Illustrative image

In a newly published macroeconomic report, the team of experts from HSBC Vietnam’s Foreign Exchange, Capital Markets, and Securities Services Group revealed that the USD-VND exchange rate experienced another year of significant volatility and unpredictability. Similar to other currencies in the region, the foreign exchange rates of countries in the area, including Vietnam, have faced numerous unforeseeable factors recently due to disturbances ahead of the US presidential election, economic stimulus packages in China, and other geopolitical tensions.

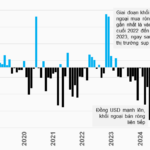

According to HSBC, the USD/VND exchange rate movement this year can be divided into three phases, corresponding to the last three quarters. In early Q2, the USD/VND rate surged from 24,650 to a year-to-date high of 25,460 within just two months, resulting in a depreciation of over 3%. During this period, the expectation of Fed rate cuts diminished, causing a stark contrast in policy management and a widening interest rate differential between VND and USD. Superior US data and geopolitical risks further bolstered the greenback during this time.

To support the market, the SBV intervened by selling USD from its foreign reserves and issuing short-term bills to curb the rising exchange rate. Entering Q3, the trend reversed, and the USD/VND rate depreciated significantly back to 24,600, resulting in a depreciation of only 1.3% as of the end of September. The market support measures from the monetary authority and the Fed’s first rate cut, which cooled down the dollar index, contributed to narrowing the interest rate differential between VND and USD.

However, in Q4, the pressure on the exchange rate resurfaced. In October alone, Asian currencies, on average, gave back more than half of their Q3 gains against the US dollar as the greenback swiftly regained strength. Overall, HSBC observed that some currencies were more negatively impacted by capital outflows, such as USD-INR hitting a new record high, while USD-KRW neared its highest level this year. Similarly, the USD-VNĐ rate rapidly climbed back towards this year’s peak of 25,450.

According to the HSBC research team, the variables leading up to the US presidential election and Donald Trump’s victory, along with positive US economic data, particularly related to employment, fueled the upward momentum of the USD index and dampened expectations for the Fed’s rate cut intensity in this new cycle. Similar to previous instances, the SBV implemented a flexible exchange rate management policy by setting the USD selling rate to support the market at 25,450 while reintroducing the bill issuance tool to regulate interbank market capital, thereby indirectly helping stabilize market confidence and alleviate pressure on the exchange rate.

“At this point, even with the US presidential election over, it remains challenging to outline a clear scenario for the exchange rate movement in the near future,” said the HSBC research team.

Regarding interest rates, with the government determined to achieve the set economic growth targets for this year, the SBV faces a challenging task in conducting a growth-supportive monetary policy by striving to reduce lending rates and boost credit growth. However, with exchange rate pressures mounting and the monetary policies of the US and other countries remaining unclear, accomplishing this task is daunting.

In reality, interbank interest rates have consistently faced upward pressure. Specifically, the VND interbank average rate surged for tenors of one month and below in early November, with the overnight rate reaching 6.2%/year, the highest since the beginning of 2024. Since the start of October, the SBV has had to simultaneously employ various liquidity management tools to address exchange rate stability through bill issuance operations and ensure system liquidity through open market operations.

Given the uneven recovery and the maintenance of high growth targets for next year, HSBC Global Research expects the SBV to maintain a flexible monetary policy and keep the operating interest rate unchanged at 4.5% until the end of 2025.

“Bank Deposits Plummet: A Troubling First Half of 2024”

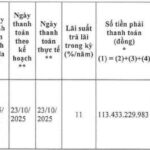

Previously, this bank’s customer deposits also decreased by more than VND 39,600 billion in 2023, equivalent to a contraction of nearly 23%.