Trump’s second term witnessed a significant shift in economic policies, particularly prioritizing domestic interests. The “America First” policy led to a re-evaluation of international agreements, including Basel III – the global standard for capital and bank risk. Designed to strengthen banks’ resilience to economic shocks, the delay in its implementation in the US sparked mixed reactions. While US banks benefited from flexibility in capital requirements, the inconsistency among countries adopting Basel III heightened systemic risks at the global level. Will this approach strengthen America’s power, or will it compromise global financial stability?

Basel III emerged as an inevitable response following the 2008 global financial crisis to prevent similar risks in the future. However, Trump’s second term highlighted the challenges in implementing these standards in the US, creating a polarized landscape among nations. While many European countries strongly promoted the implementation of Basel III, the US opted for a more gradual approach, citing the protection of domestic banks’ competitiveness. This not only affected US banks but also had a spillover effect on the global market, including Vietnam.

History and Role of the Basel Accords

Basel III is the next step after Basel I and II, developed to address the weaknesses exposed during the 2008 financial crisis. Basel I, introduced in 1988, focused on setting minimum capital requirements for banks. Basel II, in 2004, expanded on the concepts of credit and operational risk. However, neither was sufficient to prevent the crisis, making Basel III a necessary reform. Basel III requires banks to maintain higher minimum capital ratios, improve liquidity, and curb the use of financial leverage. This is expected to minimize systemic risk, but implementation has proved challenging, especially in the US. American banks argue that the high compliance costs will reduce their competitiveness, leading to implementation delays.

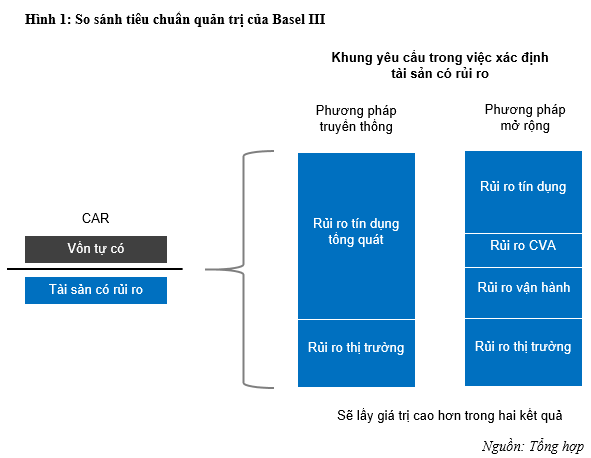

The calculation method for risk-weighted assets (RWA) under Basel III, especially when using the expanded risk-based approach, requires banks to maintain significantly higher capital levels than before. Basel III broadens the scope of risk assessment to include not only credit and market risk but also operational risk and credit valuation adjustment (CVA) risk. This forces banks to increase their capital reserves, especially Tier 1 capital, to ensure resilience against financial fluctuations. Compared to Basel II, the requirement for Tier 1 capital has increased from 4% to 6%. This requirement alone has made it challenging for many domestic banks to comply, particularly large-scale banks such as Vietcombank, Vietinbank, and BIDV.

Moreover, the regulations mandate the use of the approach that results in higher RWA between the standardized and expanded approaches, ensuring that banks cannot reduce their capital requirements by choosing the simpler method. This impact is particularly pronounced for large banks, as they must meet stricter standards, implying the need to raise additional capital or restructure their portfolios to comply.

Basel III enhances banks’ resilience to financial shocks. For example, during the COVID-19 crisis, banks in Europe demonstrated better stability due to the implementation of Basel III. The higher minimum capital quality requirements and liquidity buffers helped banks maintain operations during difficult times. However, Basel III also poses challenges for small and medium-sized banks, as the demand for increased capital can exert significant pressure, especially when facing competition from larger banks. Balancing risk and profit becomes a delicate equation, requiring flexible management strategies.

Trump’s reelection slowed down the adoption of Basel III in the US, citing the protection of domestic interests. This decision created a loophole in the global financial system, as US banks were exempt from some stringent requirements. It increased inequality among countries and put pressure on banks in developing markets. Western countries are also considering whether to halt the implementation of Basel III as they believe that the US delay could put European banks at a competitive disadvantage.

Impact of Trump’s Second Term on the US

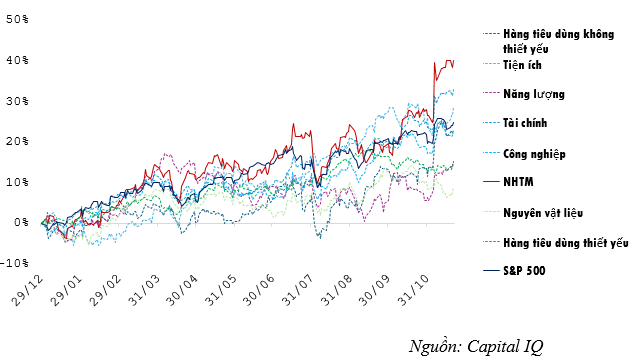

The delay in implementing Basel III gave US banks more flexibility to grow their credit portfolios. The US stock market reacted very positively to Trump’s reelection, especially in the banking sector. Banking stocks soared more than 10% immediately after Trump’s victory, and the outlook for regulatory easing became brighter than ever. The profitability of banking stocks in 2024 was exceptionally high compared to other sectors in the US market.

|

Figure 2: Sector Profitability in the US in 2024

|

The US banking stock market in 2024 witnessed a strong divergence. Large banks recorded stock increases of more than 15%, taking advantage of the flexible policy environment. In contrast, smaller banks, such as regional banks, faced pressure on their stock prices due to their inability to compete for capital. This clearly reflects the impact of the discord in the implementation of Basel III in the US. The US became a more attractive destination for investors with the delay of Basel III. However, this flexibility also made the US financial market susceptible to bubble risks, as banks rapidly expanded credit without sufficient capital buffers.

Impact of US Policies on Vietnam

Vietnamese banks are gradually implementing Basel III after most banks completed Basel II as per the guidelines of Circular 41/2016/NHNN. This has improved risk management capabilities and increased confidence among international investors. However, the US delay could make it challenging for Vietnamese banks to access international capital due to mismatched standards.

The Basel III delay in the US presents opportunities for Vietnam as international investors seek diversification. For example, FDI inflows into Vietnam’s banking sector increased by 8% in the first half of 2024. However, to seize these opportunities, Vietnamese banks need to enhance their governance and transparency. The Vietnamese banking system faces a dilemma, as it must meet the requirements of Basel III while competing with international banks. The delay in Basel III implementation in the US creates a standards gap, requiring domestic banks to strengthen their capabilities to maintain competitiveness and attract investment.

Under Trump’s second term, regulatory relaxation brings both opportunities and challenges. Reduced oversight and adjustments to Basel III could spur faster growth but also carry long-term risks to financial stability. The delay in implementing Basel III in the US presents opportunities and risks to other countries, including Vietnam. To adapt to these changes, Vietnam needs to continue implementing Basel III rigorously, enhance risk management capabilities, and increase the attraction of international investment. This is the only way to ensure stability and sustainability in the current volatile macroeconomic environment.