The market saw its fourth consecutive day of declines, albeit with a small margin and very low liquidity. This effect is mainly due to buyers lowering their prices to match the selling pressure during the downward session.

The adjustment range has not significantly damaged prices, with most stocks still ‘profiting’ from the gains made on December 5th. On average, the matching value of orders on the HSX and HNX this week was only about 12.3k billion VND per session, and the last trading day of the week reached 10.1k billion VND.

The decline in stocks is still polarized in terms of strength; those with minimal declines are only fluctuating, which is a positive sign. This development is quite similar to the resting period in May when there were also five stagnant sessions with significantly lower liquidity than the previous upward momentum. That was a phase of supply and demand testing and expectation measurement.

With very low liquidity persisting in recent days, stockholders have demonstrated their ability to hold and accept short-term damage or reduced profits. What remains is to test the tolerance level of cash flow, which has not yet shown clear signals. Intraday dips with wider ranges have seen bottom-fishing demand, but the effect of pushing prices back up is unclear – especially for the index – as cash flow choices differ.

Today’s session saw the VNI underperforming the VN30, and during this six-day decline, the VN30 formed a clearer sideways fluctuation region than the VNI. The ability to stabilize the general psychology in the adjustment phase still depends on blue-chips, and the sharp decline in liquidity this week in the VN30 group reflects the reduced activity intensity of large cash flows. Typically, blue-chips fluctuate less than medium and small-cap stocks, which are easily influenced by large orders.

Next week, the market will simultaneously witness the outcome of the Fed’s December meeting (on the 17-18th US time) and the derivatives expiry session (on the 19th, proprietary trading still holding about 21.8k short contracts), the final deadline for ETF restructuring (on the 20th). This is the only remaining event blocking the way to the end of 2024. The market may continue to weaken and witness further declines in liquidity.

The view remains that the market is experiencing a normal pause, and short-term trades are not advantageous. This slight retreat is an opportunity for those who have not yet bought to participate. The ability to reduce T+ prices is quite narrow and depends on each stock. Strong stocks adjust very little, only fluctuating within the normal range of 1-2% based on the closing price. With a good portfolio, there is no need to fuss over daily fluctuations like this. The year-end market often sees a more positive dynamic.

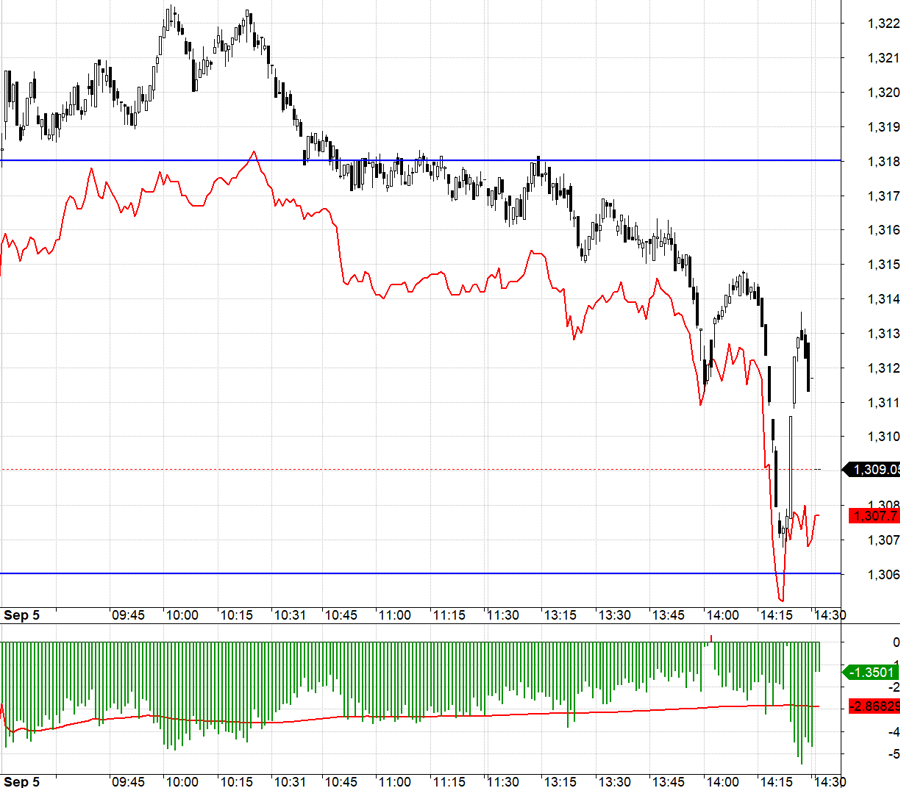

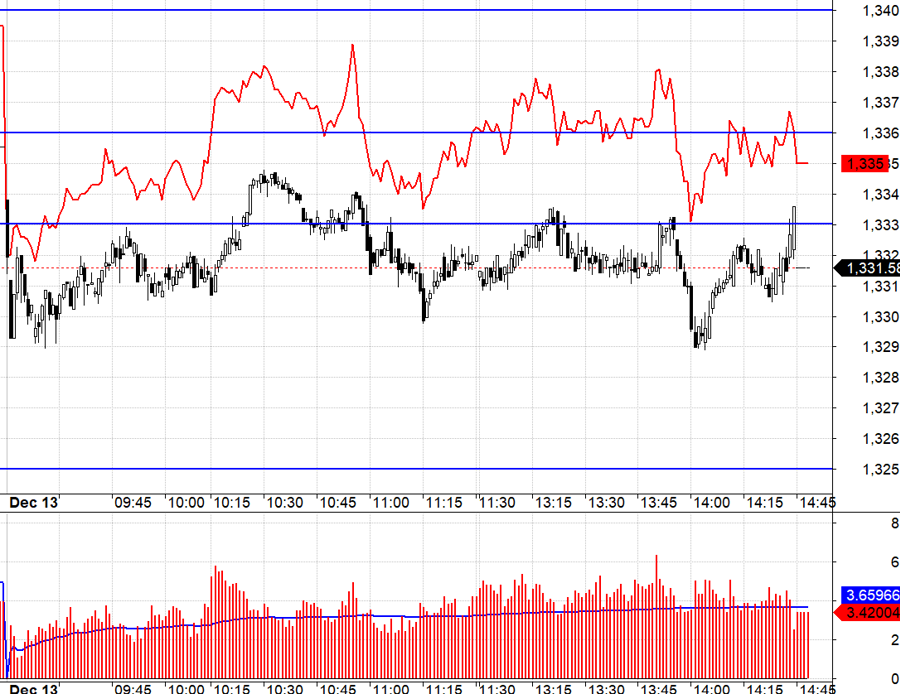

The derivatives market is approaching the last days of F1, and while the basis has narrowed, reducing trading risks, today’s fluctuations were very narrow. The VN30 reacted to 1333.xx, and the basis favored Shorts, but the downward momentum lacked inertia. While the VN30 turning back at 1333.xx presented Short setups, the low risk did not yield significant results.

With cash flow ‘letting go’ today and possibly continuing next week, fluctuations will depend entirely on how the sellers will push prices down. A narrow range of fluctuations in the context of low liquidity is positive. When selling pressure is not strong, cash flow can easily balance. The strategy is to hold stocks, and be flexible with Long/Short derivatives.

VN30 closed today at 1331.58. The nearest resistance for the next session is 1333; 1338; 1344; 1347; 1358. Supports are at 1326; 1321; 1315; 1307.

“Stock Market Blog” is a personal column and does not represent the opinions of VnEconomy. The views and assessments are those of the individual investor, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues related to the investment assessments and opinions published.

Stock Market Blog: Sell Less, Balance the Price Easy

Today’s trading value on the two exchanges dropped below 10 trillion VND, the lowest in 13 sessions. The continued low liquidity indicates weak selling pressure, with both buyers and sellers temporarily reducing their trading intensity to observe. Price volatility in this situation can change rapidly…

The Little Engine That Could: Small-Cap Stocks Attracting Big Money, Liquidity Dries Up After 30 Sessions

The small-cap stock group was the only gainer in terms of liquidity on the HoSE today, while the overall market traded at a 30-session low. Even the blue-chip VN30 group witnessed record-low liquidity since the beginning of the year.

The Market Beat: Afternoon Dip Turns All Three Boards Red

The unexpected afternoon slump saw all three market indices close in the red on December 12th. The VN-Index led the decline, falling 1.51 points to 1,267.35, followed by the HNX-Index, which dropped 0.19 points to 227.99. The UPCoM index also slipped, shedding 0.06 points to close at 92.68. Foreign investors offloaded Vietnamese shares for the fourth consecutive session.