TPBank app experiences prolonged downtime. Image: NVCC

|

According to reports, from 9 PM on December 11th to past 10 AM the following day, a technical glitch in the TPBank app prevented customers from conducting transactions, both online and at ATMs.

Mr. L. Minh, a TPBank customer in Go Vap, Ho Chi Minh City, shared that he was unable to access the bank’s Mobile Banking app to transfer funds starting 10 PM on the 11th.

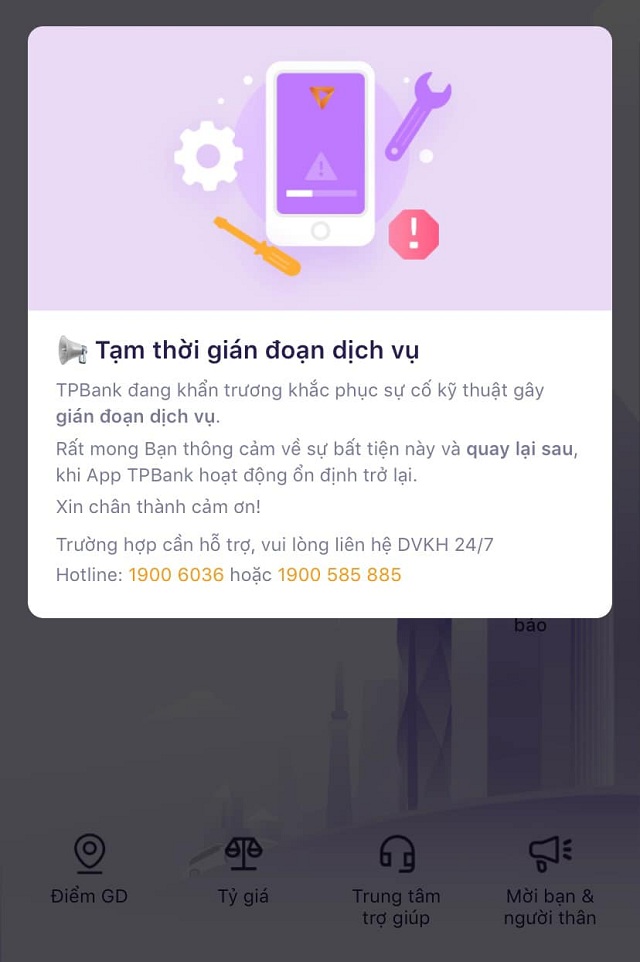

At 1 AM on the 12th, Mr. Minh still couldn’t access the app, and he received a notification stating, “Currently, the TPBank app is experiencing a high volume of traffic, which may impact your transactions. We apologize for any inconvenience, and we kindly ask that you try again later. Thank you.”

After hours of waiting, at 10 AM on the 12th, the app remained inaccessible, displaying the message, “Temporary service interruption. TPBank is working diligently to resolve a technical issue causing service disruption. We apologize for any inconvenience, and we kindly ask that you try again later when the TPBank app resumes stable operation.” Mr. Minh expressed his frustration with the prolonged downtime.

In response to the issue, TPBank acknowledged the interruption and attributed it to system updates performed in the early morning of December 12th. They assured customers that they are working diligently to resolve the problem and restore all transaction channels to normal as soon as possible. The bank also committed to providing updates on their official communication channels.

One user commented on the prolonged downtime, stating, “TPBank frequently undergoes maintenance, but this is the longest outage I’ve experienced.” They also emphasized the importance of diversifying banking services across multiple institutions to mitigate risks associated with relying solely on one provider.

Unlocking Credit Opportunities for the Underserved

With total deposits of around 15 quadrillion VND as of now, the interest rates are quite low, yet banks are “desperately seeking borrowers”. Experts suggest that banks need to open up more to Fintech in the approval process and move away from the traditional “collateral requirement” mindset if they want to avoid capital stagnation. However, how much banks are willing to embrace Fintech is a challenging question due to the prevalent “all-or-nothing” mentality.

Choosing the Right VND Bank Partner: A Shift for FDIs

The influx of FDI into Vietnam presents a significant opportunity for the economy as a whole and, more specifically, for the banking sector. With their deep understanding of the local market, culture, and people, domestic banks are ideally positioned to support and facilitate the expansion and growth of FDI enterprises in the region. This unique advantage enables them to foster the development of the local economy and strengthen their own position in the process.