As the year-end approaches, banks are stepping up as strategic partners, offering flexible financial solutions to help businesses optimize costs and focus on growth.

Cost Challenges in Year-End Business

The pre-Tet period is a bustling shopping season, especially for consumer goods, gifts, food, and decorations. This surge in production and consumption leads to increased prices of raw materials, affecting production costs and product prices. This is further compounded by the impact of Storm No. 3 (Yagi), which caused damage to the assets and business operations of many enterprises.

“Besides racing to raise capital for production recovery after natural disasters, our company also has to carefully recalculate our production and business plans for this period to ensure cost efficiency and stimulate consumer spending,” said Mr. V.T.T., a representative of a candy and confectionery import and manufacturing company in Hanoi.

In addition to capital planning for production activities, this is also the peak period for businesses to pay year-end bonuses, overtime pay, and welfare benefits to their employees, as well as expenses for internal festivals and events. As a result, business owners face the challenge of effectively managing their finances to both reward their employees’ contributions and ensure sufficient working capital for production and operations.

Banks Join Hands with Businesses to Optimize Costs

Understanding the difficulties businesses face during this critical year-end period, banks have been introducing attractive loan packages with preferential interest rates and promotional programs to support businesses in preparing resources and stabilizing costs for accelerated growth.

For instance, to support customers in resuming their production and business activities after the storms, Sacombank has implemented several initiatives, including reducing interest rates by up to 2%/year on existing loans, launching a VND 10,000 billion package with a minimum interest rate of 4% for new loans, and offering up to 50% discounts on service fees with waived prepayment penalties for all loans.

Recently, Sacombank introduced an additional short-term credit package of VND 30,000 billion to help businesses boost their production and business activities and stimulate the economy in the fourth quarter of 2024, with preferential interest rates starting from just 4.5%.

Furthermore, Sacombank is currently running a promotional program called “Vươn tầm ưu đãi – Sải bước thành công” for corporate customers from now until December 31, 2024. Specifically, new corporate customers and those resuming transactions during the program period will enjoy six consecutive months of free Business-Plus account package fees for nine types of fees.

For new corporate customers or those who have temporarily discontinued using the salary payment service, Sacombank offers three years of free salary payment fees, along with a range of benefits for business owners and employees. Additionally, they provide a waiver of the first-year annual fee for all new corporate cards and a free preferred account number when opening a payment account.

In celebration of its 33rd anniversary, Sacombank is also offering nearly 1,500 business class tickets on Bamboo Airways to VIP corporate customers throughout December 2024, providing a comfortable, convenient, and luxurious travel experience during the festive season. Moreover, 330 corporate customers will receive a premium business bag when opening a new Sacombank business card (including payment and credit cards) and reaching the minimum eligible transaction turnover earliest. The top 33 customers with the highest payment card transaction turnover (minimum of VND 33 million) during the program will receive a 1-tael SBJ gold coin as a gift.

“The Bank: Your Partner in Business for a Successful Year-End Sprint.”

The year-end festive season and the start of a new year is a golden opportunity for businesses to boost their revenue. However, it is also a challenging period with increased cost pressures, including rising raw material prices, fluctuating rental and warehouse costs, and employee salaries and bonuses. In this context, banks act as strategic partners, offering flexible financial solutions to help businesses optimize their expenses and focus on their growth objectives.

“Eximbank Launches Exclusive Credit Package for Import-Export Businesses”

Eximbank has just launched an exceptional credit promotion program tailored for import-export businesses, featuring an attractive interest rate starting from 3.7% per year and a range of service fee waivers. This program is specially designed for SMEs and customers who have not previously had a credit relationship with Eximbank.

The Stock Market “Legend” Fined Over $200,000 in Tax Evasion with Aggravating Circumstances.

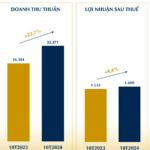

As of the first half of 2024, the company reported a profit of over 350 billion VND. A remarkable achievement, this success story is a testament to the company’s thriving business and bright future ahead.