrated resilience and growth, with positive signals across the board. The latest financial reports indicate significant improvements in the financial performance of commercial banks, especially with the impending expiration of Circular 06. The CAMELS evaluation model paints a comprehensive picture of the current health and stability of the country’s banking system.