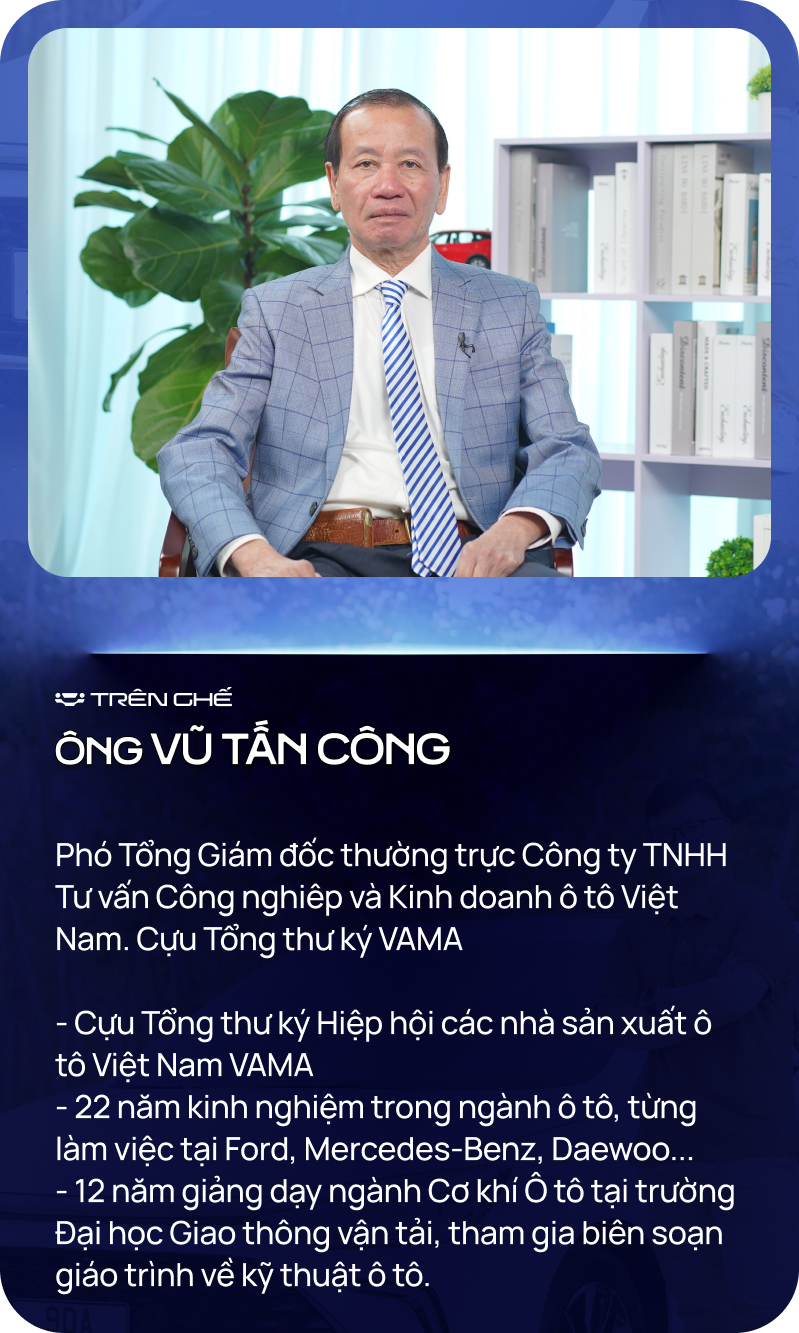

In this episode, host Đăng Việt engages in a thought-provoking discussion with Mr. Vũ Tấn Công, former VAMA Secretary-General, on the following topic: TMT Motors’ Venture into Car Manufacturing – Lessons from Wuling?

Recently, the chairman of TMT Motors revealed to the press their plans to produce an affordable electric car as a substitute for motorcycles. What are your thoughts on this strategy?

Firstly, it is feasible for TMT Motors to venture into car manufacturing. However, their ambition to produce affordable cars to replace motorcycles presents several challenges. While there are opportunities, TMT Motors also faces significant hurdles.

Firstly, the price disparity between motorcycles and cars is considerable. Currently, a budget-friendly motorcycle costs around 20-30 million VND, whereas the cheapest car available in the market starts from 200-300 million VND. This financial gap is a significant obstacle.

Secondly, parking spaces pose another challenge. Parking two motorcycles at home is relatively easy for a family. However, replacing those two motorcycles with a car introduces a whole new set of parking considerations.

Thirdly, if TMT Motors opts for electric vehicles, the availability of charging stations becomes a critical issue. Presently, VinFast is the exception, as the charging infrastructure for electric vehicles in Vietnam is underdeveloped. Other automakers, including TMT Motors, will face significant user challenges if they do not invest in building a robust charging network.

Therefore, we should view cars as a preferable option when dealing with adverse weather conditions, dust, and pollution. Passengers in cars will feel cleaner and safer, especially in the event of an accident.

TMT Motors has partnered with Wuling to distribute two models: the Mini EV and Bingo. While the Mini EV is a small and affordable electric car, it hasn’t achieved the desired success. Do you think TMT Motors is making a mistake with their idea of manufacturing low-cost electric cars?

In my opinion, TMT Motors has made a misstep by focusing on the mini electric car segment.

According to my market research, the market share for small cars in segment A and mini cars has been minimal for many years. Therefore, it will be challenging for a company to succeed in such a niche segment.

Secondly, while I am unaware of TMT Motors’ financial situation, I question their ability to invest in a public charging infrastructure. Selling electric vehicles without providing charging stations will be extremely difficult. This is an area where VinFast is making significant investments and doing an excellent job.

Thirdly, I believe TMT Motors has not thoroughly researched their product. While the VinFast VF 3 is a CUV in segment A with a high chassis, the Wuling Mini EV is a small car with a low chassis. Consequently, the Mini EV is more susceptible to damage when encountering flooded roads.

In my assessment, the Wuling Mini EV has not met with success. TMT Motors should learn from this experience to avoid repeating similar mistakes in the future.

TMT Motors has acknowledged the need to learn from their experiences if they plan to venture into car manufacturing in the future. What steps do you think they should take?

There is a Vietnamese saying that emphasizes the importance of human factors. As a Vietnamese myself, I concur with this sentiment. My advice to TMT Motors is to hire talented automotive experts who can devise effective product, marketing, brand development, and business strategies. Only by adopting this approach will TMT Motors have a chance to succeed. I am not employed by TMT Motors, nor am I privy to their financial situation, but based on their current methods, I believe they are missing the mark.

Some argue that TMT Motors’ lack of experience in passenger car manufacturing led to their mistakes. What are your thoughts on this opinion?

This perspective is entirely valid.

Customers who purchase trucks are generally less demanding than those buying passenger cars. Trucks are primarily used for transportation, and buyers do not have the same high expectations as they do for passenger vehicles. Consequently, TMT Motors has found success in the truck market, but this does not guarantee a similar outcome with passenger cars. Applying the same strategies and experiences from truck manufacturing to passenger cars is inappropriate.

As a Vietnamese, I wholeheartedly support TMT Motors if they can successfully produce cars under a Vietnamese brand and serve the country.

Thank you very much for your insightful perspectives, Mr. Công.

The Ultimate Guide to Electric Vehicles in Vietnam: Unveiling the 2024 Lineup with Price Tags Starting from a Mere 235 Million VND. A Diverse Range, Including Hatchbacks, Sedans, CUVs, and MPVs.

The electric car segment with the most accessible price range has become a playground for many Chinese brands.

The Great Automotive Alliance: How Honda and Nissan’s 70-Year Rivalry Transformed into a United Front Against the Rising Tide of Affordable Chinese Electric Vehicles and Toyota

Four years ago, no one would have believed that Japan’s second and third largest car manufacturers, with a rivalry spanning over 70 years, would merge.