This was the insight shared by Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities Joint Stock Company (VPBankS), during the Matching Orders program on December 17, 2024, with the theme Outlook for the Securities Market in 2025.

Mr. Duong assessed that the nature of securities companies’ operations has changed significantly compared to three years ago. Before 2021, profits almost paralleled the market liquidity and the movement of the VN-Index, stemming primarily from two sources: brokerage fees and proprietary trading. This meant that if a company invested extensively in stocks, its profits would fluctuate with the market.

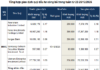

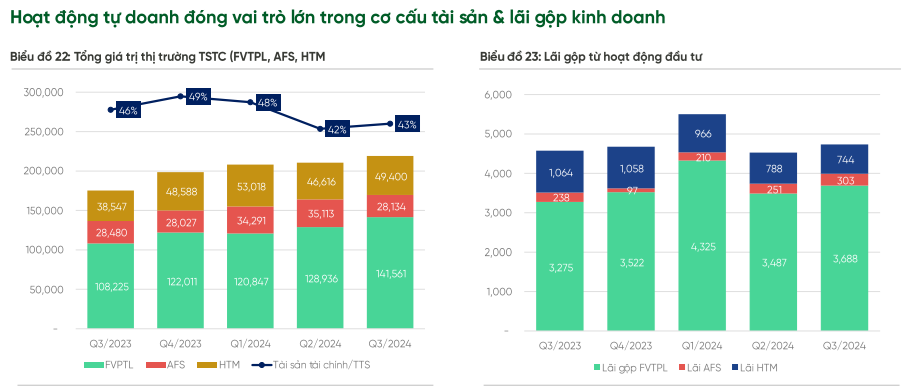

In the subsequent period, market participants witnessed a substantial increase in scale, and profit composition shifted away from brokerage. Instead, it comprised margin lending, dividends, and interest income from financial assets. Among these, dividends and interest income from financial assets originated from investments with a fixed income nature, such as deposit certificates, government bonds, and corporate bonds, rather than volatile short-term equity investments.

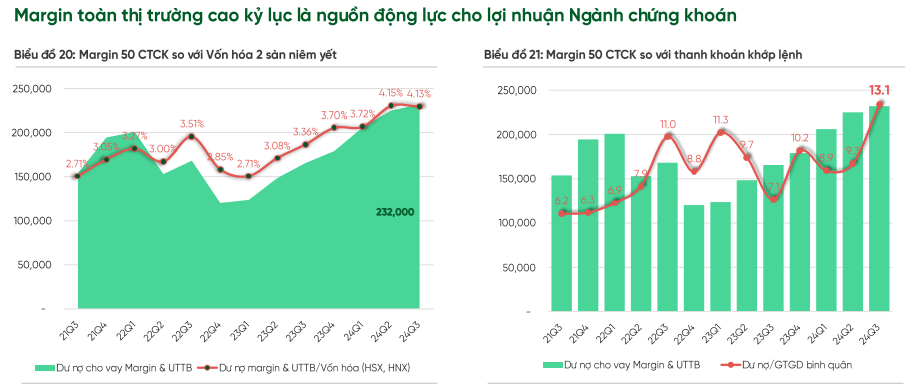

According to Mr. Duong, the stable profits of securities companies will depend on margin and the scale of financial assets of listed companies in the market.

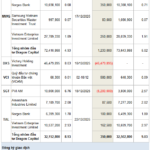

The margin composition varies among companies. Those with a large retail brokerage market share, such as VPSS, VND, HCM, and MBS, tend to experience margin fluctuations in tandem with market demand, making them more susceptible to significant volatility.

For companies that balance brokerage services and margin provision for individual and institutional clients, several have already reached the legal limit (twice the owner’s equity), including MBS and HCM. Lastly, those backed by a parent bank or with a large scale, such as TCBS and SSI, have also reached their limits.

Mr. Duong assessed that while the margin market may fluctuate, it is expected to remain stable above VND 200 trillion in 2025, providing a stable profit foundation for securities companies.

Source: VPBankS

|

Regarding the difference in financial asset values, investments in assets with fixed income are significantly influenced by interest rates. Given the projection of stable interest rates in 2025, this also contributes to steady revenue.

Source: VPBankS

|

The remaining factors that can drive profit breakthroughs are brokerage fees, stock investments, and other services like IB and underwriting if the market recovers in 2025.

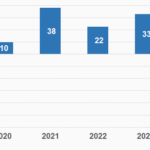

It is projected that by the end of 2024, the securities industry’s post-tax profit will reach VND 23,081 billion, a 36% increase compared to the same period in 2023. Looking ahead to 2025, VPBankS forecasts a post-tax profit of VND 26,588 billion, representing a 15% increase compared to the projected figure for 2024.

The Genesis Fund Alum Becomes SmartMind Securities CEO

The SmartMind Securities Joint Stock Company (SMDS) announces a resolution to relieve the incumbent Chief Executive Officer of their duties and appoint a successor.

The Foreign Securities Firm on the Verge of a Thousand Billion Capital Increase

On December 6, the Ministry of Finance granted a certificate of registration for public offering of shares to Guotai Junan Securities Joint Stock Company (Vietnam) (HNX: IVS). The offering entails the issuance of 69.35 million new shares, maintaining a 1:1 ratio, thus increasing the company’s capital to VND 1,387 billion.

HSC Securities Approves Plan to Increase Charter Capital by VND 3.6 Trillion

On December 4, 2024, Ho Chi Minh City Securities Corporation (HSC) successfully held an Extraordinary General Meeting of Shareholders to approve a plan to issue shares to existing shareholders to raise its charter capital by VND 3,600 billion.

PNJ Endorses a 500 Billion VND Loan

PNJ Joint Stock Company, a leading manufacturer and trader of fine jewelry in Vietnam, announced that it has guaranteed loans totaling VND 400 billion for its subsidiaries, PNJ Jewelry Manufacturing and Trading Company Limited and CAO Fashion Company Limited. The loans, amounting to VND 400 billion and VND 100 billion, respectively, will be utilized to bolster working capital and facilitate the issuance of letters of credit for the companies’ operations.