Although the VN-Index fell in 4 out of 5 sessions last week, experts do not consider it a worrying signal. In fact, after the initial good gains and the market explosion on December 5, the slowdown and retreat are seen as healthy.

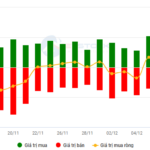

There are several factors that give experts confidence in this week’s adjustment. The selling pressure was very mild, and the VN-Index fell to the expected level of around 1260 points. Liquidity in the declining sessions last week was very small, with the average matching value on the two exchanges, HoSE and HNX, reaching just over VND 12,200 billion/session, with Monday being the highest at over VND 13,700 billion and the weekend being the lowest at just over VND 10,100 billion.

In addition, the market is approaching the end of 2024 with fundamental supportive factors likely to emerge. Experts believe this is the time when smart money starts to operate with a longer-term vision, focusing on more attractive opportunities and stories in 2025 rather than buying stocks for immediate post-settlement gains.

Experts also increased their stock holdings to high levels as expected from the previous week. The common holding level is around 70-80% of the portfolio.

Nguyen Hoang – VnEconomy

The market slowed down after the explosive session on December 5. The VN-Index adjusted 4/5 sessions of the week but very mildly. Along with that, liquidity decreased significantly. In the previous week’s discussion, you also expected a pause around the 1280-point level. How do you assess this week’s adjustment and what are the positives?

I believe that the strong bottom-fishing force recently can be considered smart money. They participate and anticipate new trends in the first half of 2025 when the economic outlook is relatively brighter as the Ukraine-Russia conflict is expected to end soon, while the Fed is expected to continue lowering interest rates and Vietnam’s GDP growth remains strong for 2024, with an expected 8% for 2025.

Nguyen Thi My Lien

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

After three consecutive weeks of gains, the market cooled down last week, with the number of declining sessions dominating with 4/5 sessions, but the decline was not strong, accompanied by a downward trend in trading volume. Although we witnessed a recovery in the USD Index last week, the USD/VND exchange rate did not fluctuate too strongly, and the global stock market also had a positive trading week.

I assess this adjustment signal as relatively positive, indicating that the selling pressure is not showing signs of strengthening, in line with the expectation of a short correction. The market is currently approaching the support zone of 1240-1260 points. If this adjustment signal is maintained, there may be a recovery next week.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

The trading sessions this week were as expected and quite slow, with a probing nature. In my opinion, these are reasonable and relatively positive market developments as liquidity is low and the market fluctuates within a narrow range. Money is being spread across sectors, and there are no signs of money fleeing the market after the explosive session on December 5.

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, the positive aspect is that the market did not correct much in terms of points and is still above the support level of 1260 points. The futures expiration week and the portfolio restructuring phase are also events that could make the market more vibrant. There have been many expiration sessions where the indexes have also recorded gains. With inflation data and the current personal consumption index – the Fed could still cut rates by 0.25% next week – information that many global investors are looking forward to about the trend reversal policy, boosting economic growth.

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

Looking back at the VN-Index’s performance over the past 3 weeks, we can see a clear positive trend after the index touched the strong support level of 1200 points. The market’s adjustment last week, after a string of good gains, was entirely reasonable and necessary to consolidate the price base. Currently, the VN-Index is fluctuating around the 1260-point level – an important support threshold. If this level is maintained, positive cash flow and stable sentiment will be the driving force for the market to move towards higher targets, with the immediate goal of 1280 and the further goal of 1300 points. This shows that the overall trend remains positive, and investors can take advantage of these fluctuations to optimize profits.

While the short-term performance is as such, if we look at the market’s performance for the whole of 2024, there has not been a clear imprint or a strong enough driving force to promote or create a common trend for the market. With candlestick patterns fluctuating within a certain range, we still need trading sessions with a trend confirmation nature when the price breaks through the upper boundary – the resistance level of 1300 or the lower boundary – the support level of 1200. If there are still no such trading sessions, as a precaution, we will look for positive aspects in seizing opportunities in the market’s fluctuations, assuming that the market will continue to “sideway” for some more time.

Nguyen Hoang – VnEconomy

Statistics show that individual investors have returned to net buying quite well last week after 2 consecutive weeks of net selling. It seems that the waiting money outside has started to come back. Last week, you also recommended that investors could wait to invest at the adjustment phase. In the last session, the VN-Index touched the level of 1260 points and recovered slightly. How do you assess this new bottom-fishing force?

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

I believe that the 1260-point region will be a good support level and will be the new buying point for investors who missed the previous opportunity. With the support of foreign capital and institutional investment groups, the 1260-point region will be a good support level in this adjustment phase.

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

Last week, the bottom-fishing force in the Vietnamese stock market showed positive signs, especially from individual investors who returned to net buying after 2 consecutive weeks of net selling. This reflects an improved market sentiment, with waiting money from outside starting to participate again as the VN-Index approaches the 1260-point support level. The bottom-fishing force appeared proactively at low prices, especially in the last session, reflecting expectations of a recovery. Of course, the recovery is only short-term in nature, rather than reflecting a long-term trend, as there are no significant supportive information for the general market. With a general cautious sentiment, perhaps the market’s mild correction along with the bottom-fishing force at the end of the session is already a positive aspect for us at the moment.

The market’s adjustment last week, after a string of good gains, was entirely reasonable and necessary to consolidate the price base. Currently, the VN-Index is fluctuating around the 1260-point level – an important support threshold. If this level is maintained, positive cash flow and stable sentiment will be the driving force for the market to move towards higher targets, with the immediate goal of 1280 and the further goal of 1300 points.

Nguyen Thi My Lien

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

From my observation, usually in the last months of the year, cash flow tends to be less abundant and is more seasonal. Therefore, the fact that the market received strong buying force on December 5 and still maintained bottom-fishing force when the market adjusted to 1260-1250 is, in our opinion, a noteworthy signal.

In addition, I would also like to note that at this time, almost all business results for 2024 are relatively clear and have been largely reflected in stock prices. Therefore, in my opinion, the recent strong participation of cash flow reflects expectations for the economic picture in 2025 rather than 2024, especially in the context of President Trump’s inauguration in early January 2025. Therefore, I believe that the strong bottom-fishing force recently can be considered smart money. They participate and anticipate new trends in the first half of 2025 when the economic outlook is relatively brighter as the Ukraine-Russia conflict is expected to end soon, while the Fed is expected to continue lowering interest rates and Vietnam’s GDP growth remains strong for 2024, with an expected 8% for 2025.

Le Duc Khanh – Director of Analysis, VPS Securities

Although the pressure to adjust increased and liquidity decreased last week – the bottom-fishing force was not strong – the strong support zone of 1260-1265 points could still be the level at which the market could bounce back. We still expect a mild recovery trend in the market in the coming trading week and an improvement in cash flow.

Nguyen Hoang – VnEconomy

On December 17-18 next week, the Fed will meet, and it is also the expiration week of futures contracts for December. Some believe that the market is waiting for better supportive factors to return to the uptrend, similar to the 5-session adjustment phase in early May. However, liquidity has weakened significantly compared to May. What could stimulate stronger cash flow at this point?

The phase of stimulating credit growth and promoting investment disbursement can be a message not only for the macro-economy in general but also for the stock market – taking a step ahead of the market to wait for a more positive growth trend in 2025.

Le Duc Khanh

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

“Give me a reason” – if we look at the bigger picture, this may be the most important question for investors at the moment. The issue here is not about which stocks to buy, at what price, or with what investment ratio, but about what will make us confident in the stock market in the coming time – 2025 – instead of a safer investment channel.

So, what could really stimulate stronger cash flow? In my opinion, it is money. Directly or indirectly, only money can truly and profoundly affect the long-term trend of the stock market. Cash flow not only directly determines the supply and demand of capital in the investment markets but also influences the quality of goods, which is the profits of businesses in that market.

Of course, we do not deny that there are many macro and micro factors that also affect the economy and the stock market, but the monetary policy shift is the most prominent factor that will determine the trend of the global financial market in general and the stock market in particular. After nearly a year of raising interest rates at many major central banks around the world to curb inflation, we are witnessing a change in monetary policy from tightening to loosening. The money supply will increase in the coming time if the monetary policy is loosened to support the economy, which will indirectly support the stock market, or in other words, when the stock market is attractive enough, cash flow will be willing to disburse.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

As I mentioned above, towards the end of the year, cash flow tends to be tighter for reasons other than stocks. Therefore, to expect a more positive market, we need one of two factors: 1) a compelling story (leading to high profit expectations in the near future) to give investors confidence to continue buying; or 2) an attractive discount to keep investors from being distracted by other investment channels, keeping money in the market and trading.

Currently, I feel that the market seems to have both. The story of economic growth with a GDP of 8% in 2025, along with the increasingly clear prospect of upgrading the stock market, will strengthen the confidence of both domestic and foreign investors, especially in the context of the market’s P/E ratios being much lower than the 5-year average.

Le Duc Khanh – Director of Analysis, VPS Securities

Macroeconomic prospects, net buying value of foreign investors, ETF portfolio restructuring activities, along with positive business results and investor confidence, can activate cash flow in the last months of the year. The phase of stimulating credit growth and promoting investment disbursement can be a message not only for the macro-economy in general but also for the stock market – taking a step ahead of the market to wait for a more positive growth trend in 2025.

I believe that the 1260-point region will be a good support level and will be the new buying point for investors who missed the previous opportunity.

Nguyen Viet Quang

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

The Vietnamese stock market in 2025 is expected to have a bright outlook with GDP growth, vibrant exports, and especially the wave of foreign investment, which will be extremely important catalysts. With these expectations and the government’s focus on economic development, I believe that our market will welcome more positive news in the future, so investors need to closely monitor market information to seize opportunities.

Nguyen Hoang – VnEconomy

Last week, you expected to increase the stock holding ratio to a high level of 80-90% of the portfolio when the market adjusted. Has this been done? What are the short-term portfolio focuses on in terms of stocks/stock groups?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

My portfolio has been adjusted to gradually increase the stock holding ratio to around 70-80%. The short-term portfolio currently focuses on stocks in industries with solid fundamentals and growth potential, such as banks, technology, steel, and rubber. I am also monitoring stocks with attractive valuations after recent adjustments.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

According to my investment perspective, in the short term, especially in the last months of this year, the preferred sectors are securities and cyclical sectors such as oil and gas, chemicals, and steel. In addition, investors should also pay attention to well-performing businesses that are trading

Stock Market Blog: Sell Less, Balance the Price Easy

Today’s trading value on the two exchanges dropped below 10 trillion VND, the lowest in 13 sessions. The continued low liquidity indicates weak selling pressure, with both buyers and sellers temporarily reducing their trading intensity to observe. Price volatility in this situation can change rapidly…

The Little Engine That Could: Small-Cap Stocks Attracting Big Money, Liquidity Dries Up After 30 Sessions

The small-cap stock group was the only gainer in terms of liquidity on the HoSE today, while the overall market traded at a 30-session low. Even the blue-chip VN30 group witnessed record-low liquidity since the beginning of the year.

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline, with a tug-of-war session accompanied by below-average trading volume. This cautious investor sentiment persists following the recent strong rally. Notably, the Stochastic Oscillator is now venturing deeper into overbought territory. Investors are advised to exercise caution in the coming days if the indicator flashes a sell signal once again.

“Unleashing the Power of Words: Vietstock Weekly 16-20/12/2024: Navigating Through Hidden Risks”

The VN-Index stalled after three consecutive weeks of gains, with trading volumes remaining below the 20-week average. This reflects a cautious sentiment among investors. Currently, the index sits above the Middle Bollinger Band. If it can sustain this level in the upcoming sessions, the outlook may not be as pessimistic.