|

The 2024 exchange rate scenario is unpredictable. Illustration: L.V.

|

Exchange Rate Pressure

Exchange rate discussions in 2024 dominated economic forums, with experts suggesting that it could influence the rest of the financial market, including credit institutions, capital markets, listed companies, and investors.

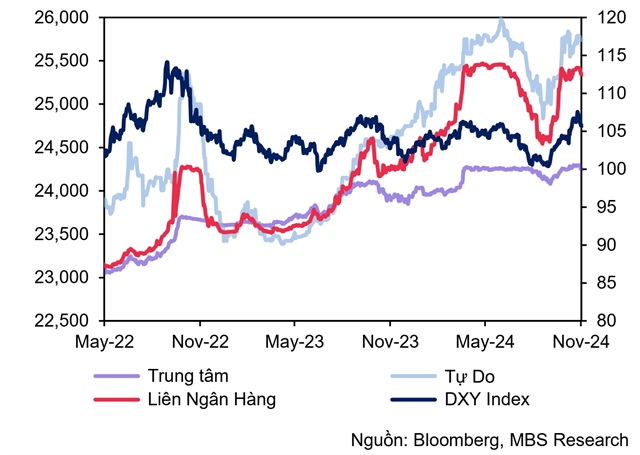

The year started with expectations of a cooler exchange rate, but historical highs. By mid-April, the rate had increased by over 3% since the beginning of the year, reaching the traditional foreign exchange policy management target. The rate then stabilized until June, when it dipped slightly. However, it started climbing again in early October, forming the second peak of the year.

The pressure during this latter period mainly stemmed from the strengthening of the US dollar, as the DXY index (measuring the US dollar’s strength against other major currencies) also hit new highs, especially after Donald Trump’s victory in the November presidential election.

In December, the DXY index dropped slightly but remained above 106 points. Meanwhile, the exchange rate also decreased but still showed a 4.4% year-to-date increase as of the end of November.

According to UOB Bank (Singapore), the Vietnamese dong has gone through a volatile period in recent months. After recording the most considerable quarterly increase since 1993 (3.5% in Q3 2024), the dong reversed its upward trend in the first two months of the last quarter of 2024.

In reality, the dong experienced a brief period just before and after the Fed initiated interest rate cuts, with an initial aggressive reduction of 50 basis points. However, the US dollar strengthened again as macroeconomic indicators remained robust, accompanied by persistent high inflation.

Most analysts agree that the exchange rate movement has been challenging to predict due to external factors, including the unpredictability of Fed interest rate cut timings, volatile gold prices, and geopolitical tensions worldwide.

“The exchange rate movement this year has been more volatile than last year,” said Dr. Can Van Luc, BIDV’s Chief Economist, at the Vietnam Economic Forum 2024’s fourth session, titled “Motivation for Businesses in the New Context,” held by NLD Newspaper on December 12th.

Dr. Luc attributed the exchange rate increase to market expectations of rising prices during Donald Trump’s new term, which could cause the Fed to slow down its interest rate reduction plan. He also mentioned the second critical reason: the relatively strong US economic recovery, which boosted the US dollar and weakened other currencies.

Exchange rate movement from 2022 to 2024, with 2024 recording 2 historical peaks. |

Pressure on Policymakers

Amid the exchange rate pressure, the State Bank of Vietnam (SBV) implemented several measures to support the foreign exchange market, from controlling liquidity and maintaining interest rate and exchange rate balance to buying and selling foreign currencies when necessary.

However, a notable aspect of foreign exchange policy management this year, according to Nguyen Xuan Thanh, a lecturer at the Fulbright School of Public Policy and Management, is the authorities’ apparent acceptance of more significant exchange rate fluctuations, even reaching nearly 5% at some points.

“This year is special because the SBV did not intervene much to depreciate the dong, even under significant pressure, but the situation stabilized afterward,” said Mr. Thanh at a workshop titled “Vietnam Economy: The Returning Star” held by the Investment Bridge Magazine on December 11th.

One important reason for this development is the concern about currency manipulation accusations, which the US has previously leveled against Vietnam. “Vietnam will need to be more flexible and not intervene in one direction; the dong will have its ups and downs,” commented Mr. Thanh.

In a previous interview, Mr. Ngo Dang Khoa, Head of Foreign Exchange, Capital Markets, and Securities Services at HSBC Vietnam, assessed the SBV’s exchange rate management in the past time as “quite good in terms of technical and diplomatic aspects.” As a result, the dong fluctuated gradually without causing shocks.

“The SBV’s actions will signal the market, but the nature is flexible, not fixed. The SBV’s mission has always been to maintain macroeconomic stability and promote economic development, and Vietnam’s economy is currently growing much better than in the region and the world. The issue is the weak domestic consumption demand,” said Mr. Khoa.

According to Dr. Le Duy Binh, Director of Vietnam Economica, the exchange rate has remained relatively stable in the past year despite recent increases due to external pressures. “Vietnam has controlled what it can, and its exchange rate management has been relatively appropriate and flexible during this period to maintain exchange rate stability,” said Mr. Binh.

Mr. Binh explained that stability means keeping the exchange rate within an acceptable range to support import and export activities, maintain macroeconomic balance, attract foreign investment, and promote the domestic economy.

Regarding the outlook for 2025, in a recent update, Mr. Tim Leelahaphan, Thailand and Vietnam Economist at Standard Chartered Bank, predicted that the Fed’s interest rate cuts could lead to a weaker US dollar in the next few quarters. As a result, the exchange rate is expected to reach 25,250 VND/USD by the end of 2024 and 25,450 VND/USD by Q2 2025.

Specifically, the US dollar could weaken in early 2025 due to continued Fed interest rate cuts and uncertainties in implementing new policies. However, it will strengthen in the second half of 2025 as the tax policies and fiscal measures of Donald Trump’s second term become clearer and are implemented.

Meanwhile, Dr. Luc predicted improved exchange rate stability in the coming period. He attributed this to a relatively favorable foreign exchange supply and demand relationship, a decrease in speculative enthusiasm in the foreign exchange market, and the Fed’s continued interest rate cut path, albeit at a potentially slower pace.

Accordingly, the BIDV research team forecasts a 3.5-4% increase in the dong value this year and a “softer” 2.5-3% increase next year. “This is a manageable and acceptable level given the global risks,” added Dr. Luc. The general recommendation is for businesses to prepare for potential adverse scenarios.

Dung Nguyen

“Standard Chartered: Robust USD and Vietnam’s Economic Growth Trajectory Towards 6.7% in 2025”

In its latest economic update on Vietnam, released on December 12, 2024, Standard Chartered Bank forecasts a strong USD in 2025, with a weakening bias in the early part of the year. The bank predicts a 6.7% GDP growth for Vietnam in 2025, with a 7.5% year-on-year expansion in the first half and a 6.1% growth in the latter half.

The Rising Dollar: A Story of Strength and Resilience

Last week (December 9-13, 2024), the US dollar continued its upward trajectory in the international market following the release of US inflation data.

Unlocking Economic Growth: Unleashing Production and Business Through Policy Reform

Prime Minister Pham Minh Chinh concluded the regular Government meeting on the morning of December 7, emphasizing that policy formulation must be forward-thinking, ambitious, and bold. He stressed that policies should “unshackle” production and business activities to unleash their full potential, with the primary focus on boosting economic growth. This, in turn, will increase per capita income, raise labor productivity, improve the material and spiritual lives of the people, and enhance the country’s stature.