Two years ago, a team of Huawei engineers arrived in Jiangyin with an urgent mission: to transform the little-known SJ Semiconductor into a competitor in chip packaging and stacking technologies.

Huawei dispatched an elite task force – talents from its own ranks – to help improve their packaging technology and boost the performance of Huawei’s AI chips, a knowledgeable official revealed to Nikkei Asia. Now, SJ Semiconductor can offer a viable alternative to TSMC’s CoWoS packaging technology, with peak capacity about one-tenth that of its Taiwanese rival.

SiEn (QingDao) Integrated Circuits, a lesser-known chipmaker based in Shandong province, has also received special support from Huawei over the past two years. During this time, SiEn has built two additional factories and is testing the production of 14nm chips, a significant advancement from their previous offerings. The company aims to progress to 7nm chip production, matching that of SMIC, China’s current chip industry leader, though still lagging behind TSMC’s 3nm chips.

Huawei is becoming the “ace” for China’s entire tech industry.

SwaySure, a memory chip manufacturer based in Shenzhen, has developed technology similar to that of Taiwan’s Nanya Technology, the world’s fourth-largest DRAM chip provider. Strategic support from Huawei has been instrumental in SwaySure’s remarkable progress. The company is even exploring high-bandwidth memory (HBM) technology, a crucial component for AI computing dominated by Samsung, SK Hynix of South Korea, and the US’s Micron.

Along with SMIC, which helped Huawei produce 7nm chips last year, both SiEn and SwaySure have been placed on the US Commerce Department’s “entity list,” with SiEn and SwaySure added in December as part of the latest effort to curb China’s technological advancement. Huawei itself was put on the list back in 2019.

Huawei: A Driving Force for China’s Tech Self-Sufficiency

The above stories vividly illustrate how Huawei’s efforts to overcome US sanctions and maintain its technological edge are benefiting China’s tech supply chain.

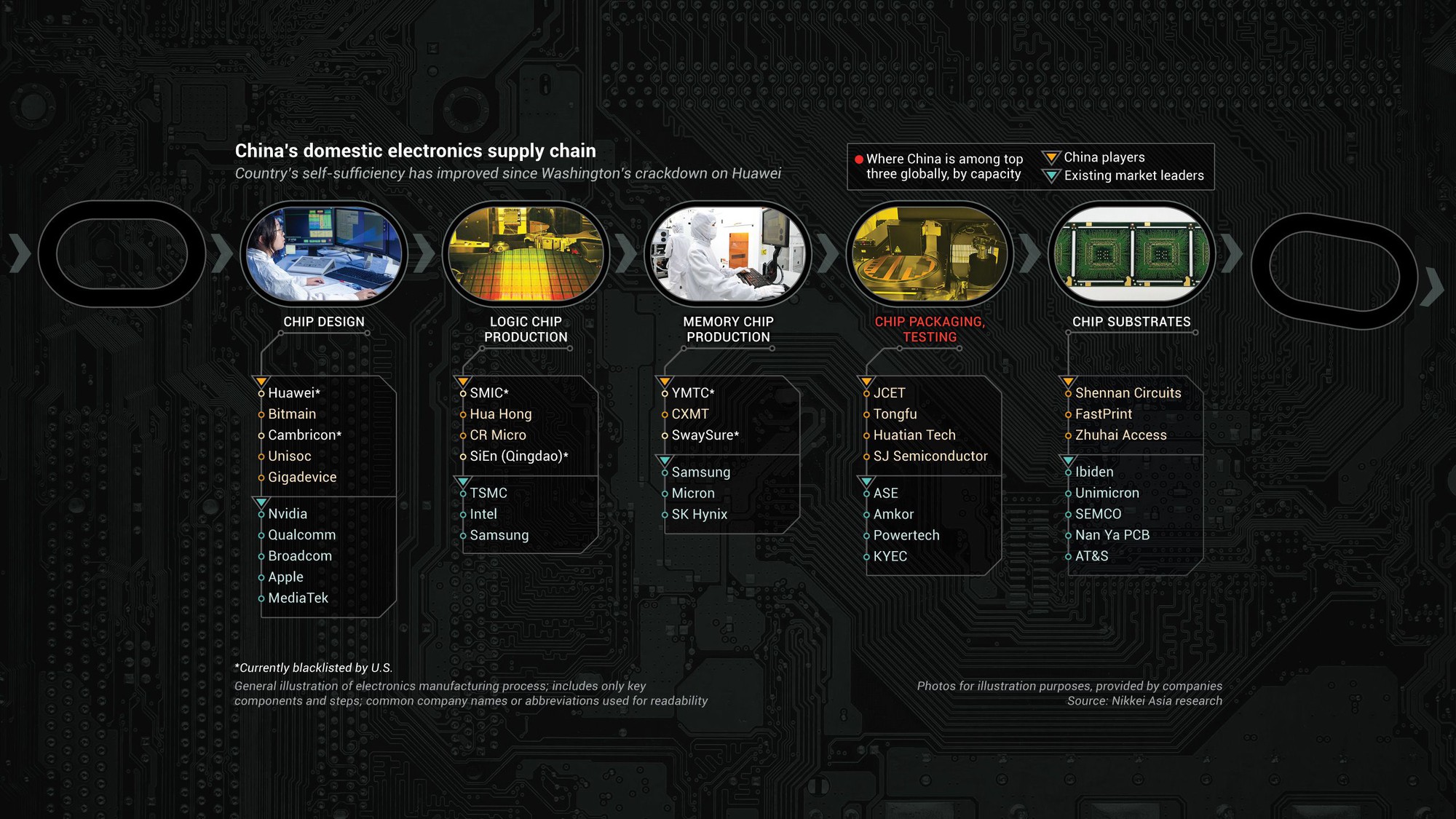

The chip industry, like the broader tech sector, relies on a complex global supply chain. This makes it challenging for a corporation or country to develop its tech industry if isolated from this chain.

China has prepared an alternative supply chain to global providers.

However, China is an exception, as it has replacement companies for most segments of this chain, even if their quality falls short of solutions from top global providers. Huawei’s task now is to “clone” its capabilities to these partners, improving their technological prowess and supporting the tech giant in withstanding the sanctions imposed on it.

In other words, while US export restrictions have significantly limited China’s access to the world’s leading tech providers, Washington’s efforts have inadvertently accelerated China’s drive to replace foreign tech supply chains with domestic alternatives.

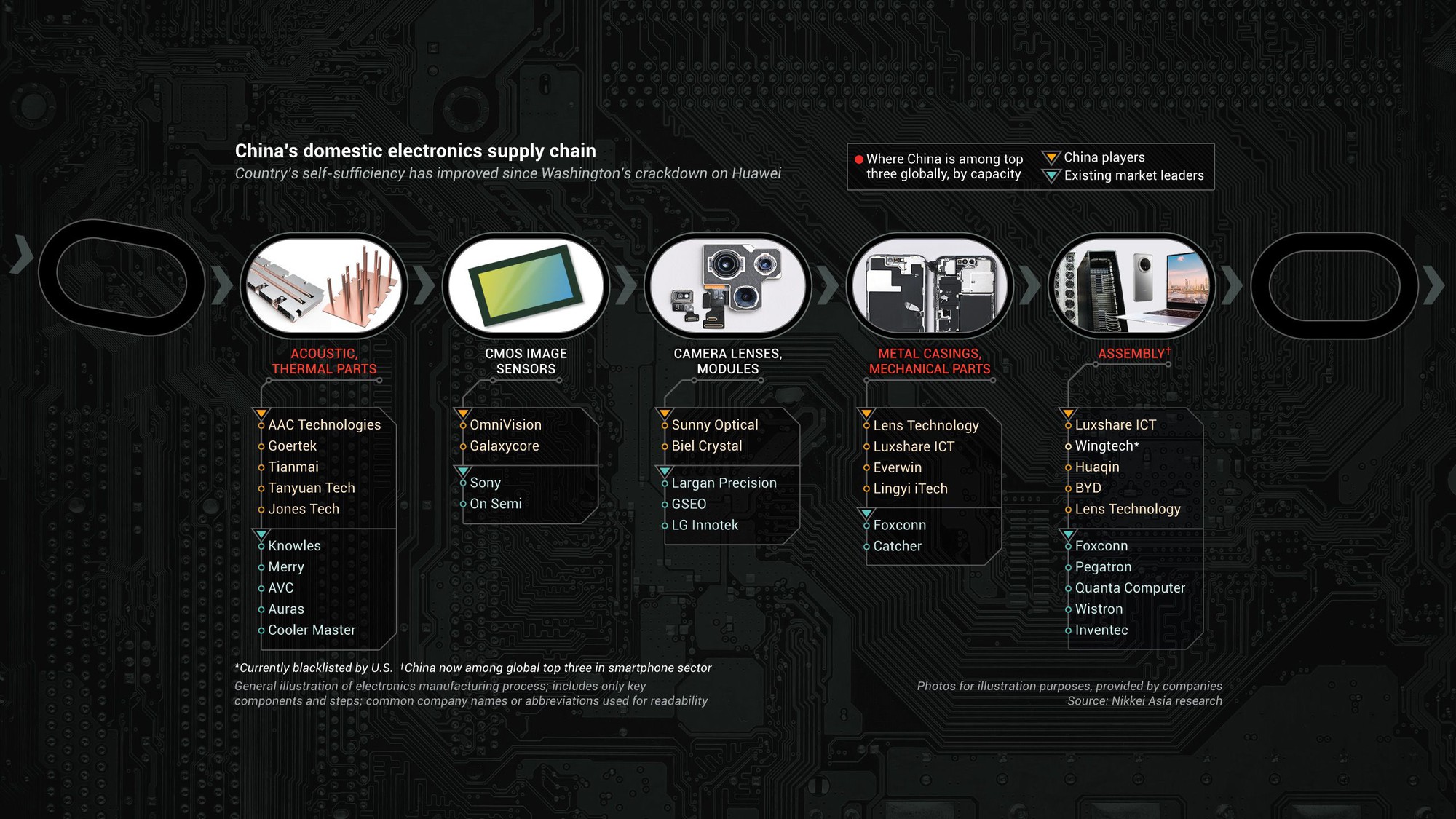

China has developed competitive domestic solutions in various fields, including specific chips, chip substrates, printed circuit boards, displays, batteries, camera lenses, metal casings, and final product assembly. Geopolitical tensions have prompted the Chinese industry to prioritize the use of domestic components whenever possible. Many Chinese suppliers have emerged as global leaders, surpassing former market leaders from the US, Europe, Japan, South Korea, and Taiwan.

While not replacing solutions from top global providers, this supply chain still meets the needs of China’s tech industry.

China’s emerging parallel supply ecosystem also increases competition and raises concerns about overcapacity amid a slow recovery in global electronics demand. Additionally, the development of China’s supply chain goes hand in hand with the global influence of its brands. According to Omdia research, Chinese smartphone makers account for nearly 60% of the global market share, and Chinese TV manufacturers hold 42% of the market, thanks to their dominance in the display industry.

Huawei is the pioneer and leading force in China’s tech industry transformation amid punitive sanctions. While US bans have cost the company its leading position in the global smartphone market, it has quickly regained growth momentum at home with cutting-edge technologies such as foldable screens, satellite connectivity, and generative AI targeting the premium segment.

Huawei is also a pioneer in researching and deploying foundational technologies like optics, materials, image sensors, and heat dissipation. The company is actively building an independent ecosystem with its proprietary HarmonyOS, free from US “interference.”

Huawei’s strategic vision and perseverance inspire and encourage other Chinese tech companies. Beyond being a leader in innovation and R&D, Huawei is willing to train and transfer top talent and management expertise to nurture its domestic partners.

Many experts believe that Huawei’s efforts are accelerating the learning curve for Chinese chip companies and narrowing their technology gap with the West. An insider in the semiconductor industry commented, “The Americans and Europeans are underestimating China, but we should never underestimate them.”

“They have a population of over 1 billion, an excellent technical education system, and a strong sense of mission to develop their chip industry and technology. When Huawei shifted orders from TSMC to Chinese chipmakers like SMIC, it truly helped them accelerate the experience curve, which is invaluable for China’s tech ambitions.”

Slowly but Surely Overcoming Obstacles

Nevertheless, Huawei and China’s tech industry still face challenges ahead. Washington is increasingly tightening export controls on less “sensitive” tech sectors where Chinese companies are leading. Additionally, the government’s subsidization of the high-tech industry may lead to overcapacity in the future.

Huawei Mate 70, the company’s latest flagship, remains popular in China despite using an older CPU technology.

But with Huawei’s determination and system-wide efforts, China’s tech ambitions are taking root. As Anil Khurana, Director of the Baratta Center for Global Business at Georgetown University, observes, “China has a massive population, an excellent technical education system, and a strong sense of mission to develop its chip industry and technology. By shifting orders from TSMC to Chinese chipmakers, Huawei is helping them accelerate the experience curve and accumulate knowledge, which is invaluable.”

Huawei remains China’s most prominent tech company, employing 207,000 people worldwide, compared to 182,000 at Google, 125,000 at Intel, and 164,000 at Apple. Over 50% of its employees work in research and development, and the company spent over 23% of its annual revenue, approximately CNY 164.7 billion (USD 22.7 billion), on R&D last year, placing it in the global top 10.

Observers note that Huawei will remain the most critical driver in China’s semiconductor and AI computing industries. In Shanghai, the company is building a vast R&D center for chip design and semiconductor development, while Huawei-supported chip manufacturing and packaging factories are spreading across China with strong government support.

The Great Tech Migration: Vietnam’s Next Challenge

In the context of the global supply chain restructuring trend and geopolitical risk mitigation, what has propelled Vietnam to the forefront as a preferred destination for major tech giants in recent times?

The Race to 100,000: Can Huawei’s Homegrown OS Dream Compete?

Huawei has set an ambitious target for its proprietary operating system, aiming to reach 100,000 apps within the next six months to a year.