Illustration

Oil Rises 2%

Oil prices climbed nearly 2% to a three-week high, driven by expectations of additional sanctions on Russia and Iran, which could curb supply. Lower interest rates in Europe and the US are also expected to boost fuel demand.

Brent crude futures settled at $74.49 a barrel, up $1.08 or 1.5%. US West Texas Intermediate (WTI) crude futures settled at $71.29 per barrel, rising $1.27 or 1.8%. Both benchmarks posted weekly gains, with Brent up 5% and WTI up 6%, their highest since November 22 and November 7, respectively.

EU ambassadors agreed on a new package of sanctions against Russia this week due to the conflict in Ukraine, targeting their oil tankers. The US is considering similar moves.

Additionally, France, Germany, and the UK informed the UN Security Council of their readiness to reinstate sanctions on Iran to prevent it from acquiring nuclear weapons.

The International Energy Agency (IEA) raised its 2025 global oil demand growth forecast to 1.1 million barrels per day, up from 990,000 barrels per day previously, due to stimulus measures in China.

In China, new bank lending fell short of expectations in November, indicating weak credit demand in the world’s second-largest economy, even as policymakers pledged further stimulus measures.

Gold Falls

Gold prices dipped after touching a five-week high in the previous session, pressured by a stronger US dollar. However, expectations of a Fed rate cut next week kept gold on track for a weekly gain.

Spot gold fell 1.1% to $2,652.29 per ounce, while US gold futures for February delivery settled down 1.2% at $2,675.80 per ounce.

Supported by loose monetary policies, central bank purchases, and safe-haven demand, gold has broken several records this year.

Copper Slides

Copper prices came under pressure from a stronger US dollar but were supported by data from the LME showing rising metal inventories.

Three-month copper on the LME fell 0.5% to $9,048 a ton. LME data showed copper inventories in their warehouses rose by 4,400 tons to 272,825 tons.

Meanwhile, copper inventories in Shanghai-monitored warehouses declined, indicating stronger demand.

A stronger US dollar makes dollar-denominated commodities more expensive for holders of other currencies, potentially dampening demand and prices.

Analysts at BNP Paribas forecast a substantial copper surplus of 491,000 tons in 2025, the largest since 2020, making copper more vulnerable to US dollar strength than other industrial metals.

Iron Ore Posts Weekly Gain

Iron ore prices slipped on the last trading day of the week but posted a weekly gain as investors assessed additional economic stimulus measures in top consumer China to support its slowing economy.

The January 2025 iron ore contract on the Dalian Commodity Exchange closed down 1.12% at 797 yuan ($109.50) per ton. It rose 0.31% for the week, marking its fourth consecutive weekly gain.

In Singapore, January 2025 iron ore futures fell 2.13% to $103.80 a ton, but still gained 2.65% for the week.

High port inventories, above 150 million tons, the highest for this time of year, also weighed on iron ore prices.

In Shanghai, steel rebar fell 1.73%, hot-rolled coil dropped nearly 1.9%, wire rod dipped nearly 1.3%, and stainless steel declined 0.57%.

Rubber Ends Three-Week Rally

Japanese rubber futures fell in the session, posting their first weekly loss in four, as concerns about weak seasonal demand outweighed expectations of additional economic stimulus from the US.

The May 2025 rubber contract on the Osaka Exchange closed down 2 yen, or 0.54%, at 369.4 yen ($2.42) per kg. It fell 2.38% for the week, its first weekly loss since November 22.

May rubber on the Shanghai futures market fell 220 yuan, or 1.17%, to 18,525 yuan ($2,545.52) per ton, declining 2.17% for the week.

Winter is traditionally a low season for tire demand, and rubber producers’ operating rates are expected to drop in December, according to Hexun Futures, a Chinese financial information website.

Coffee Climbs

Arabica coffee futures settled up 1.75 cents, or 0.5%, at $3.195 per lb, though they fell 3.2% for the week.

Dealers said the market reassessed worries about the outlook for Brazil’s crop, although production is down due to drought this year, it may not be as bad as previously thought.

Meanwhile, roasters in Brazil raised prices sharply, and traders expected prices to rise globally, meaning consumption could slow, especially in developing countries.

Robusta coffee rose 0.6% to $5,184 per ton.

Unseasonal rain returned to Vietnam, the world’s top robusta producer, which could further disrupt the already delayed harvest.

Sugar Falls

Raw sugar futures closed down 0.17 cent, or 0.8%, at 20.72 cents per lb, after touching a near three-month low in the previous session. The contract fell 5% for the week.

Sugar production in top producer Brazil unexpectedly rose at the end of November, indicating that end-of-crop volumes could be higher than most analysts had anticipated.

March white sugar fell 0.9% to $528 per ton.

Corn, Soybeans Slip

Chicago corn futures eased on technical selling and disappointment over lower-than-expected export sales.

March CBOT corn futures settled down 1-1/2 cents at $4.42 per bushel, though corn posted a weekly gain of 0.45%.

Soybeans also fell on technical selling and concerns about demand from China.

January CBOT soybeans settled down 7-1/2 cents at $9.88-1/4 per bushel.

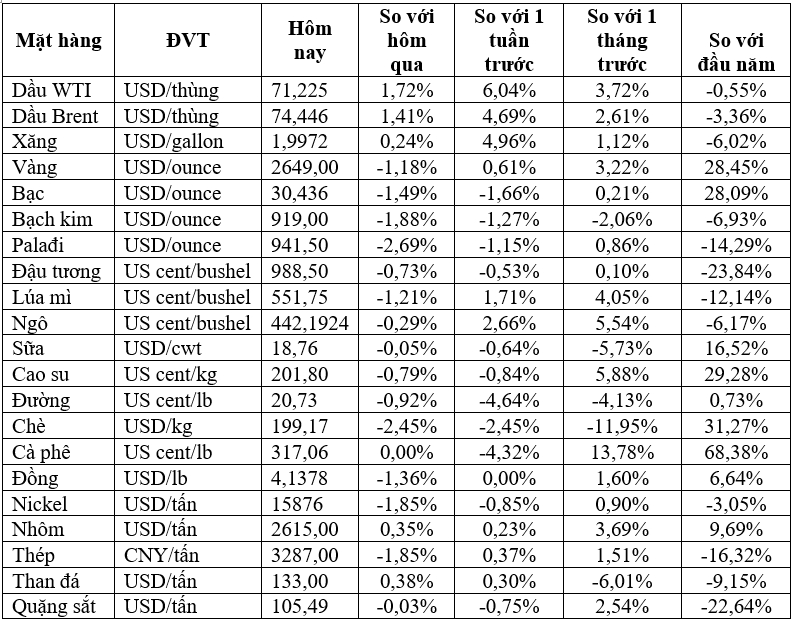

Prices of Key Commodities on December 14

Is Investing in Gold, Real Estate or Stocks the Most Profitable?

The year 2025 is set to be a period of significant change, but also a time of opportunity for investors to reap success. While real estate, stocks, bonds, and savings accounts remain the dominant investment avenues, a strategic capital allocation is key. Notably, gold is expected to be the least attractive investment option among these traditional avenues.

The Crypto Surge: Why Bitcoin’s Value Skyrocketed Post-Trump Election

Bitcoin Surges Towards $100,000: Why Trump’s Presidency Caused a Shock Spike.

A perfect storm of factors, including Trump’s unexpected victory, has sent Bitcoin surging towards the $100,000 mark, shocking investors and experts alike. But why has Trump’s presidency caused such a dramatic rise in this cryptocurrency’s value? In this introduction, we unravel the intriguing connection between Trump’s win and Bitcoin’s unprecedented surge.