The past year has seen impressive growth across most asset markets in the US, fueled by investor optimism as the Federal Reserve embarked on an easing cycle in monetary policy.

As of December 6, the S&P 500, a broad measure of US stocks, had risen an impressive 28% year-to-date, consistently setting new records. Similarly, the bond and housing markets have also experienced robust growth. In some asset classes, the growth has outpaced the two-decade average, reflecting heightened risk appetite in certain sectors.

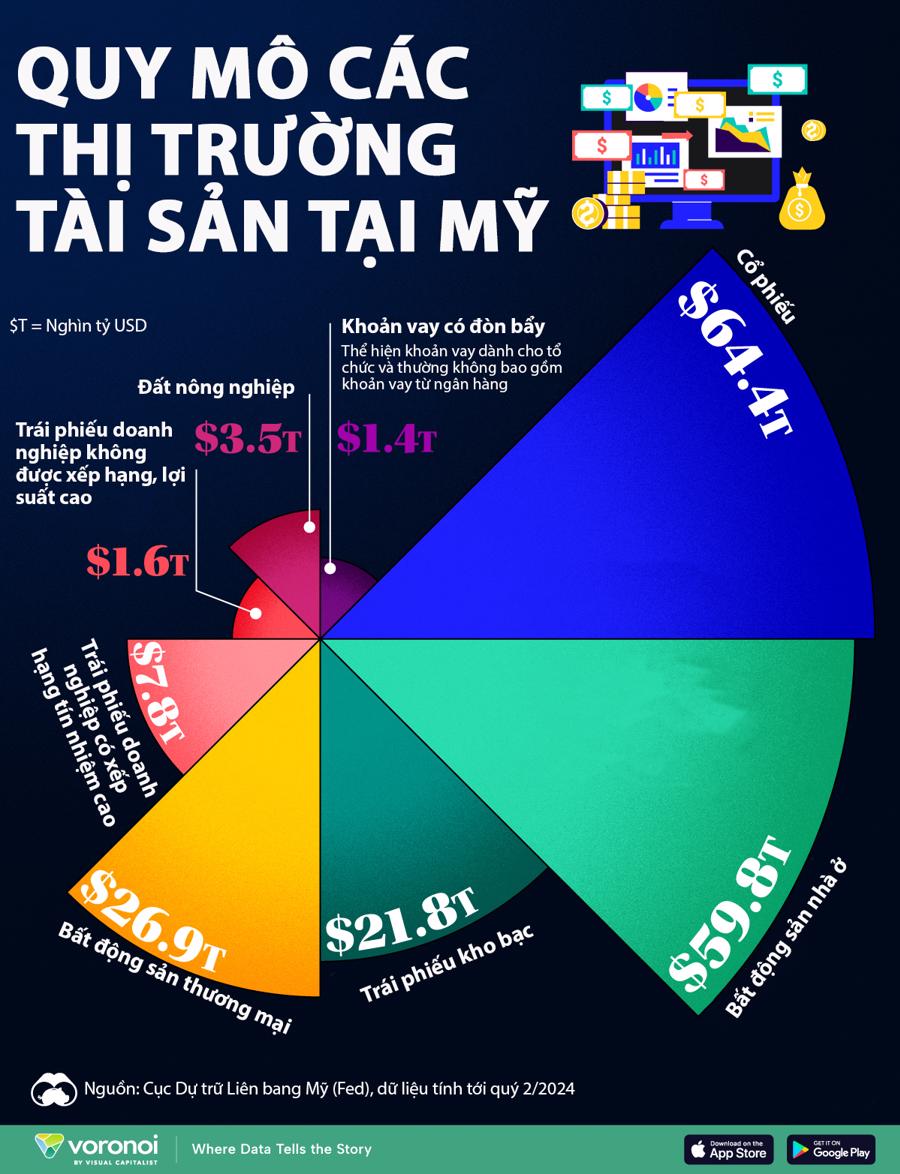

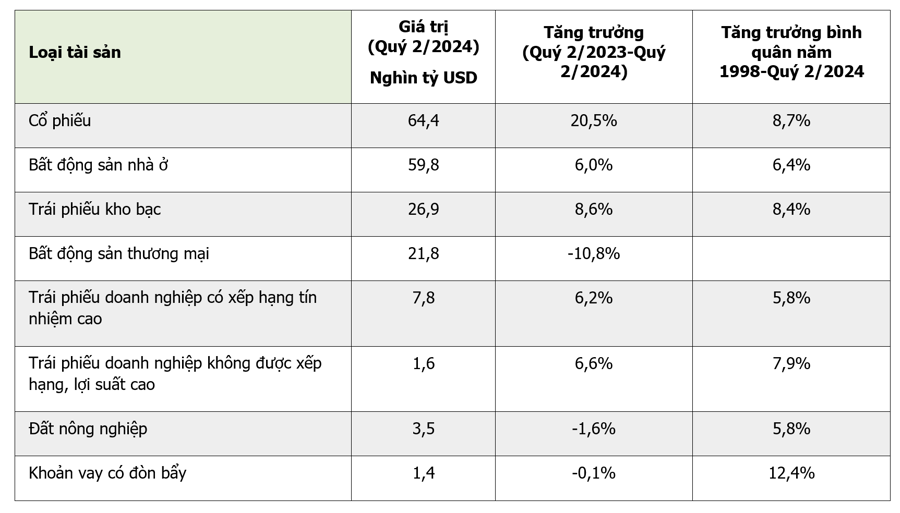

The infographics below depict the value of various asset classes in the US for the year 2024, based on data from the Fed.

The US stock market, with a total capitalization of $64.4 trillion, grew by 20.5% from Q2 2023 to Q2 2024, double the average annual growth since 1998. Similar to the past two years, large tech companies have often been the primary drivers of stock market growth. The price-to-earnings (P/E) ratio of the S&P 500 exceeded the average of 15.7 since 1989, climbing to 27.9 in Q2 2024.

In the housing market, asset valuations are nearing their peak from the mid-2000s. While nominal house prices continue to rise, the pace tends to be lower than the highs seen in 2022. Overall, the US housing market grew by 6% year-over-year as of Q2 2023, below the average since 1998. In contrast, the commercial real estate market contracted by 10.8% due to post-pandemic office vacancy pressures.

“Proposed Higher Interest Rates for Second and Subsequent Home Buyers”

In an effort to tighten lending policies for real estate speculators, the Vietnam Real Estate Brokers Association has proposed higher interest rates for those purchasing a second or subsequent home.

The Capital Conundrum: Hanoi’s Red-Hot Real Estate Market Amidst a Country-Wide Cold Snap

The Hanoi real estate market has witnessed an unprecedented surge in prices over the past decade, with apartment prices continuously setting new records and land auctions in the outskirts attracting throngs of participants, resulting in winning bids far exceeding the reserve price. This contrasts with the slower recovery observed in other regions, including Ho Chi Minh City. The question arises: Why is Hanoi’s market experiencing such a remarkable boom?