ACBS Securities has released a comprehensive overview of the banking sector’s outlook for 2025, highlighting several positive indicators. According to the report, the peak of non-performing loans appears to be over, and a decrease is expected in the coming year. Additionally, there has been a 5-basis point increase in NIM compared to the same period last year…

As of the end of November 2024, credit growth reached 11.9% year-to-date and 16.6% year-over-year, surpassing the average of 14.4% during the 2013–2024 period. ACBS forecasts a 15% credit growth for the entire banking sector in 2025, matching the 2024 target and outpacing nominal GDP growth (~10%).

This growth is mainly attributed to the expected continued economic recovery in 2025, with the government targeting a GDP growth rate of 6.5%-7% and striving for 7-7.5%. Additionally, public investment is set to increase significantly in 2025, with the government committed to boosting it, and an exceptional growth rate is anticipated during the 2026–2030 period. As the corporate bond market is not expected to recover soon, the role of bank credit channels will become more prominent.

As of the end of September 2024, market 1 deposit growth reached only 4.9% year-to-date, lower than the credit growth rate of 9% during the same period. This disparity is due to the negative difference in VND-USD interest rates at certain times, causing capital not to return to Vietnam and increasing liquidity pressure. However, the State Bank of Vietnam’s (SBV) interventions in the interbank market have helped maintain system liquidity stability.

Liquidity pressure is expected to ease in the coming periods as the Fed is likely to cut rates to 4.5% by the end of 2024 and further down to 3.5%-4.25% by the end of 2025. President Donald Trump’s import tax policy could slow down the process of reducing inflation to the 2% target, forcing the Fed to keep the dollar’s interest rates higher than expected.

However, with Vietnam’s increasing capital inflows from trade surplus, FDI, remittances, and the negligible difference between VND and USD interest rates, the latter of which will continue to decrease, there won’t be much pressure to increase VND deposit rates in 2025. It is predicted that the 1-year term deposit rate will remain stable at around 5% in 2025.

Additionally, the State Treasury’s deposits (currently, ~2/3 are deposited at the SBV) are ready to support state-owned banks (VCB, BID, CTG) whenever the system’s liquidity faces issues. As a result, state-owned banks will have more liquidity leeway to maintain competitive deposit rates compared to private banks.

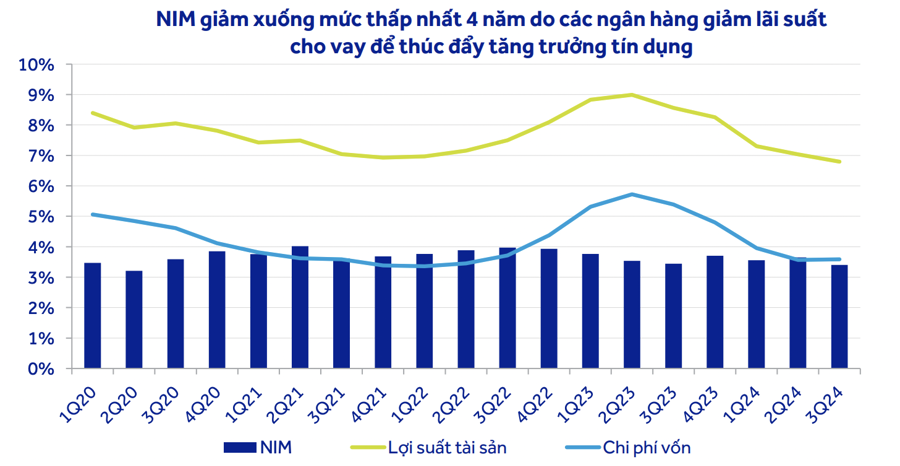

In Q3/24, the industry’s NIM decreased by 24 basis points (bps) from the previous quarter and by 4 basis points from the same period last year, reaching 3.4%. This decrease occurred as banks aggressively competed to boost credit growth. For 2025, with the expected gradual recovery of the real estate market and the government’s push for public investment, credit demand is expected to increase, supporting banks’ lending yields in the second half of 2025.

The NIM of banks in the analyzed portfolio increased by 5 basis points compared to the same period last year. There was a noticeable improvement in the CASA ratio, which helped reduce banks’ funding costs.

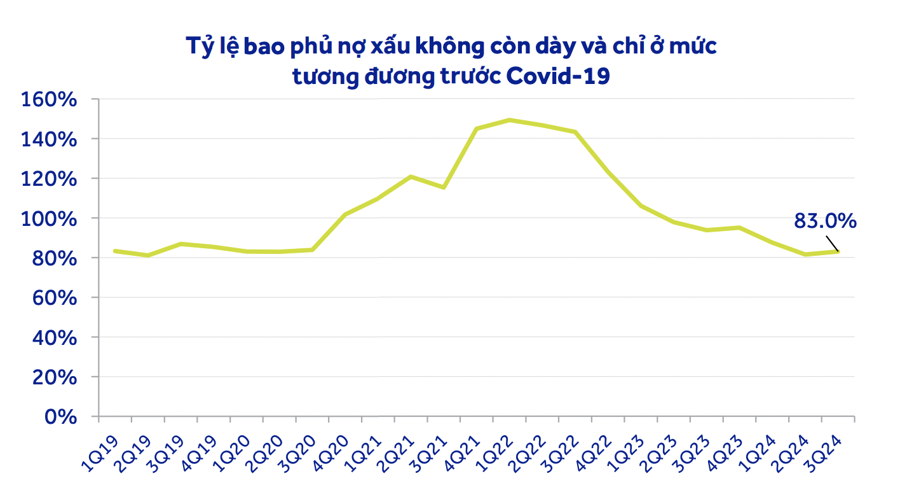

Regarding non-performing loans, although there was a slight increase for two consecutive quarters, there are indications that it has peaked and may improve in 2025. The ratio of loans past due (including restructured loans) showed a downward trend, reaching 0.23% of outstanding loans in Q3/24, lower than the historical average of ~0.5%/quarter.

Notably, Group 2 loans (an early warning sign of non-performing loans) decreased by 8 bps in Q3/24 and maintained a downward trend for two consecutive quarters due to the recovery of the retail customer group. Restructured loans under Circular No. 02/2023 also showed a decreasing trend, accounting for only about 0.8%. As mentioned, the average number of days to collect interest has also improved, indicating that potential non-performing loans are generally under control.

Overall, the most challenging period seems to be over, and the non-performing loan ratio for 2025 for banks in the analyzed portfolio is expected to decrease to 1.5% from 1.6% in 2024. However, relatively low loan loss provisions in 2023–24 will result in higher provisioning pressure in 2025.

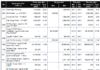

ACBS believes that the banking industry’s business results remain resilient, demonstrating improved resilience compared to the previous financial crisis in 2012–13. The pre-tax profit for 2025 is forecasted to grow by 14.9% year-over-year.

Total income is expected to grow by 15.3%, driven by high credit growth of 15.6%. Meanwhile, non-interest income is projected to grow more slowly at 8.5% as the banca segment is expected to continue facing challenges.

Banking sector stocks are currently trading at a P/B ratio of 1.5, which is equivalent to the historical median. However, it is important to note that the industry’s profitability and asset quality are significantly better than in most previous periods. Therefore, P/E is a more suitable valuation metric.

The banking sector’s current P/E is 9.5, which is almost one standard deviation lower than the historical median P/E of 11.5. Given the moderate but sustainable profit growth outlook (~15% in 2025), ACBS believes that the current price range is reasonable for long-term investment in banking sector stocks.

Nam A Bank – Leading the Pack: Ranked Among Vietnam’s Top 50 Most Efficient Businesses in 2024

Nam A Bank has been recognized as one of the Top 50 Most Effective Companies in Vietnam for 2024. The bank has excelled in meeting stringent criteria based on outstanding financial performance, efficient risk management practices, and consistent improvement in asset quality over the years.

Vice Governor of the State Bank of Vietnam Dao Minh Tu: 15% Credit Growth Target is Attainable

At the regular Government press conference for November 2024, held on the afternoon of December 7th, a representative from the State Bank of Vietnam (SBV) addressed queries regarding the feasibility of achieving a 15% credit growth target for the year 2024.