In a survey of approximately 620 real estate agents, Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, revealed that 30% of agents believed that imposing additional taxes would lead to an increase in property prices. An overwhelming 51% agreed that while prices might rise, it would also curb property speculation. This brings the total to 81% of respondents who foresee a potential price hike with the introduction of new taxes.

What are the common types of real estate taxes in Vietnam?

The Vietnamese real estate market currently imposes taxes such as personal income tax, property ownership tax, registration tax, and capital gains tax. There are also two other types of taxes found in other countries that Vietnam has not yet adopted: vacancy tax (for unoccupied properties) and development tax.

Among these, the property ownership tax is calculated based on the value of the asset and is paid annually. In Vietnam, the typical rate ranges from 0.03% to 0.15%, similar to Thailand’s 0.3%. However, countries like Singapore have a much higher rate of 16%, while the US varies between 10-20% depending on the state, and China stands at 1.2%.

The personal income tax (PIT) is considered to have a significant impact on the market. In Vietnam, a 5% revenue tax is levied on property rentals (above VND 100 million per year), and a 2% asset value tax is applied when selling property. In comparison, China has much higher rates of 32% and 60%, Thailand charges 24.5% and 35%, the US has a 37% rate, while Singapore maintains a relatively lower rate of 15% for rentals…

Mr. Quoc Anh highlighted that the global principle for taxation is based on the length of ownership. In Europe, for instance, 93% of real estate assets are held for 3 to 10 years or longer. However, in Vietnam, a staggering 86% of properties are held for less than a year, contributing to the perception of a speculative market. Therefore, following the European model, the longer the holding period, the lower the tax rate would be.

For example, in Japan, if you hold a property for more than 5 years, the capital gains tax when selling is around 20%. However, if you sell within 5 years of purchase, the tax nearly doubles to 39.6%. Vietnam is expected to adopt a similar approach in the future, emphasizing the importance of long-term asset holding and its influence on personal income tax rates.

Next is the registration tax, which is applied when transferring ownership and is usually calculated based on the transaction value or the asset’s value. In Vietnam, the registration tax is set at 0.5% of the property value. Some countries differentiate between the first, second, and subsequent properties. Singapore, for instance, imposes a registration tax (on the buyer) ranging from 1% to 6% for the first property and increases it to 5% to 35% for the second and subsequent properties. In the UK, the registration tax for the first home is between 0% and 12%, while the second home and additional properties are taxed at 5% to 17%.

As a result, the total tax-related costs in some countries can reach up to 20-40% of the property transaction value.

Illustrative image.

|

International Differences

Mr. Quoc Anh mentioned that Vietnam is considering implementing a vacancy tax, which is applied to properties that are unoccupied or left vacant for extended periods. This type of tax is intended to encourage efficient use of assets, optimize land resources, and discourage speculation. Singapore has a vacancy tax ranging from 10% to 20% of the property value, while France imposes a tax of 17% to 34% of the rent depending on the area. In the UK, a 100% tax is levied if a property is left vacant for 2 years, 200% for over 5 years, and 300% for more than 10 years. Generally, the vacancy tax rate in other countries falls between 8% and 16%. Vietnam currently lacks data on vacant property rates, but experts believe it to be considerably high.

Lastly, the development tax, already in place in some countries, is levied on real estate to fund infrastructure, utilities, services, and social welfare in the area where the property is located. This tax aims to balance social interests within a nation by utilizing the development of real estate. In the US, for instance, a 1% asset value tax is imposed on new civil projects exceeding 15,000 USD, with the tax funds allocated to infrastructure, schools, hospitals, power stations, water supply, etc. France also has a development tax of 17.2%, but it decreases if the property is held for a longer period: 15.55% for 6-21 years, 13.95% for 22 years, 4.95% for 22-30 years, and properties held for over 30 years are exempt from this tax. The funds from this tax in France are directed towards security, health insurance, and social security.

According to experts, given the emerging nature of the Vietnamese market, implementing all these taxes at once may not be feasible. Additionally, the law of supply and demand must be considered, as taxes could simply be passed from one buyer to another, resulting in continued price increases. Furthermore, accurate property valuation is essential to ensure fair taxation and social equity. Lastly, taxes should be categorized based on the purpose of the property use. Mr. Quoc Anh concluded that taxation is a complex equation that requires careful consideration to determine the most efficient investment strategies, rather than simply reacting to tax rates after a purchase.

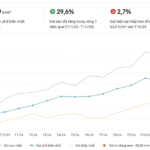

The Soaring Cost of Housing: A Couple’s 20-Year Sacrifice for a Home of Their Own.

While some essentials remain unchanged, a couple’s 20-year frugal journey highlights the stark reality of skyrocketing property prices.

The cost of real estate, gold, and even a bowl of pho has skyrocketed over the last two decades. In stark contrast, prices for some electronic goods, appliances, and air conditioners have remained stagnant.

Why Aren’t Buyers Willing to Invest in Real Estate?

“Housing prices are a significant barrier for prospective homeowners, despite the increasing demand for housing and favorable loan interest rates.” said Dr. Can Van Luc, Member of the Monetary and Financial Policy Advisory Council.