On November 20, Thu Duc City People’s Committee approved in principle the investment policy for a project to build a high-rise residential, commercial, service, and office complex in An Khanh Ward, with a total area of 8.96 hectares. The project is invested by Sun City with a total investment of over VND 10.5 trillion.

Of the total area, 3.6 hectares will be allocated for new residential construction, 1.55 hectares for mixed-use development, 4,523 square meters for transaction offices, over 248 square meters for healthcare facilities, 0.76 hectares for public green space, 0.4 hectares for isolation green space, 2.17 hectares for transportation infrastructure, and 21 square meters for technical infrastructure. The residential products will include apartments, with a mix of commercial and social housing units (20% as per regulations). The land use coefficient is set at a maximum of 10 times, and the maximum building height is 35 floors.

Regarding the proposed investment capital of over VND 10.5 trillion, Sun City is required to contribute more than VND 2.1 trillion within 12 months from the date of investment approval. The remaining capital of over VND 8.4 trillion will be mobilized according to the construction investment progress.

The project has a duration of 50 years, and the implementation period is expected to be 8 years. From 2024 to 2026, the investor will focus on completing the legal procedures and constructing the technical infrastructure. From 2026 to 2032, the construction of the main works will be carried out, followed by inspection and handover.

Sun City used to be a member of NVL

Sun City was established in April 2016 and is headquartered on Cach Mang Thang Tam Street, Ben Thanh Ward, District 1, Ho Chi Minh City. Its charter capital is over VND 3.8 trillion.

Prior to December 2020, Sun City had two organizational shareholders: Nova Land Investment Group Joint Stock Company (HOSE: NVL), holding VND 955.5 billion (25.118%), and Nova Nippon Company Limited, holding over VND 2.8 trillion (74.882%).

According to the decision dated September 26, 2017, the Board of Directors of NVL approved the company’s contribution of VND 955.5 billion to Sun City. At the time of capital contribution, this amount was equivalent to 49% of Sun City’s charter capital.

Subsequently, from December 15, 2020, Binh Dong Investment and Management Consulting Company Limited replaced NVL, holding a stake of 25.118%. About a month later, on January 21, 2021, the legal representative and General Director of Sun City changed from Mr. Tran Ngoc Dai to Mrs. Hoang Thi Kim Thanh, who also serves as the Chairwoman of the Members’ Council.

In June 2022, Sun City appointed Mr. Philip Antony Cluer (British nationality) as the foreign General Director and legal representative, while Mrs. Thanh remained as the Chairwoman of the Members’ Council and legal representative of the company.

Who is behind Sun City’s parent company?

As mentioned, Nova Nippon is the parent company of Sun City, holding nearly 75% of its capital. It is known that Nova Nippon used to be a subsidiary of NVL, with a holding of 99.98%. It was established in July 2015 with a charter capital of VND 20 billion, mainly engaged in real estate business.

In May 2018, NVL additional capital to Nova Nippon, increasing its charter capital to nearly VND 1,100 billion (NVL maintained its ownership ratio).

In 2020, Nova Nippon continued to receive additional capital from NVL through the merger of subsidiary companies. Specifically, on October 23, 2020, the Members’ Council of Phu Binh Real Estate Company Limited (a subsidiary of NVL) approved the merger with Vuong Gia Real Estate Investment Joint Stock Company (another subsidiary of NVL). A month later, on November 25, the General Meeting of Shareholders of Vuong Gia approved the merger with Nova Nippon.

After the merger and additional capital contribution from NVL in 2020, Nova Nippon’s charter capital increased to over VND 3,900 billion. NVL remained the parent company with an ownership ratio of 99.475%, followed by Mr. Bui Dat Chuong (0.514%) – the younger brother of Mr. Bui Thanh Nhon, Chairman of NVL’s Board of Directors; Ms. Huynh Phuong Thao (0.008%) – Mr. Nhon’s sister-in-law; and Ms. Pham Thi Cuc (0.003%) – also Mr. Nhon’s sister-in-law.

However, in December 2020, NVL completed the divestment of two subsidiary companies, Sun City and Nova Nippon, with a total value of over VND 6,500 billion, resulting in a gain of over VND 797 billion compared to the book value.

On December 24, 2020, not long after NVL divested from Sun City, the ownership structure of Nova Nippon also changed completely.

Accordingly, the new shareholders of Nova Nippon included three legal entities: Duc Mai Import Export Investment Joint Stock Company (41.593%), Hoang Truong Tourism Real Estate Investment Joint Stock Company (35.552%), and Phu Thinh Phat Investment Joint Stock Company (22.855%). At the same time, the Chairwoman of the Members’ Council and legal representative of the company changed from Mr. Chuong to Mr. Hoang Hong Hoa (born in 1960).

In January 2024, Nova Nippon changed its name to Nippon Company Limited, indicating the management’s intention to remove the “Nova” element from the company’s name.

The three current owners of Nippon have raised a large amount of bonds

According to our understanding, the three current shareholders of Nippon are based in Hanoi and have a significant bond debt, totaling nearly VND 3,700 billion, which is almost equal to Nippon’s charter capital of VND 3,900 billion.

The largest shareholder, Duc Mai Company, was established in 2018 and operates in the real estate business. Mr. Nguyen Thanh Long is the Director and legal representative of the company.

In the first half of 2024, Duc Mai recorded a post-tax profit of over VND 190 billion, compared to a loss of nearly VND 148 billion in the same period last year. As of June 30, 2024, the company’s total assets were approximately VND 5,700 billion. The total liabilities were over VND 5,300 billion, including nearly VND 1,400 billion in bond debt.

The company currently has one bond lot in circulation, DUCMAI2020, with a value of nearly VND 1,400 billion, a term of 5 years, issued on December 22, 2020, and maturing in December 2025. The interest rate is 9.5%/year. In early January 2024, Duc Mai paid nearly VND 83 billion in interest on this bond lot.

Another shareholder, Hoang Truong Company, was established in 2014 and has a charter capital of VND 1,200 billion. The enterprise is owned and managed by Ms. Nguyen Thi Tram Anh, who serves as the Chairwoman and General Director as well as the legal representative.

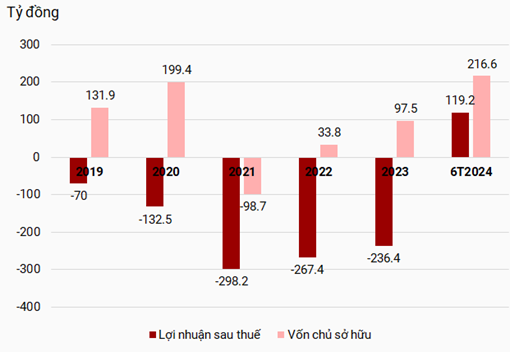

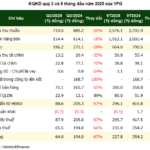

In the first half of this year, the company reported a post-tax profit of VND 119.2 billion, compared to a loss of VND 139.6 billion in the same period last year. This result came as a surprise, as the company had continuously incurred losses of hundreds of billions of dong every year from 2019 to 2023.

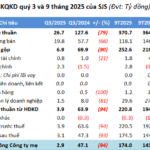

|

Hoang Truong Company’s business results for 2019-6M2024

Source: TM

|

|

In December 2023, Hoang Truong Company was fined VND 65 million by the State Securities Commission of Vietnam for failing to disclose information on time as prescribed by law to the Hanoi Stock Exchange (HNX). The undisclosed information included the 2020 and 2021 financial statements, the semi-annual financial statements for 2021, reports on the use of proceeds from bond issuance for the second half of 2020 and 2021, and the semi-annual reports on bond interest and principal payments for the second half of 2020, 2021, and the first half of 2022. |

With the profit in the first half of 2024, Hoang Truong’s equity increased to VND 216.6 billion as of the end of June 2024. In 2021, the company’s equity was negative VND 99 billion. This was also the year when the company’s total liabilities peaked at nearly VND 4,462 billion. As of mid-2024, Hoang Truong’s total liabilities had decreased to VND 2,812 billion, of which bond debt accounted for VND 1,400 billion.

Hoang Truong currently has one bond lot, HTCH2024001, with a value of VND 1,400 billion. The bonds were issued on December 21, 2020, with a term of 4 years and a maturity date of December 21, 2024. The interest rate at issuance was 9.3%/year. In the first half of this year, Hoang Truong paid over VND 84 billion in bond interest.

The remaining shareholder, Phu Thinh Phat Company, was established in 2015 and is also engaged in the real estate business. With a charter capital of VND 480 billion, the company is chaired by Mr. Hoang Hong Ha, who also serves as the Members’ Council Chairman and legal representative. In the first half of this year, the company incurred a post-tax loss of over VND 45 billion, compared to a loss of over VND 50 billion in the same period last year. As of June 30, 2024, the company’s owner’s equity was nearly VND 146 billion, while its total liabilities were nearly VND 2,000 billion, including VND 900 billion in bond debt.

Similar to the two shareholders mentioned above, Phu Thinh Phat has one bond lot in circulation, PTP2020, with a value of VND 900 billion. The bonds were issued on December 23, 2020, with a term of 5.5 years and a maturity date of June 23, 2026. The interest rate is set at 9.2%/year. The company paid nearly VND 54 billion in interest for the first interest payment of 2024.

Ha Le

What Stocks Will Be Removed From the FTSE ETF and VNM ETF in the Q4 Review?

According to the latest report by SSI Research, the foreign ETF portfolio will undergo significant changes in the Q4 2024 reconstitution. The upcoming adjustments include the addition of promising new stocks and the rebalancing of existing holdings, setting the stage for a strategic shift in the portfolio’s composition.

The Ultimate Real Estate Venture: Novaland’s $470 Million Prime Project in Thu Duc City Gets Greenlit After Four Years

The project’s new owner boasts an impressive business with a former VPBank member at its helm. In a surprising turn of events, the company has reported substantial profits, but its debt consumes a staggering 93% of its total assets. This revelation raises questions and intrigue, leaving us wanting to know more about this intriguing business venture and its future prospects.

Unleashing the Potential: Dong Nai Clears Legal Hurdles for Aqua City Project

On November 19, 2024, the People’s Committee of Dong Nai Province issued a decision approving the adjustment of the general planning of Bien Hoa City, with a vision to 2050. This decision underscores the committee’s commitment to the city’s sustainable development, ensuring it remains a thriving and vibrant urban center in the years to come.

The Heir Apparent’s Accounts Receivable: A Novaland Saga – Unraveling the Financial Mysteries of the Elusive Bùi Cao Nhật Quân in Q3 2024

As per the Q3/2024 financial statements, Novaland reported a long-term receivable of VND 76 billion from Mr. Bui Cao Nhat Quan, son of Chairman Bui Thanh Nhon.