Illustrative image

With Agribank, Director General Pham Toan Vuong said that in 2024, Agribank will achieve the highest business results after 4 years of implementing the Restructuring Plan. Specifically, total assets increased by 7%, capital sources increased by over 6%, outstanding loans increased by 11%, bad debt ratio was below 1.6%, and pre-tax profit increased by 8%. In the period of 2021-2024, the basic indicators ensured progress, of which some indicators exceeded the targets set out in the Plan (total assets, capital sources, outstanding loans, debt collection after handling, and profit).

By November 30, 2024, Agribank had restructured the repayment period and maintained the debt group of over VND 55,000 billion for 7,300 customers. Especially, right after Storm No. 3 and the floods caused heavy losses of lives and property, Agribank immediately reduced the lending interest rate from 0.5% to 2% per year and waived or reduced 100% of overdue interest and late payment interest during the period from September 6, 2024, to December 31, 2024, for existing debt; reduced the interest rate by 0.5% per year for new loans arising from September 6, 2024, to the end of 2024 to help customers stabilize their lives and restore production and business. As of November 30, 2024, the outstanding balance with supported interest rates was more than VND 39,000 billion with 25,000 customers.

At the conference, Mr. Phan Duc Tu, Chairman of the Board of Directors of BIDV said that by the end of 2024, the bank is expected to fully and synchronously complete the targets and indicators assigned by the SBV and the General Meeting of Shareholders. Accordingly, the total asset scale will exceed the threshold of VND 2.6 million billion; credit balance reaches nearly VND 2 million billion, growing by about 14%, credit capital focuses on priority fields and growth drivers as directed by the Government and the SBV.

Mr. Nguyen Thanh Tung, Chairman of the Board of Directors of Vietcombank informed that up to now, the bank has basically completed the targets and plans assigned by the SBV and the General Meeting of Shareholders. Specifically, by the end of 2024, credit growth is expected to reach 13% with a scale of over VND 1.4 million billion, total assets reach nearly VND 2 million billion, bad debt ratio is controlled below 1%…

According to Mr. Tung, in 2024, Vietcombank synchronously implemented many solutions to support the economy, unblock capital, and promote production and business activities…

At VietinBank, Mr. Tran Minh Binh, Chairman of the Board of Directors of the bank, said that by the end of November 2024, the bank’s total assets are estimated at over VND 2.3 million billion, up 14.7% over the same period in 2023; credit growth of 14.2% over the same period in 2023 (as of December 10, up 14.8%); capital mobilization reached nearly VND 1.7 million billion, up 11.3% over the end of 2023; bad debt ratio was controlled at 1.1%. The ratio of bad debt coverage continues to be maintained at a high level.

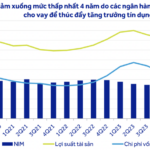

Low-Interest Rates to Support Production and Holiday Shopping

With the Lunar New Year fast approaching, businesses are bustling with production and inventory preparations to meet the surge in year-end shopping demands. The current low-interest rates offered by lending institutions are expected to further stimulate consumer spending during this peak shopping season.

“BIDV Unveils Electronic Customer Authentication via VNeID”

Hanoi, December 2nd, 2024 – Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) and the Research and Application Center for Population Data and Civil Status (Center for RAR) under the Ministry of Public Security, have signed an agreement to implement electronic customer authentication services through VNeID on the BIDV SmartBanking application.

What are the 5 banks that have received a second credit limit increase?

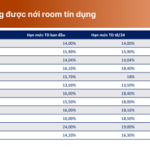

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.