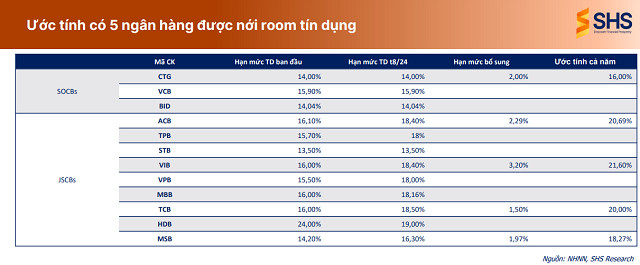

The latest report on the banking sector for Q3 2024, released by Saigon-Hanoi Securities (SHS) on December 9, 2024, estimates that five banks are eligible for additional credit limits. These include VietinBank (CTG), ACB, VIB, Techcombank (TCB), and MSB.

SHS estimates that VIB will receive the highest supplementary limit at 3.2%, raising its total credit limit for 2024 to 21.6%, a significant increase from the initial 5.6%.

SHS assesses that the additional credit room will enable these banks to expand their business operations, especially considering the typically high credit demand during the year-end period.

At the regular Government press conference for November 2024, held on December 7, NHNN Deputy Governor Dao Minh Tu shared that as of November 29, credit growth for the entire economy was approximately 11.9%. However, by December 7, this growth had reached 12.5% year-to-date, a positive development compared to the same period last year (9% as of the same date in 2023).

With these results, the total outstanding loans for the entire economy stand at around VND 15,300 trillion, while capital mobilization has reached approximately VND 14,800 trillion, up 7.36% from the beginning of the year.

Regarding the reasons for the recent rapid credit growth, the NHNN leadership attributed it to the favorable conditions in the economy, including strong export growth and the recovery of businesses to pre-COVID-19 levels. The vibrant economy has encouraged enterprises to invest and borrow, thereby increasing the economy’s capital absorption capacity.

Additionally, credit growth has been supported by the Government’s synchronized and resolute policies and the NHNN’s management measures. The central bank set a 15% growth target for the year and allocated the entire growth limit to banks at the beginning of the year, allowing commercial banks to proactively allocate credit based on the economy’s capital needs and their own capital mobilization capabilities.

The harmonious management of interest rates has also played a role, with lending rates dropping by 0.96% since the beginning of the year. This has helped businesses reduce input costs and become more active in borrowing for investment and business activities.

Emphasizing the importance of managing risks, the NHNN leadership stated, “While we continue to tightly control credit in the real estate and securities sectors, it is crucial to facilitate these fields. This is also one of our goals to boost credit growth and support economic recovery.”

According to Deputy Governor Dao Minh Tu, with the current credit growth rate and the typically active disbursement period at the end of the year, the 15% credit growth target for 2024 is within reach.

Khang Di

“Vietnam, Always Welcome in Cuba: A Business Haven”

At the Palace of the Revolution in Havana, Cuban President Miguel Díaz-Canel expressed a warm welcome and reaffirmed his country’s commitment to facilitating Vietnamese investors doing business in Cuba.

The New City: A Visionary Masterplan by Taseco Land in Quang Binh

On December 11, 2024, the People’s Committee of Quang Binh Province approved the task of detailed planning at a ratio of 1/500 for the new urban area of Luong Ninh, Quang Ninh district.