The Rising Trend of Investing in Rental Apartments in Major Cities

Investing in rental apartments is a growing trend in large cities, not only in Vietnam but also in many bustling metropolitan areas worldwide. This trend is expected to gain momentum as the population dynamics shift towards Gen Z and Gen Y. In Vietnam, according to the General Statistics Office in 2023, Gen Y and Gen Z (collectively known as Millennials) make up 47% of the population.

This generation, born and raised in an era of rapid technological advancement, prioritizes modern and fully amenitized living environments. This has led to the emergence of a trend towards renting luxury apartments, sometimes even with five-star hotel-standard services. This reality has opened up an incredibly attractive investment opportunity in the form of high-end rental apartments.

Many investors have affirmed that the income from renting properties is comparable to that of bank savings, not to mention the appreciation in asset value as apartment prices continue to rise year after year. However, a crucial factor in investing in rental apartments is location. When considering investing in rental properties, it is advisable to choose projects located in bustling areas of major cities such as Hanoi and Ho Chi Minh City, as these regions consistently offer a stable demand. Another advantage of these areas is the concentration of healthcare, educational, cultural, and social services, as well as entertainment options to meet the needs of residents.

In recent years, Vietnam has attracted significant Foreign Direct Investment (FDI), particularly with the signing of various trade agreements with developed countries. This is especially evident in centrally-located cities with strong industrial and commercial capabilities. For instance, in 2024, Hanoi aims to attract approximately 3.15 billion USD in FDI, with over 2.15 billion USD allocated for projects utilizing land and 1 billion USD for commercial and service projects. In 2025, the city further aims to attract around 2.7 billion USD in FDI.

These figures indicate a continued influx of investment and development in industrial zones and factories by large corporations and businesses worldwide. The arrival of numerous foreign experts in Vietnam, for work and residence, is expected to drive up the demand for housing and rental properties. According to a real estate brokerage firm, service apartments generally command rental rates 30% higher than regular apartments, and they consistently maintain an occupancy rate of over 80%.

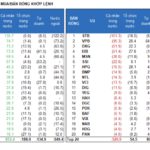

Hanoi currently offers 3,400 service apartments in both A and B grades, outnumbering Ho Chi Minh City by nearly 2,000 units. In the third quarter, the average rental rates remained stable at 31.9 USD/sq m/month for Grade A and 15.9 USD/sq m/month for Grade B.

“The serviced apartment segment is performing well and witnessing positive business activities in line with the recovery of the tourism industry and the influx of foreign experts,” said Morgan Ulaganathan, Director of Asset Services and Hospitality Consulting at Avison Young Vietnam.

A Stable and Profitable Investment

According to CBRE, in the first nine months of 2024, the total new supply of condominium apartments in Hanoi exceeded 19,000 units, surpassing the total supply for the entire year of 2023. This is the largest new supply recorded in Hanoi in the last five years. However, most of these developments are located in large urban areas in the west and east of the city, specifically in Nam Tu Liem, Tay Ho, and Gia Lam districts, as well as Van Giang district in Hung Yen province, which borders Hanoi.

Industry experts suggest that whether for self-occupation or investment, projects with prime locations in inner-city districts, complemented by comprehensive and modern amenities, always guarantee the appreciation of real estate value. A notable example is The Ninety Complex, a project that has been attracting attention in the market due to its “lease home” concept—a rental property situated in the heart of Dong Da district. With the advantage of being just “a step away from the street,” The Ninety Complex offers seamless connectivity and a vibrant community in one of the capital’s most dynamic areas.

The impressive design of The Ninety Complex optimizes natural light and ventilation without compromising elegance and luxury.

Notably, The Ninety Complex is a passion project by ROX Living, operated by the international brand CBRE. This collaboration ensures a world-class living environment for its residents. Each “sky mansion” within the complex is uniquely designed, contributing to the project’s overall appeal, especially for investors looking to rent out their properties. Impressive designs have a powerful draw for tenants, particularly foreign renters.

The Ninety Complex not only offers attractive rental potential for investors but also promises long-term capital gains. Located at the golden address of 90 Duong Lang, at the intersection of a multi-layered transportation system, the project boasts unparalleled value and exceptional potential for price appreciation.

“Patience and Trust: The Keys to Smart Investing, Says Eastspring Vietnam CEO”

The “get-rich-quick” mindset is a prevalent pitfall and a reason why many people leave the game before they can reap the rewards of success. As a guest on the talk show, “The Investors”, hosted by CafeF and VPBankS, the CEO of Eastspring Vietnam shared invaluable lessons from his own journey to success.

Stock Market Blog: Trading for Quick Profits?

The persistent upward trend is causing a slight discomfort for investors who are holding cash and have not yet bought into the market. Many are waiting for a pullback to present a better buying opportunity, with the VNI index’s level around 1240 being keenly watched.