Illustrative image

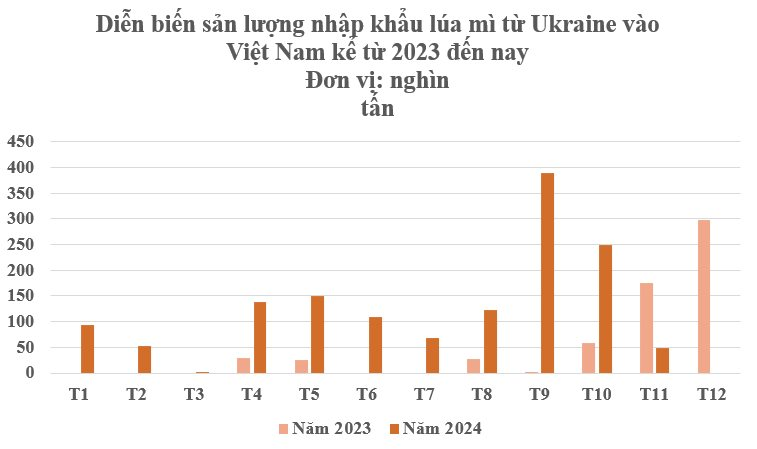

According to preliminary statistics from the General Department of Vietnam Customs, the country’s wheat imports in November reached over 354,000 tons, valued at more than $101 million, a decrease of 26.5% in volume and 21% in value compared to the previous month.

In the first eleven months of the year, Vietnam’s total wheat imports reached over 5.3 million tons, valued at more than $1.4 billion, a significant increase of 34.8% in volume and 8.3% in value compared to the same period last year. The average import price was $275 per ton, a decrease of nearly 20% compared to the same period in 2023.

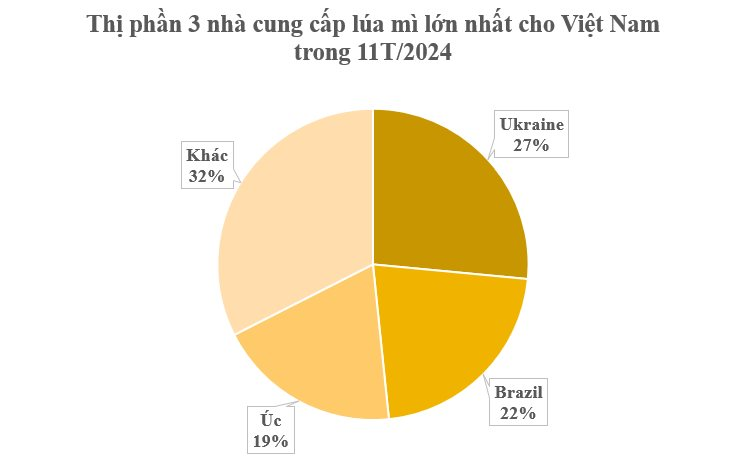

In terms of market share, Ukraine, one of the world’s leading wheat producers, has significantly increased its exports to Vietnam. It has emerged as the largest supplier to Vietnam, with over 1.4 million tons, equivalent to more than $363 million, a substantial increase of 349.9% in volume and 312.6% in value compared to the previous year. The average price decreased by 8.3% to $255 per ton.

Brazil follows closely with over 1.17 million tons, valued at nearly $293 million, reflecting a remarkable surge of 348.9% in volume and 205.9% in value. The average price witnessed a sharp decline of 32% from the previous year, settling at $249 per ton.

Australia, the third-largest importer, contributed over 1.03 million tons, valued at over $314 million. However, compared to the previous year, there was a significant drop of 60.7% in volume and 64.8% in value. The average price also dipped by over 8%, settling at $305 per ton.

Aside from the prominent markets mentioned above, Russia leads in terms of wheat export growth to Vietnam, with over 425,000 tons, valued at more than $113 million, indicating a remarkable surge of 495% in volume and 503% in value.

Vietnam is currently among the top ten wheat importers globally. In 2023, the country spent nearly $1.9 billion on importing approximately 5.5 million tons of wheat. This surge in imports can be attributed to the rising domestic demand, particularly from the animal feed and food processing industries.

According to the Livestock Association, wheat is predominantly used in the production of compound animal feed. As Vietnam does not produce wheat domestically, its supply relies entirely on imports. The plunge in wheat import prices this year, dropping by over 20% compared to last year, has prompted enterprises to seize the opportunity of lower prices, especially from Ukraine, to increase their imports.

The global wheat market is substantial, with an annual production volume of approximately 770 million tons and a value exceeding $200 billion. The leading wheat-exporting countries include Russia, the United States, Canada, and Ukraine. Prior to the conflict in 2022, Ukraine cultivated up to 6 million hectares of wheat for the winter crop. Despite the significant losses, the country’s wheat production in 2024 still reached 22 million tons, nearly matching the pre-conflict average of 25-28 million tons. Notably, the winter wheat crop accounts for 95% of Ukraine’s annual wheat production.

The United States Department of Agriculture forecasts that global wheat stocks at the end of the 2024-2025 season will reach their lowest level in nine years, estimated at 257.22 million tons. Meanwhile, the consulting firm Strategie Grains predicts that wheat production in the European Union will hit a twelve-year low due to rainfall impacting the harvest.