The General Department of Taxation has stated that they have been consistently urging local Taxation Departments to strengthen inspections and monitoring of the implementation of electronic invoices for each retail sale of gasoline and oil products. This is to timely detect and strictly handle any violations related to the regulations on gasoline and oil business and electronic invoicing.

However, the issuance of electronic invoices for each retail sale at gasoline and oil outlets nationwide has not been strictly adhered to as required. The penalties for non-compliance are still light and not sufficiently deterrent.

To combat smuggling and fraud in the gasoline and oil business and prevent state budget revenue losses, the General Department of Taxation requests local Taxation Department Directors to concentrate resources and vigorously inspect and monitor, either regularly or spontaneously, retail gasoline and oil outlets that have not adopted automatic connection solutions for issuing electronic invoices for each sale. Strict handling of violations is to be enforced.

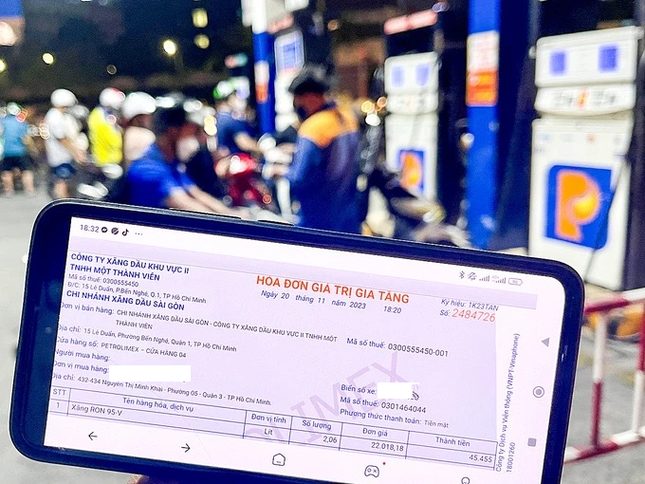

Many gasoline stations have not yet issued electronic invoices for single sales. Photo: SGGP

Local Taxation Departments are requested to report to the Provincial/City People’s Committees, directing competent authorities to consider revoking licenses for qualified gasoline and oil business operations for stores and enterprises that intentionally violate the regulations on issuing electronic invoices for each sale. Information about violating enterprises and stores should be publicized.

Taxation Departments need to coordinate with functional forces to strictly handle enterprises and stores that violate the regulations on the issuance and use of invoices or strengthen the dossier and transfer it to the Public Security for handling according to regulations.

Recently, the General Department of Taxation severely criticized 10 Taxation Department Directors with a high rate of POS/tablet use but who had not organized inspections and monitoring of the implementation of electronic invoices for each retail sale of gasoline and oil.

The General Department of Taxation assigns the Directors to directly lead and comprehensively manage the inspection, monitoring, and management of electronic invoices for each sale of gasoline and oil retail, considering this one of the key tasks for the last months of 2024 and early 2025.

The goal is that by the end of June 2025, the national rate of outlets using automatic connection solutions to issue electronic invoices for each sale will reach at least 95%. This is one of the criteria for considering commendation and reward for individual directors.

According to statistics from the General Department of Taxation, by the end of November, the number of electronic invoices processed and handled by tax authorities is estimated at 11 billion, including 2.68 billion coded invoices, over 7.22 billion non-coded invoices, over 2.04 million occurrence-based invoices, and over 1.13 billion electronic invoices initiated from cash registers…

Uncovering Administrative Irregularities: A Probe into Land, Investment, and Construction Procedures in Da Nang

The Government Inspectorate discovered 13 administrative procedures, advised by the Departments of Natural Resources and Environment, Planning and Investment, and Construction, and appraised by the Office of the People’s Committee of Da Nang City, with violations in the issuance decision signed by the Chairman of the Da Nang People’s Committee.

The Final Countdown: Gas Stations in HCMC Urged to Embrace Digital Transformation for Automated Invoicing

The current manual data entry practices and incomplete invoicing prevalent in the retail fuel industry are non-compliant and leave retailers vulnerable to penalties.

“Ho Chi Minh City: All Gas Stations to Issue Itemized Receipts to Customers”

The implementation of electronic invoicing for each gasoline retail sale has been instrumental in monitoring and controlling the quantity and volume of sales.