The real estate market is gradually recovering with many projects underway. (Photo: Tuan Anh/VNA)

|

“The significant changes in 2024 regarding policies, investment trends, and business context form a basis for us to maintain an optimistic outlook on the Vietnamese real estate market. Therefore, when positive signals become more apparent, it’s time to restart capital flow into transactions and be ready to embrace the new growth cycle.”

This is the assessment of David Jackson, General Director of Avison Young Vietnam, while analyzing the main trends of the Vietnamese real estate market in 2024 and prospects for 2025.

Residential segment on the rebound

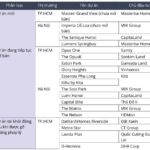

In 2024, the residential market progressed more positively than the previous year. The supply of new apartments emerged in the second half of the year, mostly in the luxury segment.

In Ho Chi Minh City, most new projects approached the luxury segment and above, with prices ranging from 72 to 142 million VND per square meter. Re-launched projects also announced new, higher prices.

Commercial buildings for office and apartment rental in Thu Thiem Urban Area, Thu Duc City. (Photo: Hong Dat/VNA)

|

In Hanoi, selling prices surged at the beginning of the year and showed no signs of cooling down towards the end. Apartments priced above 70 million VND per square meter in Hanoi were more prevalent in the third quarter, and primary prices across the market in the fourth quarter continued to increase by 2-4% compared to the previous quarter.

The mid-range segment remained scarce in Ho Chi Minh City and Hanoi, and common-priced properties, i.e., those below 38 million VND per square meter, were almost non-existent.

The continuous price increases pushed the residential market away from fundamental values, raising liquidity risks and widening the gap between products on the market and the desires, needs, and affordability of the majority of homebuyers.

Meanwhile, developing affordable housing faced challenges. Policies and preferential credit packages for social housing were not attractive enough, while investment procedures and rental/purchase processes for social housing were complicated.

However, there are still opportunities to improve the supply towards a more balanced market. Developing common commercial housing and social housing in suburban or new urban areas, where there is abundant undeveloped land and the cost of real estate development is not too high, is expected to contribute to bringing the market back to a sustainable development trajectory.

Anticipating this wave, some affordable projects were introduced in the latter part of 2024 in Binh Chanh District (Ho Chi Minh City), Binh Duong, and Dong Nai.

The land fund for housing development will also be soon supplemented as Ho Chi Minh City announces plans to develop 11 TOD urban areas and auction 22 land plots around metro stations.

“In the context of rising capital costs, the next ‘game’ for investors is to seize opportunities from these land funds, balancing costs, prices, and products to ensure liquidity and the efficient operation of projects,” Avison Young Vietnam assessed.

The industrial real estate segment continued to be a bright spot in the market, with rising rental rates, increasing supply, and high occupancy rates. The main driver of this development was FDI inflows into manufacturing industries.

In key and tier-1 markets, industrial land rental rates increased by an average of 2-5% every quarter. Meanwhile, new supply is expected to be abundant as many industrial park projects are licensed or inaugurated nationwide.

Industrial and logistics real estate remained the segment of top interest for foreign investors. This segment led the number of real estate transactions throughout 2024.

In the short term, economic, commercial, and geopolitical fluctuations due to the impact of new policies by President Donald Trump could put immediate pressure on attracting foreign investment and exports.

But in the long run, Vietnam, with its geographical advantages, relatively stable political environment, competitive costs, and an improving investment climate, could become the next global production base if it seizes the opportunity in time.

More refined legal framework, strong FDI inflows into real estate

The year 2024 marked an important legal milestone related to real estate with the Land Law 2024, Housing Law, and Law on Real Estate Business 2023 taking effect.

The changes and adjustments in the laws were highly appreciated for their transparency, clarity, and fairness, helping to professionalize brokerage and transaction activities and laying the foundation for the market’s healthy and sustainable development.

A corner of an industrial park in Binh Duong province. (Photo: VNA)

|

According to Avison Young Vietnam’s experts, the new laws have expanded and clarified four core issues, including transactions in various types and products of real estate, including completed or future works; requirements for establishment, financial capacity, and Land Use Right Certificates for different investors and project owners; contract requirements, planning in the sale of land use rights; and conditions and criteria for project transfers.

However, businesses, investors, and people still hope for early guidance and synchronous implementation to bring the new laws into life soon.

A trend noted by Avison Young Vietnam was the strong foreign investment inflows into Vietnam’s real estate in 2024 despite the global slowdown. In 2024, FDI into Vietnam slowed down, following the global trend.

As of the end of November 2024, total registered FDI reached approximately 31.38 billion USD, up only 1% over the same period last year.

This slow increase reflects the reality that Vietnam’s open economy and global FDI have declined for two consecutive years (2022 and 2023) due to macroeconomic instability and geopolitical tensions.

However, according to Avison Young Vietnam, foreign investors’ confidence in Vietnam’s market prospects remained positive, and they continued to pour capital into approved and licensed investment projects in the country.

This was evidenced by the total realized FDI in Vietnam up to November 2024, estimated at 21.68 billion USD, up 7.1% over the same period last year. With this growth momentum and efforts to disburse FDI at the end of the year, it is likely that by the end of 2024, the total realized FDI in Vietnam will be higher than last year and set a new record in the 2019-2024 period.

Notably, while global manufacturing has not fully recovered (FDI registered in the manufacturing industry decreased by 8.7% over the same period) and the world’s major real estate markets were quite gloomy, FDI flows in Vietnam tended to increase in the real estate sector.

In the first 11 months, FDI registered in the real estate business sector surged by 89.1% over the same period, reaching about 5.63 billion USD.

The strong FDI inflows demonstrated the attractiveness of Vietnam’s real estate market to foreign investors. In addition to positively assessing Vietnam’s policies, investment climate, population, and urbanization, investors also saw a supply shortage in most key segments such as I&L, residential, office, and retail.

Therefore, efforts to improve the legal framework for real estate and develop infrastructure are contributing to making the market even more appealing to international investors.

Another emerging trend that is becoming increasingly important for new projects is the green trend, with ESG criteria. Most new office buildings introduced in Ho Chi Minh City and Hanoi markets in the past few years have pursued green certification.

Anh Tuan

The Prime Minister Cracks Down on Land-Use Rights Auction Affairs

“Vietnam’s Prime Minister Pham Minh Chinh has taken decisive action to address land-use rights auction irregularities. On December 14, 2024, he issued Directive No. 134/CD-TTg, instructing relevant ministries and local governments to promptly rectify issues related to land-use rights auctions.”

Is There a New Opportunity for the Real Estate Market Post-Law Implementation?

The new real estate laws present a fresh opportunity for investors, but they also require a thorough understanding of the legal landscape, local planning knowledge, and a long-term vision. It is essential to be well-prepared and well-informed to navigate these new regulations successfully.

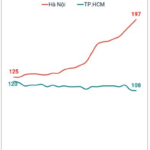

The Asking Price for Detached Homes in Hanoi Reaches 197 Million VND per square meter, Surging by 1.5 Times in Almost 2 Years

According to Batdongsan.com.vn, the average price of detached homes in Hanoi has surged from 125 million VND per square meter in January 2023 to a staggering 197 million VND per square meter just shy of a year later, in November 2024. This remarkable increase of 1.5 times the original price showcases a booming market and a potential goldmine for savvy investors.