According to the plan approved by the DIG Board of Directors on May 10, these 200 million shares will be offered at VND 15,000 per share, a ratio of 32.794% (shareholders owning 100,000 shares are entitled to buy 32,794 new shares). Compared to the DIG share price at the end of the session on December 13 (VND 20,550 per share), this offering price is approximately 27% lower.

The shares issued will not be restricted for transfer by existing shareholders but will be restricted for one year for other investors who purchase after the offering ends. The expected timeline for the offering is in the second to fourth quarters of 2024, after obtaining approval from the State Securities Commission.

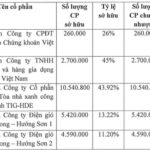

At the price of VND 15,000 per share, DIG is estimated to be able to raise VND 3 trillion if the offering of 200 million shares is successful. In order of priority, DIG will focus its capital on the Cap Saint Jacques project phases 2 and 3, with a total investment of VND 1,135 billion, of which VND 535 billion is expected for phase 2 and VND 600 billion for phase 3.

Subsequently, the Company will use VND 965 billion for the Vi Thanh commercial residential project, of which VND 695 billion will be for the payment of technical and social infrastructure construction and other works, and the remaining VND 270 billion will be used to pay land use fees.

Finally, DIG will use the remaining VND 900 billion to fulfill its obligations for two bond lots, DIGH2124002 and DIGH2124003, with amounts of VND 461 billion and VND 439 billion, respectively.

|

Capital usage plan from DIG‘s issuance

Source: DIG

|

In the event that the offering does not sell all 200 million shares or only reaches a minimum of 70% of the offered shares, the DIG Board of Directors will consider measures such as using its own capital, borrowing from banks, seeking investors to participate in capital contribution, or issuing bonds to make up for the capital shortfall.

The issuance of 200 million shares to existing shareholders is part of a larger issuance of 410 million shares to increase DIG‘s charter capital to over VND 10.2 trillion. The remaining issuance plans include: 150 million shares offered privately, 30 million shares under the ESOP program, over 15.2 million shares as dividend payment for 2023, and over 15.2 million shares to increase capital from owner’s equity.

In the resolution dated October 17, the DIG Board of Directors approved the priority of implementing the offering of 200 million shares to existing shareholders before other issuances to ensure timely capital mobilization for production, business, and investment activities.

“TIG to Divest from Five Subsidiaries, Delays Stock Dividend Payment”

The Hanoi-based Thang Long Investment Group JSC (HNX: TIG) has recently unveiled three resolutions passed by its Board of Directors. These resolutions pertain to the company’s capital investments in its subsidiaries and associated companies, as well as a plan to issue bonus shares as dividends.

The Secret to Joining the Elite 5% of Winning Investors in the Stock Market

The vast majority of active traders on the stock market, a staggering 95%, lose money. So, what’s the secret to success for the remaining 5%? How do they consistently beat the market and turn a profit?