Attracting Savings Deposits

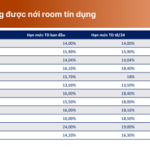

In November, 16 commercial banks adjusted their savings interest rates upwards by 0.1%-0.7% per year, including banks like Agribank, Techcombank, and MB. In the first two weeks of December, an additional 10 commercial banks followed suit, increasing their savings rates by 0.1%-0.25% compared to the previous month. Currently, the highest 12-month term deposit rate in the market stands at 6.4% per annum.

However, financial and banking experts opined that, given the State Bank of Vietnam’s (SBV) directive for credit institutions to maintain stable and reasonable deposit interest rates, in line with their capital balance and healthy credit expansion capabilities, a wave of interest rate hikes is unlikely. Moreover, Circular 48/2024/TT-NHNN, which took effect on November 20, 2024, clearly stipulates that credit institutions must not offer any form of promotion when accepting VND deposits and must publicly display interest rates, thereby ensuring transparency and contributing to interest rate stability.

Explaining the recent rise in savings rates, Dr. Nguyen Huu Huan, a lecturer at the University of Economics Ho Chi Minh City, attributed it to the recovery of credit growth in the last months of the year, which has somewhat put pressure on the system’s liquidity, leading to an increase in input interest rates. According to the latest data from the SBV, as of December 13, credit growth for the entire economy had reached approximately 12.5% compared to the end of 2023, a significant increase from the same period last year, which stood at only 9%.

“Typically, in the last months of the year, commercial banks tend to raise deposit rates to attract capital for the peak production and business season, as well as to meet the consumption and shopping needs of the people during the Lunar New Year holiday,” Dr. Huan said. “The deposit interest rate floor will likely increase by 0.5%-1% in the last month of the year, but this is only seasonal and will stabilize again in early 2025,” he predicted.

Analysts from VCBS also believe that the upward trend in deposit rates is unlikely to continue but will become more polarized. State-owned commercial banks may slightly lower their rates by the end of the year to support the economy, while private commercial banks, especially smaller-scale ones, will face pressure to increase deposit rates to meet their credit growth and liquidity needs. This is especially true given the SBV’s recent decision to raise the 2024 credit growth limit for some commercial banks.

Focusing on Disbursement and Business Support

With the increase in savings deposit rates, many businesses worry that lending rates will also inch upwards. However, committed to supporting economic growth and meeting the rising production and holiday shopping demands, many banks have not considered raising lending rates. A leader of a commercial bank in Ho Chi Minh City shared that while input interest rates had increased in the last months of the year, lending rates remained unchanged, significantly impacting the bank’s net interest margin (NIM) in the third quarter. “Despite the upward trend in deposit rates over the past two months, the bank remains focused on actively disbursing support packages to promote growth,” the leader said.

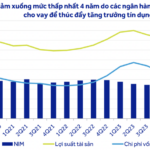

The third-quarter financial reports of listed commercial banks showed a decline in industry-wide profits compared to the previous quarter, mainly due to a narrowing NIM, which fell by nearly 0.2%. During this period, while deposit rates inched up, lending rates remained unchanged. According to MBS Securities Company, 12 out of 24 listed commercial banks reported a decrease in NIM during the first nine months of the year, mainly due to reduced capital costs, as high-interest-rate deposits from the beginning of 2023 matured, and lending rates trended downward.

Mr. Tran Hoai Nam, Deputy General Director of HDBank, said that although deposit rates had increased slightly, they remained at a very low level overall. Moreover, with the downward trend in interest rates set by the US Federal Reserve (Fed), banks’ capital sources are being supported by foreign capital inflows, helping to stabilize capital costs. “With GDP growth of about 7% and the current inflation rate, lending rates are very supportive of businesses,” said Mr. Tran Hoai Nam.

Meanwhile, to have the resources to reduce lending rates and support businesses and individuals, Agribank has implemented a series of cost-cutting solutions. “Since the beginning of the year, Agribank has reduced lending rates four times by 1%-2.5% per year, a more significant reduction than the decline in deposit rates. As of November 30, Agribank’s average lending rate has decreased by approximately 1.5% compared to the beginning of the year, a deeper cut than the average reduction across the entire banking system, which stands at 0.96%,” a leader of Agribank shared. “Currently, Agribank’s lending rates range from 5% per annum for short-term loans to 7% per annum for medium and long-term loans.”

From a financial expert’s perspective, Dr. Can Van Luc, Chief Economist at BIDV, assessed that, despite the increase in deposit rates, lending rates have remained positive and even decreased by about 1 percentage point compared to the beginning of the year. These positive factors are supporting businesses’ operations and economic growth.

Mr. Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam, Ho Chi Minh City Branch, also shared that credit growth in the city had reached 12.5% in the first eleven months compared to the same period last year, and is expected to achieve double-digit growth by the end of 2025 as planned. “In addition to the capital needs for production and business and the year-end and Lunar New Year holiday shopping, low lending rates also encourage businesses and households to borrow, and credit institutions to disburse preferential credit packages. In the remaining months of the year, credit will continue to play its role in supporting businesses and promoting economic growth,” Mr. Lenh said.

What Will the Vietnamese Stock Market Look Like in 2025?

The Vietnamese stock market is projected to witness an impressive average liquidity of over 23 trillion VND per session in 2025. Amidst this vibrant liquidity, the VnIndex soared to its highest point, surpassing 1,400 marks, while fluctuating around the 1,341 mark throughout the year.

What are the 5 banks that have received a second credit limit increase?

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.

The Future of Banking: A Brighter Outlook with Declining NPA’s and 15% Profit Growth

The banking sector’s financial performance remains robust, indicating a much stronger resilience compared to the previous financial crisis of 2012-2013. The industry’s pre-tax profit forecast for 2025 projects a growth of 14.9% year-over-year, showcasing a healthy and stable outlook.