This week was packed with potential market-moving events, such as ETF rebalancing, derivative expiration on Thursday, and the final Fed meeting. However, the market seemed to be in a holding pattern, with subdued trading activity.

The VN-Index traded sideways throughout the session, briefly dipping more than 4 points in the afternoon before recovering to close slightly higher by 1.22 points at 1,263. The advance-decline ratio remained unfavorable, with 214 declining stocks outweighing 158 gainers. Banks, the backbone of the market, witnessed a mixed performance, with VCB trading flat while other heavyweights like CTG, TCB, MBB, and VPB retreated. BID stood out as a rare gainer, joined by smaller peers VIB, HDB, and STB.

On the other hand, two other large sectors, real estate and securities, edged higher. Real estate giant VHM led the advance, climbing 0.74%, while other residential and industrial real estate stocks, such as KDH, DXG, KBC, IDC, BCM, and SIP, also posted solid gains. Securities stocks shone, with SSI up 1.16%, VCI up 1.17%, VIX up 2.99% on expectations of ETF inflows, and PHS surging to its daily limit, contrasting with VND’s 0.38% decline.

Beyond these sectors, other sectors like telecommunications, information technology, transportation, and food & beverages also inched higher. Top performers that buoyed the market included BID, HVN, VNM, VHM, and FPT.

Market-wide liquidity on the three exchanges dipped to VND14 trillion. While today’s trading activity was lackluster, it reflected a temporary pause as investors awaited upcoming events. Notably, the VN-Index briefly dipped below the 1,260 support level during the session but managed to recover, indicating that buying interest remained robust enough to counter the mild selling pressure.

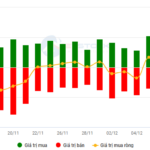

Foreign investors offloaded a net VND217.9 billion, with a net sell figure of VND151.8 billion in the matched bargain segment. Their net buys in the matched bargain segment were concentrated in the financial services and real estate sectors, primarily in SSI, HDB, SIP, VIX, KDH, VCI, KBC, HAH, VDS, and FRT.

On the other side, their net sells in the matched bargain segment were focused on basic materials. The top net-sold tickers included HPG, BID, DIG, MSN, CMG, VPB, PDR, MWG, and E1VFVN30.

Individual investors were net buyers to the tune of VND489.4 billion, with a net buy figure of VND161.6 billion in the matched bargain segment. In the matched bargain segment, they were net buyers in 16 out of 18 sectors, mainly in basic materials. Their top net buys included HPG, BID, MSN, MWG, DIG, CMG, VPB, MBB, PLX, and VRE.

On the other hand, their net sells in the matched bargain segment were focused on financial services and healthcare. The top net-sold tickers included SSI, HDB, VNM, VIX, KBC, VCI, FRT, VIB, and VPI.

Proprietary traders were net buyers, purchasing a net VND179.8 billion worth of stocks, with a net buy figure of VND158.5 billion in the matched bargain segment. In the matched bargain segment, they were net buyers in 6 out of 18 sectors, primarily in industrial goods & services and food & beverages. Their top net buys in the matched bargain segment included GEE, VNM, TCB, E1VFVN30, DPM, VHM, NLG, CTR, CTG, and EIB. Their top net sells were in the retail sector, with PNJ, HPG, MWG, VPB, HDB, VIC, STB, FRT, PVT, and MSN being offloaded.

Domestic institutions were net sellers, offloading a net VND464.4 billion worth of stocks, with a net sell figure of VND168.3 billion in the matched bargain segment. In the matched bargain segment, they were net sellers in 10 out of 18 sectors, primarily in industrial goods & services. Their top net sells included GEE, SIP, MBB, HAH, KDH, PLX, ACB, DCM, TPB, and GVR. Their net buys were focused on financial services. The top net-bought tickers were HPG, VIB, FUEVFVND, FRT, VTP, VCB, PVD, FPT, KBC, and DIG.

Negotiated trades surged 50.6% from the previous session to VND3,702.9 billion, accounting for 26.5% of the total trading value.

Notable negotiated trades occurred in EIB, with over 45.7 million shares worth VND895.3 billion changing hands between individual investors. Additionally, domestic institutions transacted 13.5 million VPB shares (VND270 billion) in negotiated deals.

Individual investors remained active in the banking sector (TCB, LPB, TPB, MSB, STB), large-cap stocks (FPT, VIC, VHM, HPG), and SIP.

In terms of sector allocation, money flow increased in real estate, securities, food & beverages, electrical equipment, water transport, and aviation, while it decreased in banking, construction, steel, chemicals, agricultural products, retail, and oil & gas production.

Specifically, in the matched bargain segment, money flow increased in mid-cap stocks (VNMID) while decreasing in large-cap (VN30) and small-cap (VNSML) stocks.

The Flow of Capital: A Week of Healthy Adjustments

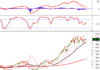

Although the VN-Index fell in 4 out of 5 trading sessions last week, experts do not consider this a cause for concern. In fact, a slowdown and a pullback are healthy signals for the market after the initial strong gains and the explosive session on December 5th.

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline, with a tug-of-war session accompanied by below-average trading volume. This cautious investor sentiment persists following the recent strong rally. Notably, the Stochastic Oscillator is now venturing deeper into overbought territory. Investors are advised to exercise caution in the coming days if the indicator flashes a sell signal once again.

“Unleashing the Power of Words: Vietstock Weekly 16-20/12/2024: Navigating Through Hidden Risks”

The VN-Index stalled after three consecutive weeks of gains, with trading volumes remaining below the 20-week average. This reflects a cautious sentiment among investors. Currently, the index sits above the Middle Bollinger Band. If it can sustain this level in the upcoming sessions, the outlook may not be as pessimistic.