On January 18, 2024, at the 5th Extraordinary Session, the National Assembly passed the Law on Credit Institutions (amended), consisting of XV Chapters with 210 Articles. The Law takes effect on July 1, 2024.

Prohibiting the sale of non-mandatory insurance with loans

Article 15, Clause 5 of the Law prohibits the act of “Credit institutions, branches of foreign banks, managers, executives, and employees of credit institutions and branches of foreign banks linking the sale of non-mandatory insurance products with the provision of banking products and services in any form.”

To align with the Law on Credit Institutions, the State Bank (SBV) is drafting Decree 88 on administrative sanctions in the monetary and banking fields. It stipulates a fine of VND 400-500 million if banks link non-mandatory insurance products with the provision of banking products and services in any form.

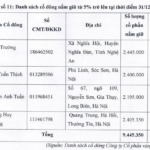

Banks must disclose information about shareholders owning 1% or more of the charter capital

Article 49 of the 2024 Law on Credit Institutions introduces new provisions on the obligations of shareholders of credit institutions to provide information. Shareholders owning 1% or more of the charter capital must disclose information and provide the credit institution with the following information: Full name; Individual identification number; Nationality, passport number, date of issue, and place of issue for foreign shareholders; Business registration certificate or equivalent legal documents for organizational shareholders; Date of issue and place of issue of these documents; Information about related persons; Number and proportion of shares owned by them in that credit institution; Number and proportion of shares owned by their related persons in that credit institution.

Credit institutions must post and keep the information of these shareholders at the head office of the credit institution and send a report to the SBV. Periodically, credit institutions must disclose this information to the General Meeting of Shareholders, Members’ Meeting, or Members’ Council of the credit institution.

In addition, credit institutions must publicly disclose the full name of individuals or names of organizations that are shareholders owning 1% or more of the charter capital and the number and proportion of shares owned by the shareholder and related persons on the credit institution’s website within seven working days from the date the credit institution receives the provided information.

Reducing the percentage of shareholding of shareholders in credit institutions

An organizational shareholder must not own shares exceeding 10% of the charter capital of a credit institution. Shareholders and their related persons must not own shares exceeding 15% of the charter capital of a credit institution. A major shareholder of a credit institution and its related persons must not own 5% or more of the charter capital of another credit institution.

For shareholders currently owning shares exceeding the new ratio, from the effective date of the 2024 Law on Credit Institutions, shareholders and their related persons owning shares exceeding the new shareholding ratio are allowed to continue holding the shares but must not increase their shareholding until they comply with the provisions on the shareholding ratio stipulated in the 2024 Law on Credit Institutions, except for receiving dividends in shares.

Early intervention for weak credit institutions

The Law adds a chapter dedicated to early intervention for credit institutions. The new provisions amend and supplement an additional case where early intervention must be implemented. At the same time, it sets out specific requirements and plans for credit institutions to apply during the intervention period. These regulations are expected to contribute to the stability of credit institutions’ operations and the restructuring of the credit institution system.

This is also a supportive tool for the SBV and related agencies and organizations in managing credit institutions and the financial market. However, agencies and ministries need to promptly issue guiding documents on this matter to implement these mechanisms and provisions in practice soon.

Gradually reducing the credit limit

According to Clause 1, Article 136 of the Law on Credit Institutions (amended), the total credit balance limit for a customer and related persons of that customer of commercial banks, cooperative banks, branches of foreign banks, people’s credit funds, and microfinance institutions will be gradually reduced from 23% of equity to 15%, effective from January 1, 2029 (including both credit and bonds). Specifically, the Law stipulates that from the effective date of this Law until before January 1, 2026, the total credit balance that commercial banks can extend to a customer is 14% of equity, and 23% of equity for a customer and related persons of that customer.

From January 1, 2026, to before January 1, 2027, the credit limit will be 13% of equity for a customer and 21% of equity for a customer and related persons of that customer. From January 1, 2027, to before January 1, 2028, the total credit balance that credit institutions can extend to a customer is 12% of equity and 19% of equity for a customer and related persons of that customer.

From January 1, 2028, to before January 1, 2029, the limit will be further reduced to 11% and 17%, respectively. From January 1, 2029, onwards, the limit will be 10% and 15%, respectively.

The credit limit for non-bank organizations has also been reduced compared to before. The total credit balance limit for a customer must not exceed 15% of the equity of non-bank credit institutions (previously 25%); for a customer and related persons, it must not exceed 25% of the equity of non-bank credit institutions (previously 50%).

Stay tuned for Part 2: Biometric Authentication and Security Compliance

Two Garment Companies Share “Dividend” Gifts at the Beginning of the Year

In the beginning of 2025, Textile Companies 7 and 29/3 allocated over 15 billion VND and nearly 8 billion VND respectively, to pay dividends to their shareholders.

The Ownership Structure Compliance Roadmap for Commercial Banks

The State Bank has issued Circular 52/2024/TT-NHNN, which directs commercial banks with shareholders, members, and related parties holding a higher percentage of shares than stipulated in Clause 55 of the Law on Credit Institutions No. 47/2010/QH12, amended and supplemented with certain provisions under Law No. 17/2017/QH14. The circular outlines a roadmap for these banks to align their ownership structures with the updated regulations set forth in the Law on Credit Institutions No. 32/2024/QH15.

The Expert’s View: Are Independent Board Members in Banks Just ‘Figureheads’?

Mr. Hieu remarked that independent board members at many banks are often mere figureheads collecting salaries and rubber-stamping the policies decided by the Chairman of the Board. He emphasized that these independent members should instead represent and voice the concerns of minority shareholders.

The Golden Exodus: A Mining Company’s Leadership Transition

Despite a challenging economic landscape, Vàng Lào Cai has persevered through difficult times. From 2020 onwards, the company experienced a hiatus in sales and service revenue, culminating in a challenging year in 2023, with a loss of nearly 14 billion VND. As of the end of 2023, the cumulative loss exceeded 113 billion VND.